Weekly update from Brewin Dolphin

Further comment and update below from Brewin Dolphin below as this pandemic continues and the world adjusts to the coronavirus:

As we enter week two of lockdown in the UK (is that all its’s been?!) the UK government has given the clearest indication yet that measures could be extended beyond the current three-week period. Deputy Chief Medical Officer, Dr Catherine Calderwood, has suggested restrictions on movement may be necessary for at least 13 weeks whilst the UK deputy chief, Dr Jenny Harries, has warned resumption of normal life may be six months away, stressing the importance of phasing out restrictions over time to avoid a second peak down the line. For the NHS, meanwhile, the return of 20,000 staff to the workforce should prove a welcome boost as they come under pressure with up to a quarter of staff off work in some wards as doctors and nurses affected by the virus, either directly or indirectly, self-isolate.

In the US, Donald Trump conceded the US would not be open for business as usual by Easter after all, extending the current social distancing measures until the end of April amidst warnings from a leading infectious disease expert that 200,000 Americans could die. The US now has the most cases of any nation and the President’s handling of this crisis could well become a key determinant in his bid for re-election in November.

Meanwhile, as China looks to re-emerge from lockdown, their central bank unexpectedly cut the rate by 20 basis points, the largest in nearly five years, in a bid to relieve pressure on their economy as they pick up the pieces post-pandemic.

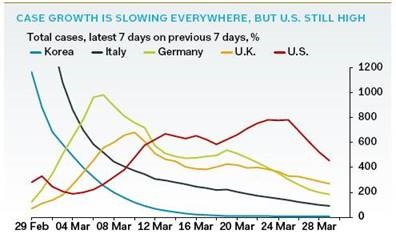

Finishing on a hopeful note, the chart below put together by Pantheon shows that case growth is slowing in some of the most impacted countries, perhaps an indication that the social distancing and lockdown measures in place are beginning to bear fruit though some are further down the curve than others.

Dollar Outlook

The dollar is the world’s major funding currency. Earlier this month, as the coronavirus crisis intensified, companies began to get worried about a sharp drop in revenues and a seizing up in funding markets – both of which would impact their access to dollars. As a result, companies started to max out their dollar credit lines, which pushed the dollar sharply higher earlier this month. Last week, we saw the dollar pull back. There are a couple things causing this: –

First, the Fed stepped in by offering swap lines to the world’s central banks, which has eased dollar funding concerns.

Second, risk assets bounced in the middle of last week. As the chart shows, the dollar has been moving inversely with stock prices, as it did during the Global Financial Crisis, as the chart on the right shows.

It’s too soon to say the dollar rally is over, but on a 12m view, even after the sharp decline of the last few days, the dollar probably has more downside, for three main reasons: –

- Although the economic pain will be severe and this crisis will leave scars, the current consensus suggests the global economy is most likely going to snap back strongly in Q3, possibly Q4, this year. This backdrop, combined with ultra-accommodative monetary policy and currently depressed risk appetite suggests investors spend most of the next 12m in risk on mode, which benefits higher risk currencies.

- The second reason to expect downside in the dollar is interest rate differentials. The 2-year rate spread in the UK, Eurozone, Japan and China have all moved sharply against the dollar. This didn’t matter when markets were tanking, but it should matter more once the volatility stabilizes and the pound, euro, yen and RMB all appear to have upside versus the dollar based on the historical correlation with interest rate spreads, which are unlikely to move much over the next 12 months.

- Commodity prices are depressed now, but should move higher over the next 12 months as the economy starts to pick up. It’s true that the US has higher commodity exposure now given the rise in shale, and UK, Euro area, China and Japan have very little commodity exposure. But the rise in commodity prices should give much more of a boost to the Russia’s, South Africa’s, Brazils, Norway’s, Canada’s and Australia’s of the world.

In addition to these 3 drivers, the dollar is also expensive, market sentiment on the dollar is bullish, which has negative implications from a contrarian perspective, and its already massive current account and budget deficits are set to balloon even further.

Markets in a Minute

– The oil price plunged further over the weekend to its lowest level since 2002 with West Texas Intermediate falling as low as $19.92 a barrel due to vanishing demand and a continuation of the Russia-Saudi price war, heaping pressure on high cost producers such as US shale.

– Businesses are rising to the challenge of creating the tens of thousands of ventilators required to help those most at risk patients with Airbus, BAE, Ford, Rolls Royce and Siemens forming the “VentilatorChallengeUK” Consortium to help meet the demand.

– easyJet has grounded their entire fleet and given no indication when they can restart commercial flights. Virgin Atlantic, meanwhile, look set to request a government bailout with other carriers likely to join the queue. Grounded crew meanwhile have been asked to help staff field hospitals.

Thanks to Brewin Dolphin for the input above emailed to me yesterday afternoon (30/03/2020). If this needs a little interpretation for you or you would just like to catch up, please phone me on 0151 546 1969.

Lines could be busy, but we are fully operational to date with all other staff working remotely as I ‘isolate’ in the office.

Steve Speed

31/03/2020