Please see the below weekly market commentary update from Brewin Dolphin received yesterday (2nd June 2020):

Markets

Share markets had a positive week with most assets rising despite increasing political tensions between the US and China over Beijing’s imposition of security laws in Hong Kong.

There were widespread demonstrations in the city and markets were cautious ahead of President Trump’s speech on Friday in which he would outline his response. However, there was a collective sigh of relief when his speech, which took place after the UK and European markets had closed, lacked any threat of direct action against China or any intention to pull out of Phase 1 of the trade deal.

As a result, US markets closed effectively flat on Friday and UK and global markets rallied on Monday, having lost ground ahead of his speech last Friday. But the best gains were seen in Asia.

• Hong Kong’s Hang Seng closed up by 3.36% yesterday.

• Overall, the MSCI Asia ex-Japan index jumped 2.27% on Monday alone.

• Indices in Europe, the US and UK all finished higher yesterday; the FTSE100 gained 1.5%.

Last week’s gains: *

• FTSE100: 1.4%

• Dow Jones: 3.75%

• S&P500: 3%

• Dax: 4.6%

• Nikkei: 3.7%

• Hang Seng: 1.5%

• Shanghai Composite: 1.4%

*Data to close on Monday 1 June 2020

“The speed at which the economy is able to open over the next two months will be an important factor determining the trajectory of unemployment thereafter.”

PMIs signal slow improvement

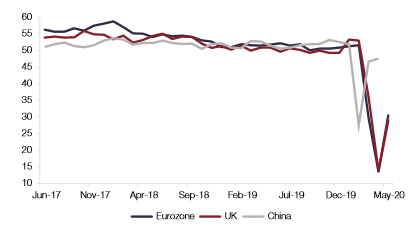

Two surveys over the weekend suggested China’s recovery was continuing, with manufacturing activity expanding.

• China’s National Bureau of Statistics manufacturing PMI hit 50.6 in May, slightly down on April but above the key 50 level that indicates expansion.

• The private Caixin/Markit manufacturing PMI came in at 50.7 for May, above expectations of 49.6. • In the UK, the IHS Markit/CIPS Manufacturing PMI came in at 40.7, still firmly in contraction territory but sharply up from April’s reading of 32.6, suggesting the easing of the lockdown is stemming the decline in activity.

• Eurozone manufacturers appear to have passed their nadir, with the region’s manufacturing PMI rising to 39.4 in May from 33.4 in April.

PMI Data June 2020

Source: Datastream June 2020

Stimulus news

Chancellor Rishi Sunak confirmed on Friday that the furlough scheme will be gradually unwound. Starting from August, firms will have to pay employer national insurance and pension contributions for furloughed staff. In September, they will have to pay 10% of their wages, rising to 20% in October.

This comes despite plenty of lobbying for less burden on business. The Institute of Directors said only around half of firms can afford this. The speed at which the economy is able to open over the next two months will be an important factor determining the trajectory of unemployment thereafter. However, companies will be able to bring back staff on a part-time basis from 1 July, a month ahead of schedule, giving companies some flexibility in adapting to the new levels of demand.

Sunak also extended the Treasury’s self-employment income support scheme, so that those eligible would be able to claim another payment, albeit to a lower level of 70% of average monthly earnings. The first payments had been based on a ratio of 80%. Welcome news nonetheless.

Boost for Europe

The European Commission has proposed a €750bn package, dubbed “Next Generation EU”. The fund would consist of €500bn in grants to hard-hit member states which would not have to be repaid, with a further €250bn in loans. This follows a proposal from France and Germany of €500bn, which the EU’s so-called “Frugal Four” (Austria, Denmark, the Netherlands and Sweden) countered with a proposal of loans only. Since any proposal requires agreement from all 27 member states, we would not be surprised to see them meet somewhere in the middle.

Virus optimism

The general sense within the market seems to be that the worst of the virus is over and the re-opening of the economy will proceed. There are varying degrees of caution over the process which makes it hard to draw conclusions about how well it will go.

Asia is an example of how well the virus can be contained. As we expected, privacy concerns are causing resistance to the track and tracing amongst western populations, and the lack of an effective app means any track and trace programme will be limited in its effectiveness.

As the crisis appears to be ebbing and the UK government is loosening restrictions further, support for containment measures is starting to decline. Indeed, police have said that the lockdown is no longer enforceable, and scenes from parks around the country this past sunny weekend have shown crowds clearly breaching social distancing regulations.

So far, however, there have been very limited instances of cases starting to rise as a result of lifting lockdowns, although it is early days. Denmark remains on a downward trajectory despite lifting its lockdown early, as does Sweden despite much less strict suppression measures. The exceptions are largely in the US where, although the overall trend is lower, several states are seeing an upward trend including California. In Europe it is probably the more general persistence of cases in Italy, where lockdowns are being lifted, that is of greatest concern.

But convincing evidence of a second wave is lacking, which is good news, but there is no room for complacency.

Vaccine progress

Stories regarding vaccines continue to support investor sentiment despite the challenges of producing these to a scale which would facilitate global herd immunity. However, a variant of these stories relating to GlaxoSmithkline was that the company plans to produce a billion doses of adjuvant. This can boost the effectiveness of a vaccine, reducing the quantity, improving the response and creating longer lasting immunity. With so many vaccines in early trials, we await news of concrete developments.

These weekly updates from Brewin Dolphin provide their view of the markets, the frequency of these reports is particularly useful given the present high levels of volatility.

We try to take on board a wide variety of fund managers’ and investment experts’ opinions such as Brewin Dolphin to give you an informed and overall view of the current climate we are in, the consensus view and any variation in views.

Paul Green

03/06/2020