Please see below for Brewin Dolphin’s latest Markets in a Minute Article, received by us yesterday evening 14/09/2021:

US and European stocks fell last week as the prospect of higher inflation and slower economic growth weighed on investor sentiment.

The S&P 500 and the Dow ended their four-day trading week down 1.7% and 2.2%, respectively, amid a higher than-expected rise in producer prices and concerns about the Delta variant’s impact on the economic rebound.

The pan-European STOXX 600 eased 1.2% as the European Central Bank (ECB) said it would trim its emergency bond purchases. The FTSE 100 also fell 1.5% on concerns the Bank of England could start increasing short-term interest rates.

In contrast, Japan’s Nikkei 225 extended the previous week’s gains, adding 4.3% amid ongoing optimism that the new prime minister will bring further fiscal stimulus. China’s Shanghai Composite rallied 3.4% after newspapers reported ‘candid’ talks between the country’s leader Xi Jinping and US President Joe Biden.

S&P 500 ends five-day losing streak

The S&P 500 added 0.2% on Monday, ending its five-day losing streak, as rising oil prices boosted energy stocks. Airlines and cruise line operators also performed strongly, after the seven-day US Covid-19 case average fell to 144,300 from 167,600 at the start of the month.

UK and European stocks also edged higher, after a top European Central Bank official said recent gains in inflation did not yet pose a risk, and that the extremely low level of inflation seen in 2020 needed to be taken into account.

The FTSE 100 opened Tuesday’s trading session down 0.3%, after the Office for National Statistics reported that while UK company payrolls have returned to pre-pandemic levels, the recovery is uneven and labour shortages are likely to persist for the rest of the year.

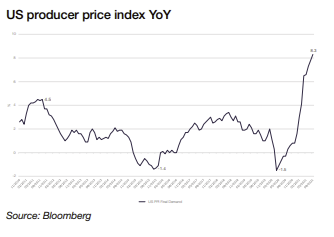

US producer inflation accelerates

Last week saw the release of the latest US producer price index, which is a measure of inflation based on input costs to producers. The index rose by 0.7% in August from the previous month, which was a slowdown from July’s 1.0% increase but above estimates for a 0.6% rise.

The index rose by 8.3% on an annual basis, which was the biggest yearly increase since records began over a decade ago. This followed a 7.8% annual increase in July.

The data, which comes amid supply chain issues, a shortage of goods, and heightened demand related to the pandemic, suggests inflationary pressures are persisting despite the Federal Reserve’s insistence they will prove temporary and ease through the year.

Firms are also facing cost pressures from the tight labour market. The closely watched US Jobs Openings and Labor Turnover Survey (JOLTS), released last Wednesday, showed there were a record 10.9 million positions waiting to be filled in July, up from 10.2 million in June. It marked the seventh consecutive month of increased job openings, fuelled by factors such as enhanced unemployment benefits, school closures and virus fears.

ECB to trim bond purchases

Over in Europe, the ECB said it would move to a ‘moderately lower pace’ of pandemic emergency bond purchases following a rebound in eurozone economic growth and inflation. ECB president Christine Lagarde sought to reassure investors by stating that the shift to a slower pace of purchases was not tapering. This contrasts with the US Federal Reserve and the Bank of England, which have signalled they plan to start tapering asset purchases this year.

In comments reported by the Financial Times, Lagarde said the economic rebound was ‘increasingly advanced’, but added: “There remains some way to go before the damage done to the economy by the pandemic is undone.” She pointed out that two million more people are out of work than before the pandemic, and many more are still on furlough schemes.

Lagarde added that a fourth wave of infections could still derail the recovery, while supply chain bottlenecks could last longer and feed through into stronger-than-expected wage increases.

BoE split over rate increase

BoE governor Andrew Bailey gave a speech last week in which he revealed the central bank’s policymakers were evenly split between those who thought the minimum conditions for considering an interest rate hike had been met, and those who thought the recovery wasn’t strong enough. According to Reuters, Bailey said he was among those who thought the minimum conditions had been reached, but that they weren’t sufficient to justify a rate hike.

The comments have led to speculation that the next vote could skew towards raising the base interest rate, which currently stands at 0.1%.

Bailey also said there were signs that the UK’s economic bounce back from the pandemic was showing some signs of a slowdown. Indeed, data published by the Office for National Statistics on Friday showed monthly gross domestic product (GDP) grew by 0.1% in July – lower than the expected 0.5% rise and the 1.0% growth seen in June. Output in consumer-facing services fell for the first time since January, driven by a 2.5% decline in retail sales. Output from the construction industry also dropped amid a shortage of building materials and higher prices.

Please continue to utilise these blogs and expert insights to keep your own holistic view of the market up to date.

Keep safe and well

Paul Green DipFA

14/09/2021