Please see below for Brewin Dolphin’s latest ‘Markets in a Minute’ article, received by us yesterday evening 13/07/2021:

Equities mixed as US Treasury yields slide

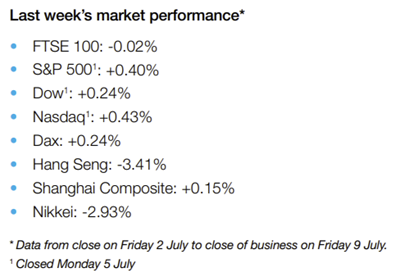

Stock markets were mixed last week as fears about a slowdown in global economic growth led to a steep decline in longer-term bond yields. US indices suffered heavy losses on Thursday as the yield on the benchmark ten-year Treasury note slid to a near five-month low. Although falling bond yields usually increase the relative appeal of equities, investors feared it signalled expectations of a slower recovery from the pandemic. The S&P 500 and the Dow managed to claw back losses on Friday to end the holiday-shortened week up 0.4% and 0.2%, respectively.

The spread of the Delta variant of Covid-19 also weighed on investor sentiment, particularly in Asia where Japan’s Nikkei 225 plunged by nearly 3.0%. Tokyo is being placed under a fourth state of emergency to try to curb the rise in infections. In Europe, the STOXX 600 recovered from Thursday’s sharp pullback to end the week up 0.2%. Germany’s Dax also added 0.2%, whereas France’s CAC 40 slipped 0.4%. The UK’s FTSE 100 was flat as the government confirmed it would ease quarantine rules for fully vaccinated adults and under-18s from mid-August, despite the surge in infections.

Stocks rise ahead of Q2 earnings season

Wall Street stocks were in the green on Monday (12 July) ahead of the start of the second quarter earnings season. Analysts expect strong results from banks such as JP Morgan Chase and Bank of America. The Dow, S&P 500 and Nasdaq all closed at fresh record highs, with the Dow narrowly missing the 35,000 mark. The FTSE 100 edged up 0.1%, with insurer Admiral leading the way on news its first half profits are likely to be higher than expected. Travel-related stocks underperformed amid data showing passenger numbers at Heathrow Airport in June were almost 90% lower than pre-pandemic levels. The FTSE 100 was up 0.3% at Tuesday’s market open, after the Bank of England said it was lifting Covid-19 restrictions on dividends from lenders. Shares in NatWest, HSBC and Lloyds all rose by around 2% following the announcement.

US economic data miss forecasts

A raft of worse-than-expected US economic data weighed on equities and bond yields last week. The Institute for Supply Management’s gauge of service sector activity fell to 60.1 in June, lower than the 63.5 figure forecast by economists in a Reuters poll and down from 64.0 in May. It came amid labour and raw material shortages, which resulted in the survey’s measure of backlog orders rising to 65.8 from 61.1 in May. The IBD / TIPP economic optimism index also slipped from 56.4 in June to 54.3 for July, its lowest reading since February. Elsewhere, figures from the Labor Department showed US weekly jobless claims rose to 373,000 for the week ending 3 July, worse than the 350,000 Dow Jones estimate. Job openings hit a record high of 9.2m in May, which was up 1.7% on the previous month but lower than the expected 9.3m.

UK economic rebound slows

Here in the UK, gross domestic product (GDP) expanded by 0.8% in May from a month ago, down from April’s 2.0% increase and weaker than the 1.5% expansion predicted in a Reuters poll. The Office for National Statistics said GDP growth remained 3.1% below its level in February 2020, just before the pandemic struck. The services sector rose by a weaker-than-expected 0.9% between April and May, as the huge surge in accommodation and food services output failed to offset slower increases elsewhere. Services growth was 3.4% below its February 2020 level. Meanwhile, manufacturing output slipped by 0.1% as the ongoing microchip shortage disrupted car production, leading to the steepest fall in the manufacture of transport equipment since April 2020. Construction output fell for a second consecutive month, down 0.8%, but remained the only sector to have output levels at above its pre pandemic level.

Eurozone retail sales rebound

There was more positive economic data from the eurozone, where monthly retail sales rose more than expected in May following a decline the previous month. According to Eurostat, retail sales rose by 4.6% monthon-month and by 9.0% from a year ago. This was above consensus forecasts of a 4.4% monthly rise and an 8.2% annual increase. The surge was driven by purchases of non-food products and car fuel as several countries lifted coronavirus restrictions. However, the rapid spread of the Delta variant has cast doubt over the speed of Europe’s economic recovery. On Friday, Germany and France warned people against travelling to Spain, where the infection rate is the highest in mainland Europe. The Netherlands said it would reintroduce restrictions on hospitality venues just two weeks after lifting them. Figures from the European Centre for Disease Prevention and Control, reported by the Financial Times, showed the weekly Covid-19 infection rate for the EU and European Economic Area rose to 51.6 per 100,000 people on Friday, from 38.6 the week before. The infection rate is expected to exceed 90 per 100,000 people in four weeks’ time.

Please continue to utilise these blogs and expert insights to keep your own holistic view of the market up to date.

Keep safe and well

Paul Green DipFA

14/07/2021