Please see below for the latest Markets in a Minute update from Brewin Dolphin, received late yesterday 02/09/2020:

Global share markets mostly rose over the past week, driven by growing signs of an economic recovery, positive news on coronavirus developments, and the US Federal Reserve’s shift on inflation targeting (see below).

Sentiment in the US was so bullish that the S&P500 set fresh record highs every day last week, helped by a cooling of the US/China tensions. The UK, however, was a notable underperformer, with the FTSE100 weighed by a stronger pound. This reduces the value of multi-national companies’ dollar-based earnings.

A mixed start to the week

The UK markets, along with many in Europe, were closed on Monday, although in the US it was business as usual and shares fell slightly.

On Tuesday, however, US shares rebounded, with the Dowgaining 0.76% and the S&P500 rising by 0.75%, while the Nasdaq continued its extraordinary rally, rising by 1.4% to 11,939.67.

In the UK it was a different story, as the continuing strength of the pound and Brexit uncertainties saw the FTSE100 fall by 1.7% to 5,862.05, its worst level in three months.

In early trading on Wednesday, UK shares were heading up, as Nationwide reported house prices had had risen to an all-time high of £224,123 in August, as activity rebounded after the lockdown was eased.

Market performance*

- FTSE100: -3%

- S&P500: +2.4%

- Dow: +1.4%

- Nasdaq: +4%

- Dax: -0.6%

- Hang Seng: -1.2%

- Shanghai Composite: +1%

- Nikkei: -0.7%

*Data for the week to close of business, Tuesday 1 September.

Coronavirus news

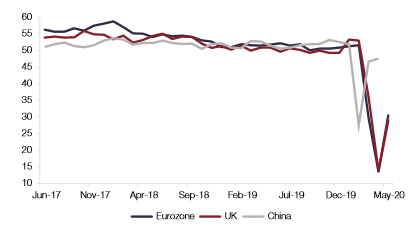

New global coronavirus cases have been trending sideways for a month now. Infections in emerging economies may be slowing especially in Brazil, South Africa (which has gone from 13,000 new cases a day down to around 2,000), Pakistan, Mexico and Saudi Arabia.

In addition, new cases are falling in developed countries, led by the US which has seen a sharp decline, and also Japan, both of which are helping to offset some worrying rising trends in Europe.

Encouragingly, the death rate in this second spike of cases in developed countries is far lower than the highs of April, even though the number of new cases being detected is well above the April highs. This is likely to be because there is more testing of younger people and therefore more cases detected among younger, more resilient populations. This is helping to avoid a return to a generalised lockdown and helping keep confidence up.

UK piles on the debt

Although the UK has only just entered a recession, recent data has started to illustrate the true extent of the damage so far suffered during the coronavirus pandemic. The Office for National Statistics has revealed that, following the sheer cost of its Covid-19 response, UK government debt has risen above the £2trn mark for the first time.

According to the data, spending on measures (such as the widely used furlough scheme) meant total UK government debt was £227.6bn higher in July 2020 than it was a year before. At the same time, tax revenue has been hit hard by the fact many businesses and people are earning and spending less. Combined with greater government borrowing, this is the first time UK government debt has been above 100% of gross domestic product (GDP) since the 1960s.

Jackson Hole Symposium

In his speech to the annual gathering of central bankers and policymakers in Jackson Hole, Wyoming, US Fed Chair Jerome Powell confirmed it is moving to a system of inflation “average targeting”.

This is important because it means that it will allow inflation to run above 2% to make up for a previous undershoot. The Personal Consumption Expenditure (PCE) price index is the Fed’s preferred inflation index for the 2% target, and in the chart below you can see it has been running below 2% for a sustained period of time for the past decade.

According to the St Louis Fed, even if you allow for 2.5% PCE inflation, which is an overshoot of inflation of 0.5%, it will take until 2032 to make up for the inflation undershot over the past decade. So, the implication is that the Fed wants to let the economy to run “a little hotter”, with faster-rising prices, without the need to raise interest rates or tighten monetary policy when inflation is above 2%. It also likely means that US interest rates will stay at, or near, 0% for a long time, which should be a positive for investment assets. Indeed, many think that the US will need to return to near-full employment and inflation of at least 2% before the Fed will consider raising rates again. We expect further guidance on this at the next Fed meeting later this month.

US/China tensions cool

Powell’s speech came in a week of broadly positive economic news for the US. At the beginning of the week, both the US and China affirmed their willingness to negotiate and declared they were ready to progress with trade talks. With tensions between the two nations a recurring source of stress for investors, this update was welcomed by markets.

US economic data

- US Durable goods orders in July were up 11.2% vs expectations of 4.8%, helped mostly by new orders for vehicles and parts (+21.9%), electrical equipment and electronic products. Durable goods orders are a proxy for business investment demand and it has now risen for a third consecutive month – a sign things are really normalising.

- US housing data, which is vital in supporting economic growth, has been really encouraging. July new home sales came in significantly above expectations at $900k versus the estimated $790k, surging to the highest level since the 2009 financial crisis. Existing home sales increased by a record 24.7% in July to an annual rate of $5.86m, the highest level since December 2006. The median house price rose to 8.5% on an annualised basis, the highest since April 2015. Pending home sales also rose 5.9% in July compared to June, after a huge 16.6% increase in June over May.

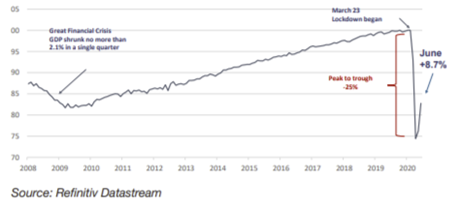

Australia enters recession

Having avoided a recession even during the financial crisis of 2008/09 (thanks to huge demand from China for its iron ore and other commodities), the world’s longest economic expansion has finally ended. After almost 30 years of uninterrupted growth, Australia’s economy contracted by 7% in the June quarter, following a 0.3% contraction in the first three months of the year.

Brewin Dolphin are market leading fund managers, and so receiving their regular insight in this efficient manner is a quick but well-informed way to update your consensus view of the global markets.

Please keep using these blogs to regularly update your knowledge of current market affairs from around the world.

All the best, keep well!

Paul Green

03/09/2020