Please see below an article published yesterday and received today by Evelyn Partners, which details their thoughts on the latest UK inflation figures:

What happened?

UK November annual headline CPI inflation was reported at 10.7% (consensus: 10.9%), versus 11.1% in October. The CPI monthly increase was +0.4% (consensus: +0.6%), compared to 2.0% in October. November annual core inflation (excluding food, energy, alcohol and tobacco) was 6.3% (consensus: 6.5%), versus 6.5% in October. The core CPI monthly increase was +0.3% (consensus: +0.5%), compared to +0.7% in October.

What does it mean?

Though CPI inflation slowed in November from October, the data has yet to show conclusive evidence that it has indeed peaked. For instance, there remains upward inflation pressure in services: the annual rate for restaurants and hotels was 10.2% in November 2022, up from 9.6% in October and the highest rate since December 1991.

Moreover, core CPI inflation (excluding food, energy, alcohol and tobacco) is elevated and there are concerns that this could lead to the secondary impact of workers demanding higher wages to keep up with the rising cost of living. There is some evidence of this from the labour market statistics released this week: annual regular wage (excluding volatile bonuses) rate accelerated to 6.1% in October for the whole economy on a 3-month moving average, up from 3.6% at the end of 2021. With the unemployment rate still near cyclical lows, there is a possibility that higher wage rates become entrenched in the economy, increasing the risk of a wage-inflation upward spiral. This is a risk that the government has cited in their discussions with the trade unions.

Nevertheless, CPI inflation should decelerate in 2023, as expected by the consensus of economists. First, slowing economic growth, along with higher taxes, rising mortgage rates and less government support on energy prices next year is likely to be a drag on real household take-home pay in 2023. Lower discretionary incomes should prove to be significant headwind against accelerating inflation from here. Second, core output Producer Price (PPI) inflation has deteriorated to 13.2% in October, after peaking in the summer at 14.9%. Over time, the lower cost of inputs into production should exert downward pressure on consumer prices. Third, high base effects from sharp price increases in 2022 will make it difficult to sustain high annual CPI inflation rates in 2023. And fourth, the impact of supply chains disruption on creating inflation in the goods market from the pandemic should begin to fade.

Bottom Line

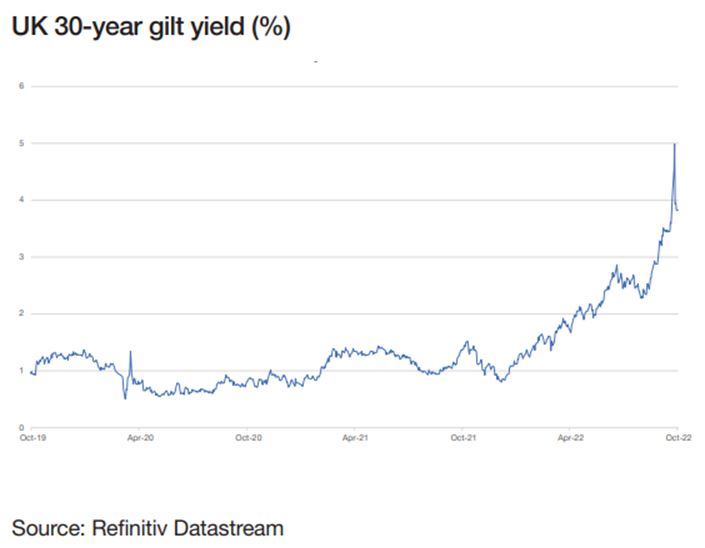

Given the current high rate of consumer price rises, the Bank of England will continue to raise interest rates for now, and particularly as inflation is a long way from its 2% target.

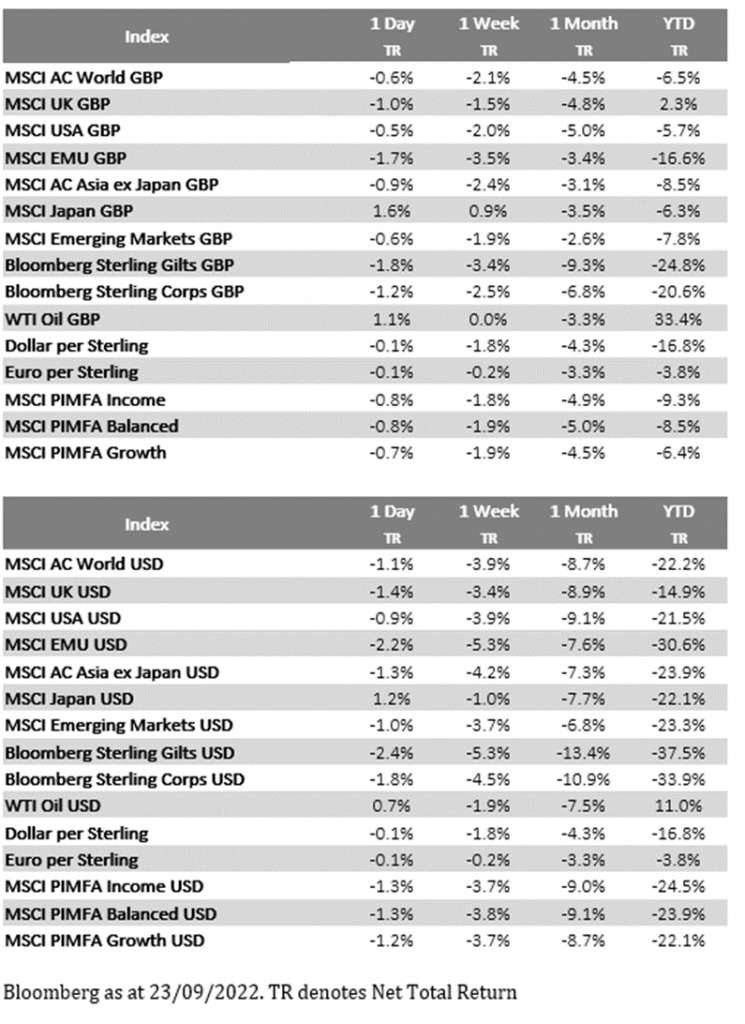

For investors, elevated inflation is a near-term risk to the UK economy. However, the UK economy is not the stock market. Many of the largest companies in the UK stock market have a global focus; around two-thirds of UK large-cap index earnings are from abroad. This means that many companies have relatively low exposure to the domestic economy. The UK stock market still looks cheap relative to many of its peers and a weak sterling exchange rate has boosted the value of US dollar earnings when repatriated back to the UK.

Still, given the downside risk seen in consumer demand, it is probably prudent to steer away from consumer discretionary parts of the UK equity market and tilt towards opportunities in large cap UK stocks linked to raw material prices. For example, the MSCI UK energy index appears attractively priced and trades on a record low Price-to-Earnings ratio of 5.5 times earnings. This shows that even during the current market volatility there are opportunities.

Please continue to check our Blog content for advice and planning issues and the latest investment, markets and economic updates from leading investment houses.

Carl Mitchell – Dip PFS

Independent Financial Adviser

15/12/2022