Please see below for one of Invesco’s latest investment articles, received by us yesterday 07/07/2021:

A year and a half after the first reported cases of a new SARS-like virus in Wuhan, China, we can now look back with greater clarity on a period of some of the most dramatic volatility since the Asian and global financial crises. Here, we assess what this volatility and the associated policy responses have meant for China and emerging markets and plot a dotted line for the road ahead.

Looking up after locking down

At the time the pandemic hit, the unresolved US-China trade war loomed large and global manufacturing was in the early stages of restructuring to accommodate new trade patterns. Despite this, China stood out from other countries in terms of its fiscal, monetary and industrial policy response.

Beijing’s policy decisions focused on maintaining domestic productivity and employment with as little disruption on the demand side as possible. Manufacturers were given liberal access to capital to maintain operations, and refunds on social security tax and unemployment insurance incentivised businesses to retain staff without layoffs.

At the same time, the central bank lowered its reserve requirements and removed blocks on certain loan extensions and renewals. Investments were made in traditional infrastructure projects like housing and transportation, and spending on the nationwide 5G network was accelerated.

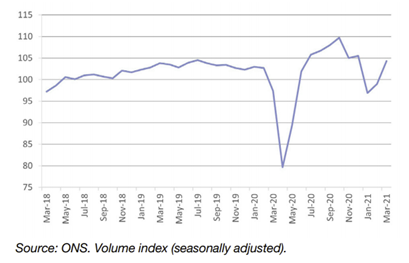

As a result, China moved from having a GDP contraction of almost 6% for the first quarter of 2020 to being the only major world economy to print a positive GDP growth number for the year.

A dolorous relationship?

While China’s growth in 2020 is unmatched, the road ahead is not unwinding, particularly when we consider the impact that US policy decisions could have on the US dollar.

The growth of the US fiscal balance sheet in 2020 (accommodated via easy monetary policy) appears to have stimulated real inflation in the US economy – an outcome which has led to talk of tightening. If asset purchase programmes are tapered or rates increased, the likely outcome is a stronger dollar.

Historically, a strong dollar has been negative for emerging markets, as it increases the burden of US dollar-denominated debt. This is less of a factor today than it was prior to the Asian and global financial crises. However, the fact remains that this could dampen growth prospects in some emerging market economies.

Commodities buck the trend

In spite of the observation noted above, it is likely that a stronger dollar will benefit firms selling commodities into US dollar-denominated markets, as long as there is global demand for these products. This factors into the dramatic outperformance we have seen from steelmakers, iron miners, commodity chemical companies, and even coal producers.

The demand behind this outperformance is not part of the same super-cycle seen after China’s admission to the World Trade Organisation, when investment in capacity and infrastructure facilitated the country’s transition to the so-called ‘world’s factory’.

Even when we account for the fact that some of this capacity has moved to other countries in the context of trade realignment, the overall demand for commodity materials is not in the same league as two decades ago.

Instead of a broad, sustainable growth in demand, we are seeing a short-term build-up of inventories that reflects ‘new normal’ uncertainties about tariffs and pandemic lockdowns. This goes all the way through the product cycle, from raw materials to finished goods.

Although these dynamics are almost certainly near-term and should subside in the medium-term, they do attract speculation that disrupts the market.

The road ahead

What does this disruption mean for emerging markets? In the absence of significant inflows, there is a conservation of capital within the asset class. The sharp and transitory shifts described above get funded by parts of the market that have outperformed — in this case growth companies, in particular those in China. In this sense, China has been a victim of its own success as far as its response to the pandemic is concerned, as some investors look to lock-in potential gains.

That said, in our opinion, these sharp transitions do not signify a change in the long-term view for emerging markets. The types of firms that create and capture value for shareholders remain the same.

Even with an ageing population, China remains a large economy with an outlook for sustained, high-speed growth. The growing middle class offers opportunities for investment in education, real estate services, and world-leading innovative technology platforms that facilitate consumption.

It is worth adding that the size and scale of the domestic market should make it less susceptible to external volatility than other markets in the asset class.

What these transitions offer, then, is the potential to invest in the best long-term opportunities at more attractive valuations than normal market conditions afford.

Please continue to utilise these blogs and expert insights to keep your own holistic view of the market up to date.

Keep safe and well.

Paul Green DipFA

08/07/2021