Please see this week’s Markets in a Minute update below from Brewin Dolphin, received yesterday afternoon – 11/11/2025.

Could this be the end of the U.S. shutdown?

We examine the potential breakthrough to the U.S. government shutdown and the positive news from earnings season.

Key highlights

- U.S. government shutdown breakthrough: after a record-breaking 41-day shutdown, U.S. senators vote in favour of a resolution.

- All eyes on tariffs: the U.S. Supreme Court heard evidence related to the legality of President Donald Trump’s sweeping global tariffs. A ruling is expected sometime in December or early 2026.

- A fractured look into the U.S. jobs market: while official data is still limited due to the government shutdown, independent figures showed an uptick in layoffs in October.

- Strains in the credit market: a widening credit spread raises companies’ cost of capital, prompting them to cut investment and output growth. Is there reason for concern?

Shutdown end in sight

After a record‑setting 41‑day impasse, the Senate voted 60‑40 on Monday in favour of a stop‑gap spending bill that keeps most of the federal government funded until January 30, 2026 (a subset of agencies are funded through to September 30, 2026).

The bill pays back furloughed workers and prevents layoffs but defers the decisive vote (which the Democrats had been holding out for), on extending the Affordable Care Act premium subsidies. The deal, brokered by a bloc of centrist Democrats who dropped the subsidy renewal demand in exchange for a promise of a mid‑December Senate vote, sparked an intra‑party backlash but secured the crucial Freedom Caucus Chair’s conditional support.

House Speaker Mike Johnson has signalled a swift floor vote on Wednesday, and with the Grand Old Party‑controlled chamber expected to approve the measure, the bill should soon land on President Trump’s desk for signature. Equity markets seem buoyed by the news. Nevertheless, analysts warn that air‑travel disruptions and SNAP (food stamps) benefit backlogs will linger, and the ultimate fate of the Obamacare subsidies remains uncertain.

Tariffs are back in the spotlight

The Supreme Court of the United States (SCOTUS) was in focus last week as it heard oral arguments on the legality of President Donald Trump’s sweeping global tariffs. You‘ll recall that these measures were the subject of legal challenges that were originally heard by the U.S. Court of International Trade, then moved to the Courts of Appeal, and eventually to SCOTUS. The tariffs were imposed under the International Emergency Economic Powers Act (IEEPA).

The challengers argue that the IEEPA doesn’t grant the president authority to impose tariffs; that power is reserved for Congress according to the U.S. constitution.

The session seemed to favour the complainants. A majority of the justices – including Chief Justice John Roberts and Justice Neil Gorsuch – appeared deeply skeptical. They focused heavily on the separation of powers and the “major questions doctrine,” questioning whether a law intended for emergency sanctions could be twisted to impose a massive, sustained, global tax (i.e., a tariff). This signals that SCOTUS is likely to rule that the president exceeded his legal authority under IEEPA.

What happens next?

The consensus among observers is that SCOTUS will strike down the IEEPA‑based tariffs, with a ruling expected sometime in December or early 2026.

The administration has said it will immediately try to reimpose the tariffs using alternative statutory tools, such as:

- Section 232 (National‑Security Tariffs)

- Section 301 (Unfair‑Trade‑Practice Tariffs)

However, the short‑term fix most likely involves Section 122 (Temporary Balance‑of‑Payments Tariffs). Legal experts believe the administration has the authority to use these provisions, so the substantive outcome may not change dramatically.

One important consequence of SCOTUS upholding the lower‑court decision is that the Treasury would have to refund all duties collected under the IEEPA authority – which is estimated at $90 billion to $130 billion (plus interest). This amount is roughly 5% to 7% of the federal budget deficit. The refund would go to the parties that paid the duties directly – primarily U.S. importers.

Much debate took place in the immediate aftermath of ‘Liberation Day’ over whether the taxes were borne by exporters or U.S. consumers. In reality, both groups shared the burden, but only importers would receive the refund. Consequently, the net effect is a wealth transfer from consumers and exporters to importers.

Broader economic context

The event is significant, but it doesn’t appear to be systemic in the short term.

However, assessing its impact is complicated by the record‑breaking federal government shutdown. Assuming this now ends, as seems likely, the U.S. economic data series will begin to resume.

A fractured look into the U.S. jobs market

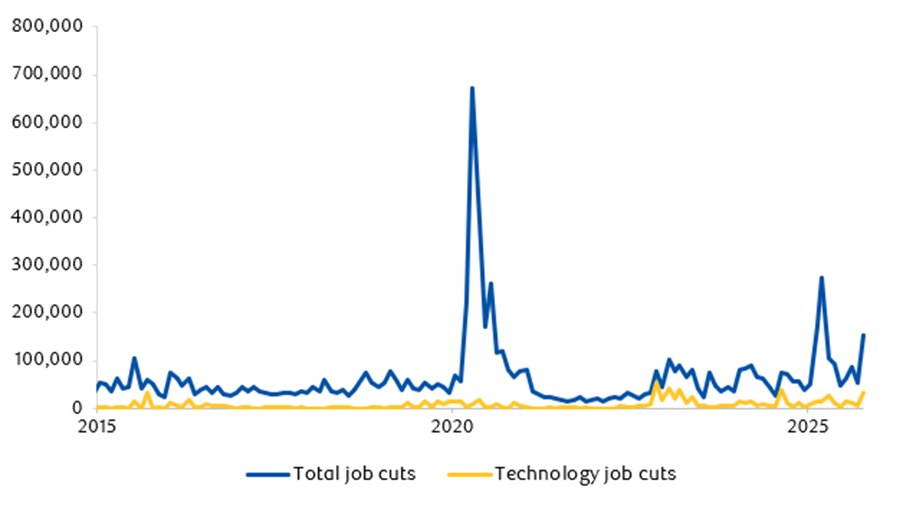

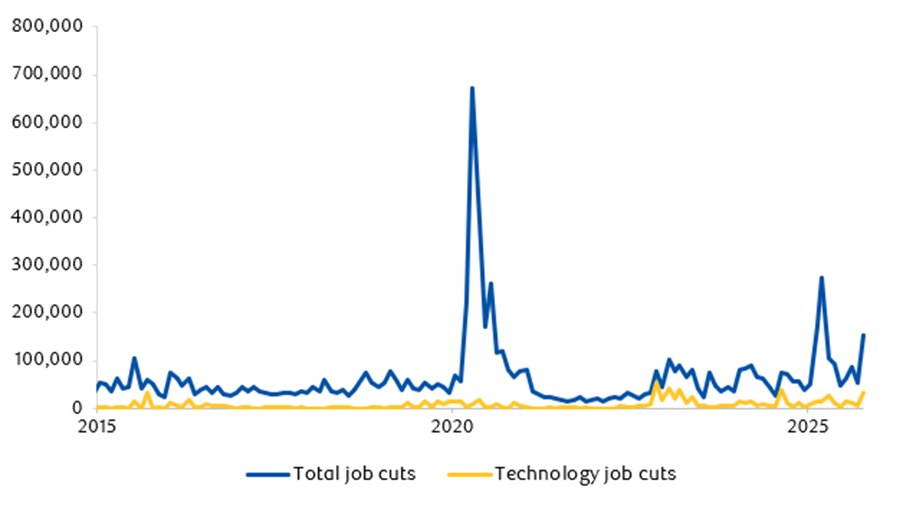

Because of the shutdown, there’s limited data on the broader U.S. labour market. Some private sector sources, such as the Challenger Job Cuts report, continue to track announced layoffs.

Employment is highly seasonal, a nuance that’s obscured in seasonally adjusted data series like non‑farm payrolls or the unemployment rate.

The Challenger report highlighted an unusual uptick in job cuts during October, a month when companies typically avoid layoffs to preserve goodwill before the holiday season.

The second most cited reason for October cuts was artificial intelligence (AI). Most of these cuts came from the technology sector, which has experienced the largest amount of private sector job losses over the past two years (though the public sector surpassed it after the Department of Government Efficiency (DOGE) cuts earlier this year).midst concerns over their investment plans.

U.S. job cut announcements have picked up but are still dwarfed by the DOGE cuts earlier this year

Source: LSEG Datastream

AI‑related layoffs in 2025 total under 50,000 – a relatively small figure, especially given that most of those cuts occurred in the last month. At present, this looks more like a blip than a trend.

Strains in the credit markets

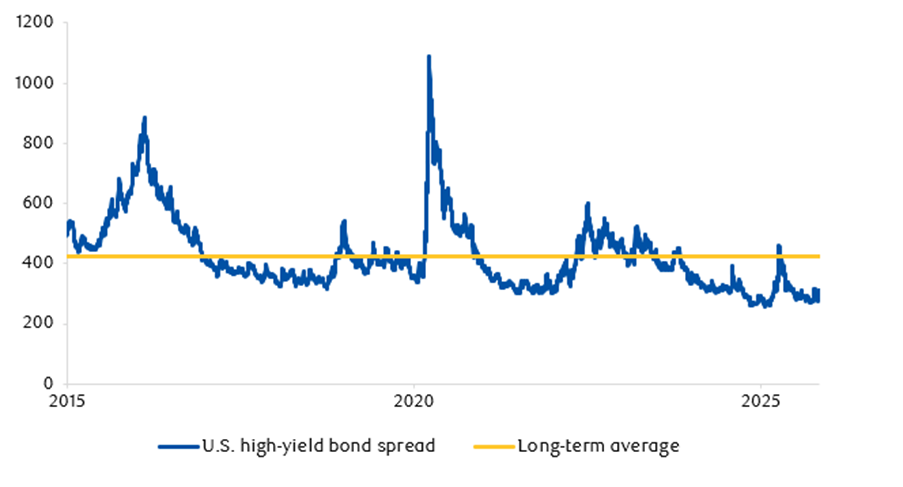

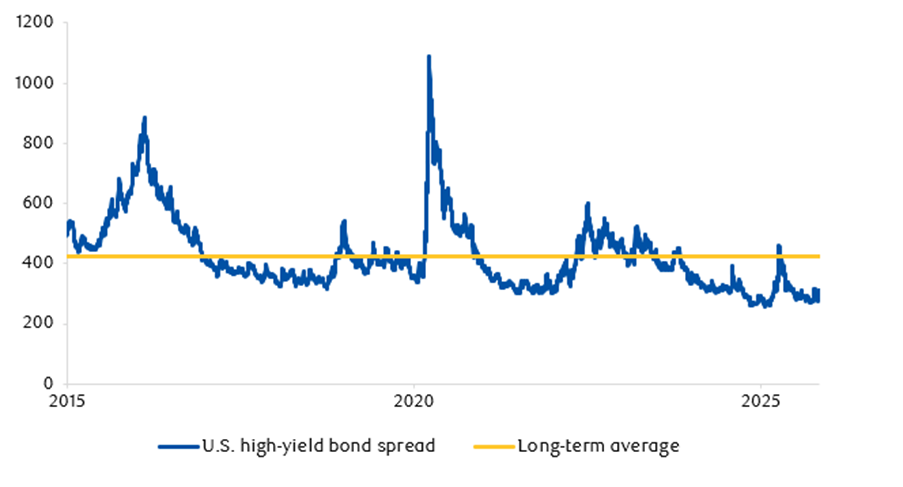

The high‑yield (HY) credit spread remains a robust leading indicator for both real economic activity and equity market performance.

A widening spread raises companies’ cost of capital, prompting them to cut investment and output growth. HY spreads are also predictive for equities; historically, high‑yield returns correlate with equity returns at a range of 66% to 92%. Essentially, equities and high-yield bond returns have a strong positive correlation.

Spreads have risen recently, but they started from a low base, so they’re not yet prohibitively high. A handful of credit concerns have emerged in recent weeks, involving names such as First Brands, Tricolor, Western Alliance, Zions Bancorp, Broadband Telecom, and Bridgevoice. This follows JPMorgan Chase CEO Jamie Dimon’s comment that the first credit worries, “like cockroaches”, often signal the presence of many more.

How to view the credit market

The recent uptick in credit spreads has been modest, and spreads remain relatively low in a long‑term historical context.

High-yield bond credit spreads have widened but don’t appear attractive on a long-term basis

Source: LSEG Datastream

High‑yield investors accept higher default risk in exchange for extra yield; even with the recent spread widening, the overall yield on high‑yield bonds is still modest compared with safer credit.

There’s room for defaults to increase without indicating a systemic financing crisis – this is what we would expect in a normal credit cycle.

Consequently, we can tolerate a further widening of spreads or additional distressed credit cases before becoming overly concerned about an economic slowdown.

Please continue to check our blog content for advice, planning issues and the latest investment market and economic updates from leading investment houses.

Charlotte Clarke

12/11/2025