Please see article below from J.P.Morgan’s weekly market update – received 13/07/2020.

The US presidential election will take place on 3 November 2020. The result will have important implications for investors, as the combination of policies employed by the next administration could have a significant influence on whether the US stock market can continue the outperformance that it has recorded for much of the last decade. Our regularly updated election insights provide investors with all they need to know as the election story evolves.

US election insight – July 2020

The race for the White House is heating up. Joe Biden and the Democrats have seen a surge in the polls in recent weeks, as the US experiences a wave of Covid-19 cases and against a backdrop of widespread protest against racial inequality and social justice issues. The Democrats are also making strong headway in the battle for the Senate, increasing the odds of a “blue wave” in November. The next key event will be the selection of Joe Biden’s running mate – a decision that takes on more significance this year than in a normal election campaign.

What will be voted on in November?

The race for the White House is the main focus, but a president’s ability to achieve their policy goals is influenced by who controls Congress.

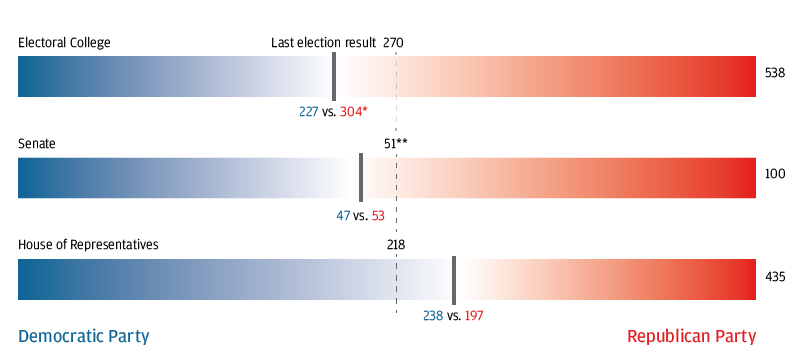

American voters will be asked to make three key decisions on 3 November. The main focus will clearly be on who wins the keys to the White House, but a president’s ability to achieve their policy goals is influenced by which parties control the two arms of Congress: the House of Representatives and the Senate. If Congress remains divided between the Democrats and the Republicans as it is today, the winner of November’s contest will rely heavily on unilateral action taken via executive orders and rulemakings through the federal government via the department and agencies that have significant power. Enacting larger policy proposals requires approval by Congress and the winner of the election will have a much tougher time enacting that part of their agenda. Exhibit 1 shows the numbers needed to win each race.

The electoral college

The presidential candidate that wins the most number of votes (or wins “the popular vote”) does not automatically become president. Instead, the US employs an electoral college system. Votes are tallied at a state level, and the winner in each state earns the “electoral votes” that belong to that state (with the number of electoral votes in each state determined by population size). A candidate needs to win at least 270 of the 538 electoral votes in order to win the presidency.

The Senate

US senators serve six-year terms, which means that roughly a third of the 100 Senate seats are up for grabs at each federal or mid-term election. Currently the Republicans control the Senate. There are 35 seats up for election this year – 23 currently held by Republicans and 12 currently held by Democrats. To win control of the Senate, the Democrats would need to keep all of their existing seats and flip three seats if they win the presidency, or four if they do not, as the vice president casts tie-breaking votes.

The House of Representatives

Each of the 435 seats in the House are up for election in November, with the winners serving a two-year term. Currently the Democrats control the House. For the Republicans to win back control, they would need to win 21 additional seats and hold on to two vacant seats that were previously held by Republicans.

Members of both the House and the Senate serve on a wide range of committees. The Senate has the authority to approve presidential nominations – such as Supreme Court justices and members of the Federal Reserve Board. Betting odds at the start of July put a Democratic sweep of the House and the Senate as the most likely by a significant margin.

Exhibit 1: Votes or seats in the Electoral College, the Senate and the House of Representatives

Source: 270 to Win, The Cook Political Report, J.P. Morgan Asset Management. *In 2016 Trump earned 306 pledged electors, Clinton 232. They lost, respectively, two and five votes to faithless electors in the official tally. **51 seats are needed for a simple majority if the dominant party in the Senate is not represented in the White House. If the president and majority party are the same, only 50 seats are needed for a majority because the vice president casts the tie-breaking vote. 2016 numbers include two independents that vote with the Democrats. Data as of 30 June 2020.

How might Covid-19 change the election timeline?

While Covid-19 has upended the usual schedule, election day itself is unlikely to shift given the need for Congress to approve any change.

The coronavirus outbreak has already had a significant impact on the primary season – the process by which Democratic and Republican presidential candidates are formally nominated. After state lockdowns began in earnest in mid-March, 16 states and one territory either postponed, cancelled or switched their primaries to vote-by-mail with extended deadlines. The Democratic National Convention, at which the Democratic candidate is officially nominated to represent the party in the presidential election, has been delayed by a month to 17-20 August, a week before the Republican National Convention.

While election day may well look very different to any other seen before in the US, the 3 November date is not likely to move. Presidential elections are set in federal law to take place on the Tuesday after the first Monday in November, and for this to be changed, approval from the Democrat-controlled House of Representatives would be required.

It appears that social distancing is highly likely to be required in some form and may threaten voter turnout, which is particularly important for the Democrats’ prospects given the distribution of the electoral college. Non-traditional voting methods have been rising in availability and popularity in recent years (see Exhibit 3), but Democratic proposals for further expansions in 2020 have so far been met with strong opposition by the Republicans.

Exhibit 3: States permitting different methods of alternative voting

Number of states

What are the investment implications?

Election years are on average characterised by lower returns and higher volatility, but market dynamics in 2020 will be dominated by the prevailing economic environment

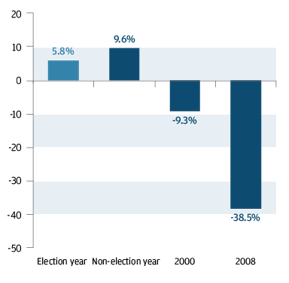

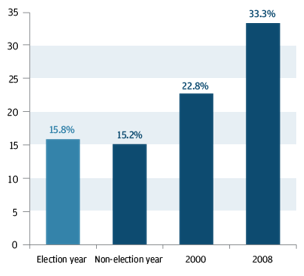

Typically, returns are lower and volatility is higher in election years than in non-election years (see Exhibit 6), although these averages are significantly skewed by major recessions and market events in recent election years. Returns and volatility in 2020 will almost certainly be attributable to Covid-19, not the political campaigns quietly existing alongside it. While the election is still a few months away, there are three areas of focus that could materially impact investor sentiment over the summer.

1. Roadmap for the rebound

Top priority for whoever leads the next US administration will be to manage the economy as it restarts in earnest in 2021. Government finances have been stretched by the vast fiscal packages approved so far and tough choices will need to be made about whether to push ahead with further stimulus, or to try to tighten the belt as the recovery gets underway. The Federal Reserve (the Fed) may come under increasing pressure to keep yields low, although if this pressure is so strong as to cause investors to question the Fed’s independence, there is a risk that longer-dated yields could be pushed higher.

2. US-China relations

The US-China relationship is now back on a worrying path. The hit to both business confidence and investment intentions across the globe in 2019 highlighted the economic damage that was caused by the trade war. Actions from either country that ratchet up tensions further ahead of the November election are a clear catalyst for market volatility. While so far it has been a Republican administration in charge of the negotiations, further information from the Democrats about how they would propose to manage this relationship may also impact market sentiment.

3. Progressive policy proposals

The most progressive policies moved out of the picture as the most progressive Democratic candidates exited the race. Yet it is still evident that Joe Biden’s vision for corporate America is clearly different to President Trump’s. Democratic proposals for the use of anti-trust legislation to clamp down on “Big Tech”, plans for corporate tax changes and how to shore up the healthcare system are all matters that warrant close attention.

The combination of policies employed by the next administration will be an important factor in determining whether the US stock market’s leadership over much of the past decade will continue. An environment of escalating trade tensions has favoured the higher-quality US stock market relative to other regions historically, although we recognise that an increase in regulatory pressure on the tech titans could pose risks to US market leadership given the high weights to technology and communication services sectors in US indices. We will be tracking developments closely as 3 November approaches.

Exhibit 6: S&P 500 price returns

Percent, average return from 1932 – 2019

S&P 500 realised volatility

Percent, 52-week standard deviation of price returns, 1932-2019

As the US is one of the largest most influential markets globally, what happens next from a political point of view is important to the global economy.

Please keep checking back for regular updates and blog posts.

Charlotte Ennis

14/07/2020