Please see below for one of Invesco’s latest Investment Intelligence Updates, received by us yesterday 14/06/2021:

After April’s US CPI upside surprise, last week’s May reading was eagerly anticipated, albeit with a degree of trepidation. It didn’t disappoint. Headline CPI came in at 0.6%mom and 5%yoy, its highest level since 2008 (inflation peaked at 5.6%yoy then), while Core CPI rose even more at 0.7%mom, leaving it at 3.8%yoy, its highest since 1993. Both were 30bp above consensus expectations on a year-on-year basis. Strength was largely led by what are seen as “transitory” components, such as used cars (7.3%), car and truck rental (12.1%) and airfares (7%), even if there are other elements of consumer prices, such as shelter costs, that show more sustainable price pressures. Notwithstanding that we are probably close or at peak inflation as the impact of the lockdown starts to fall out of the calculation. How quickly and how far it will drop will be a function of whether rising costs, corporate pricing power and rising wages in a stimulus fuelled economy translate into more persistent inflation. For now, the Federal Reserve and increasing numbers of investors, witness a 10yr UST that is at its lowest level since early March, appear unconcerned about this risk. Time will tell whether this complacency is warranted or not, but it clearly remains a significant tail risk for financial markets.

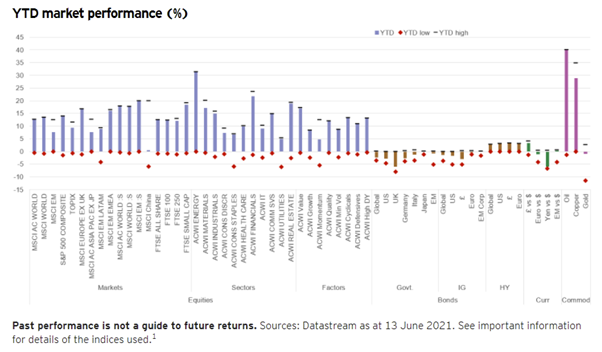

Global equity markets finished the week at a fresh all-time high, with a rise of 0.6% for MSCI ACWI. It is now up 12.7% YTD. DM (0.6%) led EM (flat), with both the US and Europe ex UK hitting new all-time highs, up 13.8% and 16.7% respectively YTD, with the latter the strongest major market of the week (1.2%). Small Caps (1.3%) outperformed again, hitting new all-time highs, with DM (1.3%) ahead of EM (1.1%). It was a rare week of Tech and tech-related sector outperformance, led by IT (1.6%). HealthCare (2.8%) was the best performing sector. Real Estate also had a good week (2.1%) and is now the third best performing sector YTD, up 18.8%, behind Energy and Financials. Lower bond yields weighed on Financial sector performance, while commodity sectors also lagged. Sector performance underpinned a strong relative performance week for Growth (1.4%) versus Value (-0.3%), while Quality (1%) had a good week too. UK equities were slightly ahead (All Share 0.9%) on the back of a good week for large caps (FTSE 100 0.9%) on strength in HealthCare, Telecoms and Energy.

Government bonds had a strong week with yields pushed lower by the belief that US inflationary pressures are transitory and a dovish stance at the latest ECB meeting. 10yr USTs and Gilts fell 10bp and 8bp respectively, taking them to their lowest levels since early March. They are now down 28bp and 18bp below their YTD highs, but are still higher than their starting level, hence the negative returns YTD from the asset class. Bunds and BTPs fell 6bp and 12bp. The better tone in government bond markets supported a good week for credit markets, where IG outperformed HY globally. IG yields fell 5bp with spreads narrowing by 2bp. The latter at 91bp are within touching distance of their post-GFC low (87bp). In HY a decline of 5bp in yields took them to all-time record lows (4.54%), but spreads at 353bp remain somewhat above their post-GFC lows (311bp).

The US$ edged higher over the week with the US Dollar Index up 0.5%, its third weekly gain, leaving it up 0.7% for the year. The Euro and £ were down -0.4% and -0.3% respectively.

Commodities overall were down slightly on the week with a -0.6% loss for the Bloomberg Commodity Spot Index, which is up just under 22% YTD. Brent, up 0.9%, hit its highest level ($73) in two years. In its latest monthly report, the IEA said that OPEC+ would need to boost output to meet demand that is set to recover to pre-pandemic levels by the end of 2022. Copper was up marginally too, 0.4% on the week, after a late rally on Friday as investors bet that China’s sales of strategic reserves would have a muted impact on demand. Gold edged lower (-0.6%) as it continued to consolidate around the $1900 level.

Andy Haldane, the Bank of England’s outgoing Chief Economist, described the UK’s housing market as being “on fire” last week. Recent House Price indices from the Halifax and Nationwide, the two biggest mortgage lenders, showed annual price growth of 9.6%yoy and 10.9%yoy respectively. These were the fastest rates of growth since 2007 and 2014 respectively and a lot faster than the rates of growth (3% and 3.5% CAGR respectively) seen in the decade leading up to the pandemic, described by another senior BoE official as housing’s “Quiet Decade”. And last Thursday’s RICS House Price Net Balance reading, which measures the breadth rather than magnitude of price falls or rises over the previous 3 months, hit +83% – its highest level since the housing boom of the late 1980s. Regionally it hit +100% in the N, NW and SW of England and Wales, while London was the standout laggard at just +46%.

All in all, a very uncharacteristic housing market, which typically fall and only recover slowly in severe economic contractions. This time around a combination of factors have delivered a very different market outturn: easing of lockdown restrictions have released pent-up demand. The government has supported the market through the Stamp Duty holiday (due to finish at the end of September), although it may not be as big a motivator for moving as some think. A recent survey by Rightmove shows that it is not the biggest motivation, with only 4% saying that they would abandon purchase plans if they missed the Stamp Duty deadline. Mortgage availability has improved, particularly for first-time buyers. Borrowing costs are low. Excess savings built up during the pandemic have provided cash for larger deposits. Finally, lifestyle factors (more space, relocating from large metropolitan areas) are at play. This has created an excess of demand over supply (the gap between new buyer enquiries and new instructions in the RICS survey was the widest since 2013) and, as with any commodity, when these imbalances occur prices tend to rise.

So, will the market remain “on fire”? In the RICS survey a national net balance of +45% envisage higher prices in the short-term (3m), while a greater +64% see them higher over 12m, although prices are only seen rising between 2-3%. Halifax and Nationwide also see the potential for further price rises in the coming months as most of the current demand drivers remain in place against a backdrop of a continued shortage of properties for sale. So, the fire may rage for a bit longer. Longer-term the RICS survey sees house prices appreciating by between 4-5% over the next 5 years. A still robust market, but certainly not to the same degree that we’re seeing currently. That would be a positive outturn for the economy.

Key economic data in the week ahead

The Federal Reserve and Bank of Japan meet this week to set their respective policy rates. Inflation data is a feature in both Japan and the UK this week, with the UK also publishing its latest employment report. In China economic activity for May is also released. Finally, there will be a number of post-G7 meetings in Europe next week, which may stir some interest, particularly those between the US and EU and Biden’s meeting with Putin.

In the US Retail Sales data for May is released on Tuesday. A decline of -0.6%mom is expected after no growth the previous month as the impact of pandemic-relief cheques faded. On Wednesday the Federal Reserve’s FOMC meets. While no change in policy is expected, market focus will be on its update of its economic projections, particularly any changes to the rates dot plot, employment and inflation projections (after two strong prints recently), as well as any clues on the future tapering of QE. Last week’s Initial Jobless Claims fell to a new pandemic low of 376k as the number of job openings has surged. On Thursday a further decline to 360k is expected.

There are a number of important data points this week in the UK. April’s Unemployment figures are published on Tuesday. A small decline to 4.7% from 4.8% is forecast. This compares to a recent high of 5.1% and 3.8% before the pandemic struck. On Wednesday May’s CPI will come out. Headline inflation is estimated to have increased 0.3%mom to 1.8%yoy mainly due to higher fuel prices. This will take inflation back to the levels seen immediately pre-pandemic. Core is also expected higher at 1.5%yoy from 1.3%yoy. So, both measures remain below the Bank of England’s 2% target. Retail Sales for May are released on Friday. After the non-essential shops re-opening bounce last month, a more sedate 1.6%mom is expected this month for sales ex Auto Fuel.

In Japan the Bank of Japan meets on Friday and is expected to keep its policy unchanged. CPI on the same day is forecast to have increased in May, but the Headline rate is still expected to be negative at -0.2%yoy, while Core is seen as flat, having fallen 0.1%yoy in April.

Chinese activity data for May is released on Wednesday. Industrial Production is forecast to have risen 9.2%yoy, slightly lower than 9.8%yoy in April. Retail Sales are also expected lower, but still strong at 14%yoy compared to 17.7%yoy in April. Fixed Asset Investment is seen up 17%yoy from 19.9%yoy last month.

There is no significant data coming from the EZ this week.

Please continue to utilise these blogs and expert insights to keep your own holistic view of the market up to date.

Keep safe and well.

Paul Green DipFA

14/06/2021