Please see below for Brewin Dolphin’s latest Markets in a Minute article received yesterday 18/08/2020:

Global equity markets pushed higher for most of last week on positive economic data, before an ugly session on Friday erased most of the gains. Markets dropped in the UK and Europe as France was added to the quarantine list, which hit travel stocks hard. Prior to that, the Nasdaq hit a new record high, as did the gold price, while the S&P500 briefly surpassed the record high it set back in February before closing slightly lower.

Last week’s markets performance*

• FTSE100: +0.95%

• S&P500: +0.64%

• Dow: +1.8%

• Nasdaq: +0.07%

• Dax: +1.8%

• Hang Seng: +3.84%

• Shanghai Composite: +0.2%

• Nikkei: +4.3% *

Data for the week to close of business on 14 August 2020

Mixed start to week on US/China tensions and virus concerns

Markets were mixed yesterday after digesting news that the US and China cancelled their weekend talks to assess how Phase 1 of the trade deal was progressing. It was blamed on “scheduling conflicts” but given the recent escalation in tensions, including banning WeChat and Huawei, perhaps a postponement is no bad thing. London equities rose, with the FTSE100 up by 0.6%. In the US they were mixed – the Dow closed down 0.3% at 27,844.91, while the S&P500 rose 0.27% to 3,381.99. The Nasdaq closed 1% higher at 11,129.73. Europe was also mixed, with the pan-European Eurostoxx up by 0.3%, alongside gains in Germany and France, but equities in Italy and Spain lost ground.

There are concerns that economies are reaching their maximum capacity for growth without further easing of restrictions, which could increase the chances of a second wave of coronavirus infections. However, surging cases in some European countries are leading to more containment measures, not less.

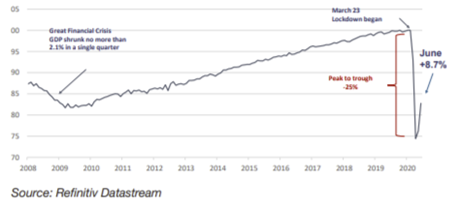

Level of UK GDP (February 2020=100)

UK recession

The standout headline last week was the UK’s record decline into recession in the second quarter. The -20.4% quarterly fall in GDP does look ugly. It is the largest quarterly decline on record, and it was the biggest quarterly fall amongst major economies. As a services-sector driven economy, the UK has been hit harder than other countries – there was a -23.1% drop in consumer spending, while business investment fell by -31.4% in the second quarter.

More encouragingly, GDP rose by 8.7% month-onmonth in June after 2.4% rise in May thanks to the easing in lockdown restrictions and there is good reason to think this will continue in the short term. For instance, wholesale and retail output rose by +27.0% in June compared with May. And with the reopening of pubs and restaurants in July and the “eat out to help out” scheme in August, we believe the unprecedented fall in GDP in quarter two will be followed by a recordbreaking double-digit growth in quarter three.

In addition, more current high-frequency data such as restaurant bookings, retail footfall and travel show normalisation in activity. However, the risk is that unemployment rises sharply once the furlough scheme ends in October. The ONS said last week that 730,000 fewer people were employed in July compared to March, based on data from HMRC, but with an estimated 5 million people still on furlough.

If such headwinds emerge later in the year, we think the Bank of England will expand its asset purchase program and further stimulus maybe announced by the Chancellor.

Japan follows UK into recession

Japan announced on Monday that its economy had contracted by 7.8% in the second quarter, which is less severe than the slowdowns in the UK, US and much of Europe. This is most likely because it had a less stringent lockdown. Still, the annualised rate of contraction of 27.8% for the three months to June is worse than Japan’s decline at the height of the financial crisis.

US retail sales and inflation

US retail sales rose 1.2% in July compared to June, below expectations for a 1.9% increase. While the sharper than expected slowdown was a disappointment, the good news is that US nominal retail sales have already surpassed their pre-Covid level, so a flattening off is to be expected. Also, there is uncertainty surrounding the unemployment benefits which account for a large part of the income for millions of unemployed Americans, and there is little sign of progress between Republicans and Democrats at the moment. This will be weighing on consumer confidence.

Meanwhile, the US consumer price index jumped 0.6% in July compared to June, which is the biggest monthly increase since June 2009 (vs +0.3% expected), while the core annualised rate rose to 1.6%. These numbers are clearly still very benign compared to the Fed’s inflation target of 2%, but the risk is that inflation could be a problem further down the road.

Chinese data hints at slowing recovery

Overall the China July activity data continued to show improvement but at a slower pace, not surprising given the lingering Covid threat. The talking point was the disappointment in retail sales given China is increasingly a consumption-based economy, retail sales were still down -1.1% on an annualised basis, perhaps due to a spike in cases and people being cautious about going out. However, the Chinese savings rate is over 40%, so consumers would appear to have plenty of spending power for when confidence returns.

We can use these blogs to keep an up to date consensus view of the global markets. Recent recession news may have come as a shock to many, but the background to situations like these can be more easily understood by reading widely on investment issues.

Keep safe and well.

Paul Green

19/08/2020