Please see the below article from Invesco:

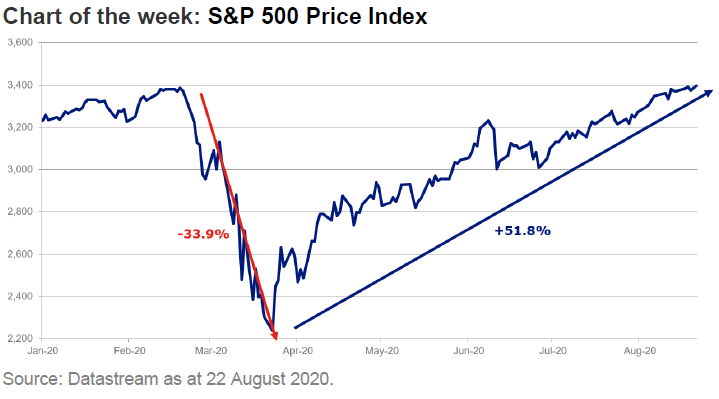

The health crisis of 2020 created a synchronised economic depression requiring equally radical policy responses.

Europe’s response was the creation of a €750bn European Recovery Fund. However, rather than just deploy the capital, member states chose to focus on a Green Recovery and hence use the funds to address the existential threat of climate change. In practice this means the European Commission spending is being guided by the newly developed sustainable finance taxonomy. Promoting activities supportive of the environmental objectives of climate change mitigation and adaption:

- Sustainable use and protection of water and marine resources

- Transition to a circular economy

- Pollution prevention and protection of biodiversity and ecosystems

- It also contains criteria that ensure activities ‘do no significant harm’

European environmental legislation is not new. For years Europe has been a first mover in safety standards and best practices that become global standards, however, the European Green Deal marks a more dynamic approach. Taxonomy is the means by which the market will administer the carrot or the stick to companies. Winners will be those seen to solve the environmental crisis and losers will be those thought to be the cause.

This comes at a time of other changes to the investment landscape. Savers now demand their asset managers embed sustainability into allocation decisions. Fund regulation is playing its role too, through the deployment of SFDR this year, funds will be classified dependant on embedding ESG principles thereby making it easier for savers to pick compliant funds and avoid others. Lastly, the pandemic has created the political cover to deploy the significant European Recovery Fund to sustainable companies.

Combined these elements create the foundations for success. European companies that comply with taxonomy will see their cost of capital fall vs those that don’t.

The EU Recovery Plan is interlocked with the Commissions’ 2019-24 priorities that included the realisation that “Europe needs a new growth strategy that will transform the Union into a modern, resource efficient and competitive economy”. This is an inclusive plan with The Just Transmission Mechanism’s goal that ‘no person or place left behind’. At least E150bn is being made available to address socio-economic effects of the transition out to 2027 – a topic we discuss in greater detail in another piece (link to The Just Transition article). However, the real prize isn’t intra-Europe it’s global.

The goal of climate neutrality requires significant investment and innovation. If the transition is effective through taxonomy rewarding companies in the transition phase, we will grant our existing enterprises a competitive advantage though access to the cheapest capital. This will create more dynamism through more innovation and the creation of products, services and refreshed skilled jobs to achieve all the EU goals. Brown companies can become Green.

This idea of creating a pathway isn’t new. Europe has 2030 targets not just 2050, including transition plans for hybrid ahead of full electric vehicles, coal to gas electricity generation and developing blue hydrogen ahead of green hydrogen being viable. Through this approach we can incentivise European companies to allocate their existing cashflow towards green innovation as opposed to being forced into ever larger dividend yields.

Silicon Valley is perhaps the best example of the prize on offer. The birth of Silicon Valley was a confluence of skilled science-based research, education, venture capital and defence spending, particularly through the creation of NASA and the space race. The success and longevity of which is a function of being the first and with it a sustainable multiplier effect.

We are already starting to see the positive effects from this focus on transition. European oil companies lead the way in reallocating hydrocarbon cashflows towards greener alternatives (Total, Repsol, BP). In renewable energy, Europe is home to the leading wind turbine manufactures (Vestas, Nordex and Siemens Gamesa) and our power generators are world leaders in green production (Enel, EDP, Acciona). In technology, European semiconductor companies have leadership in Auto electrification (Infineon and STMicro). We also have expertise in building materials and renovation focused on reducing energy consumption (SaintGobain, Wienerberger, Kingspan). Europe’s paper companies are transitioning to sustainable packaging and biofuels (UPM) and Europe is home to worldwide leaders in the circular economy (Veolia and Suez). All are stocks that are held in portfolios across the team, to a varying degree.

Europe has grand ambitions and a once in a generational opportunity to steal a march on other continents through early adoption of regulation and technology. Through incentivising companies to innovate and embrace climate change Europe can become a global exporter of Greentech products and services to the rest of the world and enjoy the multiplier effect. Europe has the potential to achieve net zero and in doing so become the Silicon Valley of Green Tech including the vibrancy, jobs and sustainability that comes with it.

Please continue to check back for a range of blog content and regular updates from us.

09/04/2021

Andrew Lloyd