Please see this weeks Weekly Market Performance Update from Invesco which was published today:

The overall tone in forward-looking economic data remains broadly supportive, albeit with occasional disappointments, such as the EZ’s weaker than expected Composite PMI data. Beyond the (inevitable) strong post-lockdown bounce, however, the outlook remains less certain, reflected in continuing dovish comments from Central Banks and further fiscal support. Positive news on the vaccine front continues to come out, but widespread availability of a proven vaccine is likely to be a mid-2021 story rather than anytime sooner. Meanwhile on the virus front the situation remains mixed, with still high levels of new cases globally and the emergence of new clusters of inflections. But these generally have not been met by new aggressive lockdowns as authorities have so far reacted with only very localized and limited measures. With the Democratic Convention over and the Republican equivalent this week, the US Presidential and Congressional elections will increasingly become a major focus for investors as we move into the autumn. Another potential stumbling block for those looking for reasons to be more cautious on the outlook, even if history has shown that such concerns are often misplaced.

Global equities edged higher last week, with the MSCI ACWI in sight of its all-time high set in February. Gains were concentrated in the US, as all other major DMs saw modest declines. Small caps also fell. Value’s relative rally came to an abrupt halt, as Financials and Energy were weak and IT-related stocks boosted Growth. This weighed on UK stocks too.

Fixed income markets eked out modest gains across the board but are struggling to make sustained upward progress with yields at current levels and spreads in credit markets around their post-bear market lows. Government bonds were slightly ahead of credit, with IG ahead of HY.

The US$ recovered the previous week’s losses but remains close to its YTD lows against most major currencies. Commodities had a mixed week. Oil and Gold saw small declines, but copper appreciated.

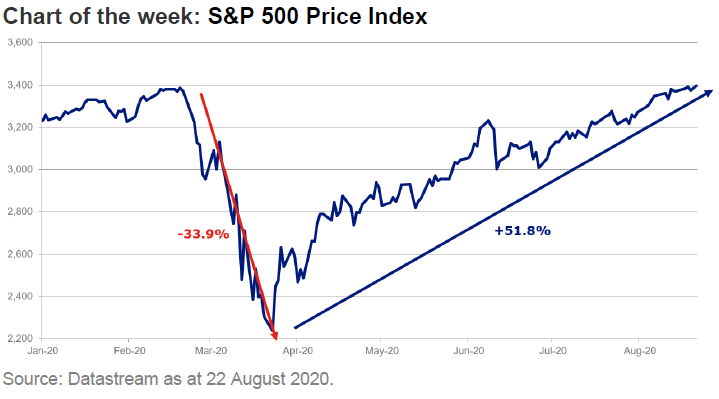

• After a precipitous decline of nearly 34% in just over a month in February and March, the S&P 500 has staged a spectacular rally off its lows, rising just under 52% since then and making a new all-time high last Tuesday. It is now up 5.1% YTD.

• The recovery has surpassed anything seen in other major DM equity markets. Japan (Topix), Europe (MSCI Europe ex UK) and the UK (FTSE All Share) are still respectively -8%, -13% and -21% below their YTD highs. EM equities have fared somewhat better and are now just -1% below theirs.

• The US’s rally has not, however, been exceptional compared to previous bear market recoveries. Post the GFC crisis the equivalent rise was 49.4%, so broadly the same. The difference then, of course, was that this was after a multi-year bear market, which saw the market fall materially further than this time around (-56.8%).

• And a rising tide has not lifted all boats, at least not equally. The equally-weighted S&P 500 remains 7.8% below its all-time high, highlighting that the rally has been mega-cap led. Apple (+71%), the US’s first $2trn company, Microsoft (+36%) and Amazon (+77%), the three largest companies in the index, have all seen outstanding performance YTD. But there are still around 150 companies that are down more than 20%, while more than half the market has not made any gains this year.

• What has driven the rally? It’s been all about a re-rating. The 12m Trailing PE has risen from 23.4x to 29x (based on Datastream data), with earnings down -15%. At 22.3x the 12m Forward PE has only been surpassed during the TMT bubble. It’s been a spectacular rally, but one that has left the market not without its risks against the backdrop of an uncertain economic outlook and expectations of a strong earnings recovery.

Key economic data in the week ahead:

• A light week ahead on the data front.

• While not data, the key focus of the week in the US will be the annual (virtual this time) Jackson Hole Symposium. This year’s symposium is entitled “Navigating the Decade Ahead: Implications for Monetary Policy”. On Thursday attention will be on Federal Reserve Chairman, Jerome Powell, and his expected comments on the Fed’s ongoing policy framework review, while on Friday Governor of the Bank of England, Andrew Bailey, will also be speaking. Outside this, Tuesday sees the Conference Board Consumer Confidence reading for August, which is expected to show a slight improvement compared to July but remaining depressed relative to pre-virus levels. Initial Jobless Claims out Thursday are expected at 925k from last week’s above expectations reading of 1.1m. The week ends with the Fed’s preferred inflation measure, Core PCE Inflation, on Friday, which is expected to show a sharp rise (0.5%mom from 0.2%mom). This outsized gain is unlikely to have a material impact on the Fed’s medium-term inflation outlook given that the drivers of this outperformance largely reflect payback from virus-related declines previously.

• In the UK the Lloyds Business Barometer on Friday is expected to remain relatively weak compared to the robust PMI readings that we saw last week. Nationwide House Price Index on the same day is expected to see year-on-year growth increasing to 2%, up from 1.5% in July.

• No data of note from China, the EZ or Japan.

Please keep checking back for regular updates on the markets from a range of investment managers.

Andrew Lloyd

24/08/2020