Please see the below article from Tatton Investment Management, providing a brief analysis of the key stories from global markets and economies over the past week. Received this morning – 02/05/2023

Overview: Let May’s sway guide your way

In recent weeks, it has been hard to ignore the rather directionless and decreasingly volatile bond, equity and currency markets. In particular, credit markets have been very stable or – as one could also interpret them – indecisive. There appears to be lots of investor demand for higher-yielding corporate bond securities without much new supply through issuance matching it. This demand overhang has cheapened credit spreads, or in layman’s terms the premium that corporates pay over governments. With the current total cost of capital at any maturity still higher than the return on capital that many companies appear to expect over the longer term, there is understandably little appetite among corporates to rollover existing debt, let alone create new finance. Instead, they appear to be collectively trying to sit out this yield high, hoping for better financing terms later in the year. We suspect many mortgage holders in the UK with their mortgage terms nearing expiry are having similar thoughts.

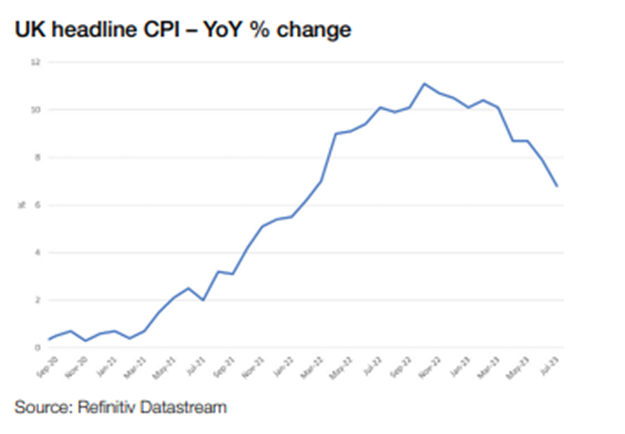

Last week’s earnings reports in the UK, Europe and in the US offered more evidence of companies trying to offset weak (often negative) volume growth by raising prices. Unilever and Procter & Gamble were notable in this respect. Companies don’t like to use whatever pricing power they have, but they will if they have to. We should hope that central banks recognise this as the last throes of a cycle, rather than worrying that the latest service sector-driven inflation data is indicative of a spiral.

As we head into the next round of rate decisions, it will be important for companies – and the risk assets that represent them – that central banks tell us they recognise they have done enough and the growing need to change course. The Federal Reserve Open Markets Committee meets tomorrow, the European Central Bank on Thursday, and the Bank of England meets next Thursday. The expectations are that we will get small rate rises but accompanied by the ‘cooing of doves’ – soothing sounds telling us that they expect inflation to cool and rates to be moved to less tight levels as inflation allows. Therefore, contrary to the old stock market adage of ‘sell in May and go away’ it seems to us that ‘let May’s sway guide your way’ may prove far better guidance for investors this year. We will certainly be monitoring central bank messaging, and the market perception of it, very closely.

Cash and money market funds: part 2

We wrote about US money market funds (MMFs) last week, noting how popular and systemically important they have become and what this might mean for capital markets going forward. MMFs are particularly prominent in the US, due to its specific financial and regulatory structure, and have been for many years. Today, money markets are a global phenomenon. As of late 2020, MMFs held over $5.3 trillion worldwide, $3.9 trillion of which came from institutional investors. More recent data is hard to come by, but we can only assume the current figure is much higher, given recent flows into MMFs.

The main selling point for any MMF is its ability to offer cash-like liquidity with better returns than a regular bank deposit. But, given the focus on extremely safe assets, the actual differences in return – both between MMFs and deposits and between MMFs themselves – are naturally quite low. (Though, as noted last week, when base interest rates change as rapidly as they have, banks’ slowness to adjust can create some pretty wide spreads) Even so, not all MMFs are the same, varying on expected duration, risk level, returns or accounting structure.

UK money markets still operate according to European Union regulations, and in the post-Brexit environment, some investors have been concerned about funds under European jurisdiction. For those that wish only to have a UK-regulated fund, there are only a few choices. Almost all funds are under Irish regulation, some under Luxembourg. The main reason appears to be that the jurisdiction can be costly for both investors and fund managers – Ireland remains the cheapest. Interestingly, MMFs in the US can be quite expensive, despite their prominence and popularity with retail investors. Most MMFs in the US now charge around 0.5%, while the median figure is much closer to 0.15% in the UK. This is a positive for us, as Sterling-based investors. MMFs do not compete much on performance, nor would we really want them to, as the incentive to up returns would go against the need for low risk, low volatility. But being competitive on price is exactly what you would want from cash-like assets.

The resurrection of Bitcoin?

It might be surprising to hear that the largest cryptos have had an incredibly good year so far. At the time of writing, Bitcoin is up nearly 80% year-to-date, while Ethereum has jumped more than 60%. Cryptocurrencies suffered a devastating 2022, and Bitcoin and Ethereum are both still below half their late 2021 peaks. Still, the current rallies are impressive, all the more so given the wider market challenges. Bitcoin’s rebound coincided with the US government’s decision to bail out SVB and Signature Bank depositors. Since, prices have climbed to more than $30,000 per token in mid-April, a level it has bounced around since.

Some of that renewed optimism is because of expectations of looser monetary policy from the Fed in reaction to the banking sector concerns. Many analysts have posited that the crypto world still has a tight correlation with global (and particularly US) money supply growth. But industry insiders also point to the slower rate of Bitcoin mining – the process by which new tokens are produced – as a longer-term reason for price growth. In a year’s time, the world’s biggest crypto is set to go through another round of ‘halving’. This is the process every four years that cuts in half the amount of reward Bitcoin miners receive for their work. It is designed to eventually limit the total Bitcoin supply to 21 million tokens. Prices hit new records after each of the last three halving events, and analysts estimate that only 50% of the upcoming supply reduction is priced in, based on previous cycles. While this might not take Bitcoin to a new record – the $69,000 achieved in November 2021 – analysts think $50,000 is an achievable target.

Although advertised as a long-term alternative to fiat currencies, Bitcoin has mostly traded like a speculative risk asset. Indeed, Morgan Stanley notes that the last 10 years for Bitcoin mirror the behaviour of gold prices in the 1970s, when exchange rates became free-floating, asset price speculation was rife, and the price of gold rose by several orders of magnitude. The similarities with gold hint at a deeper problem with Bitcoin as a functional currency. Halving means Bitcoin is by its very nature limited in supply, which gives holders a huge incentive to hold onto their tokens rather than transact them, as they are likely to increase in value. But transaction is one of the key functions of a currency, and so this disincentive could be Bitcoin’s undoing, whereas Bitcoin’s younger sibling Ethereum is not limited in supply.

One of the reasons gold did so well in the 1970s was that holders of seemingly weaker currencies – those from less-trusted nations and markets – had a huge incentive to buy it before their savings depreciated. A similar dynamic seems to be happening with cryptos increasingly being used as alternatives to Emerging Market (EM) currencies, as recently evidenced by Argentina’s letter of intent to the International Monetary Fund in March, which effectively admitted that EM investors see Bitcoin or Ethereum as more credible than some of the regional currencies. Chinese corporations and wealthy individuals have a longstanding desire to move money out of government control, so given the market hype around China this year, this could go some way to explaining Bitcoin’s recent incredible strength. It could even provide a crucial backstop to Bitcoin’s value in the months ahead. The crypto rally might run out of steam, but it is unlikely to reverse.

Please check our blog content for advice, planning issues and the latest investment, market and economic updates from leading investment houses.

Alex Clare

02/05/2023