Please see below the latest market update which was published by Invesco today (13/07/2020):

Although the virus pandemic is in decline in many parts of the world we’ve also seen a resurgence in infections, highlighting that the virus is by no stretch of the imagination under full control. Cases continue to rise in many EM, last week saw Melbourne go into a six-week lockdown, while the US’s most populous states, Florida, Texas and California, reported record jumps in deaths.

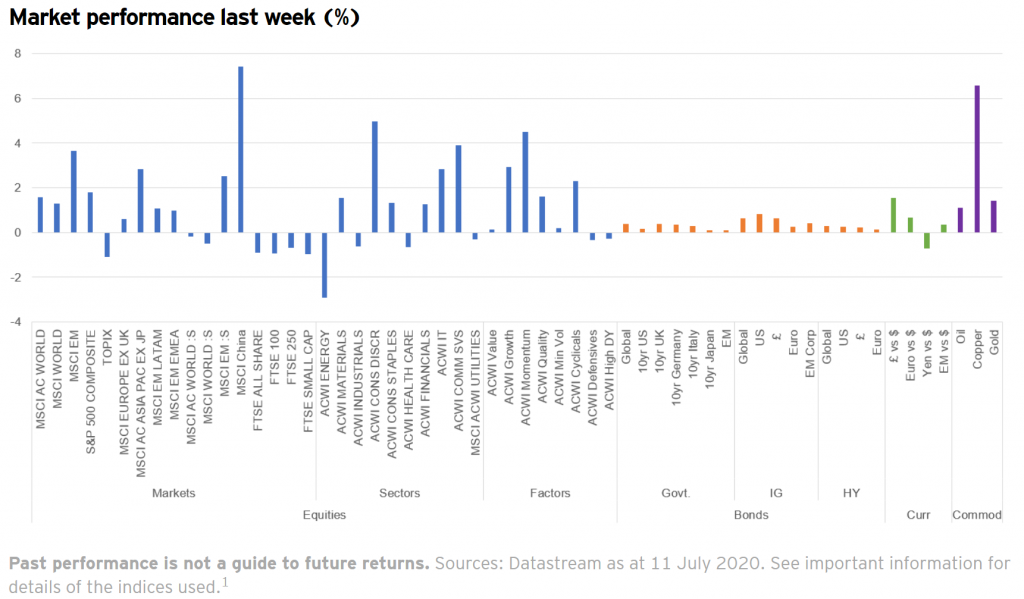

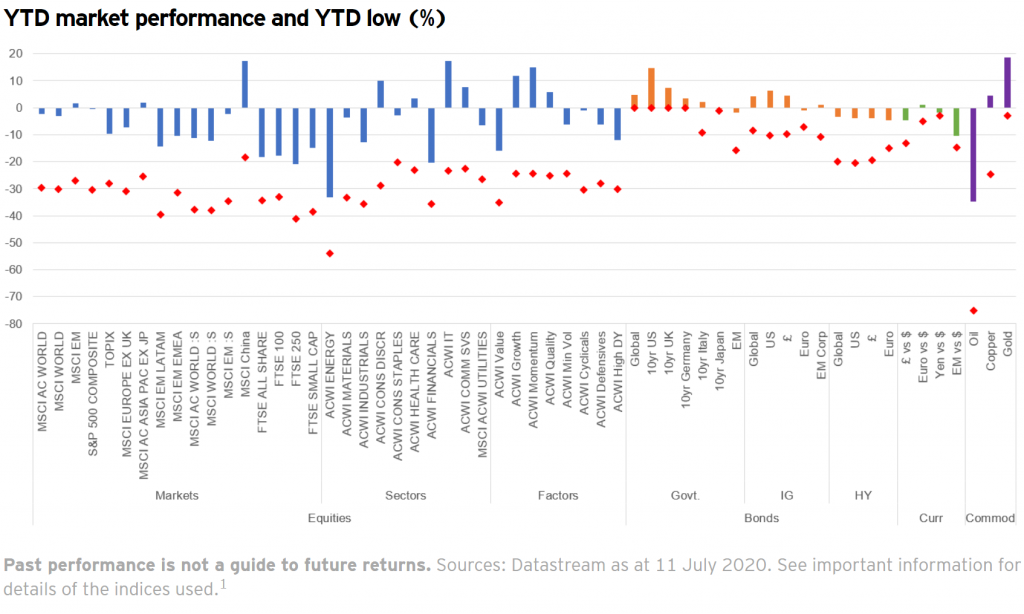

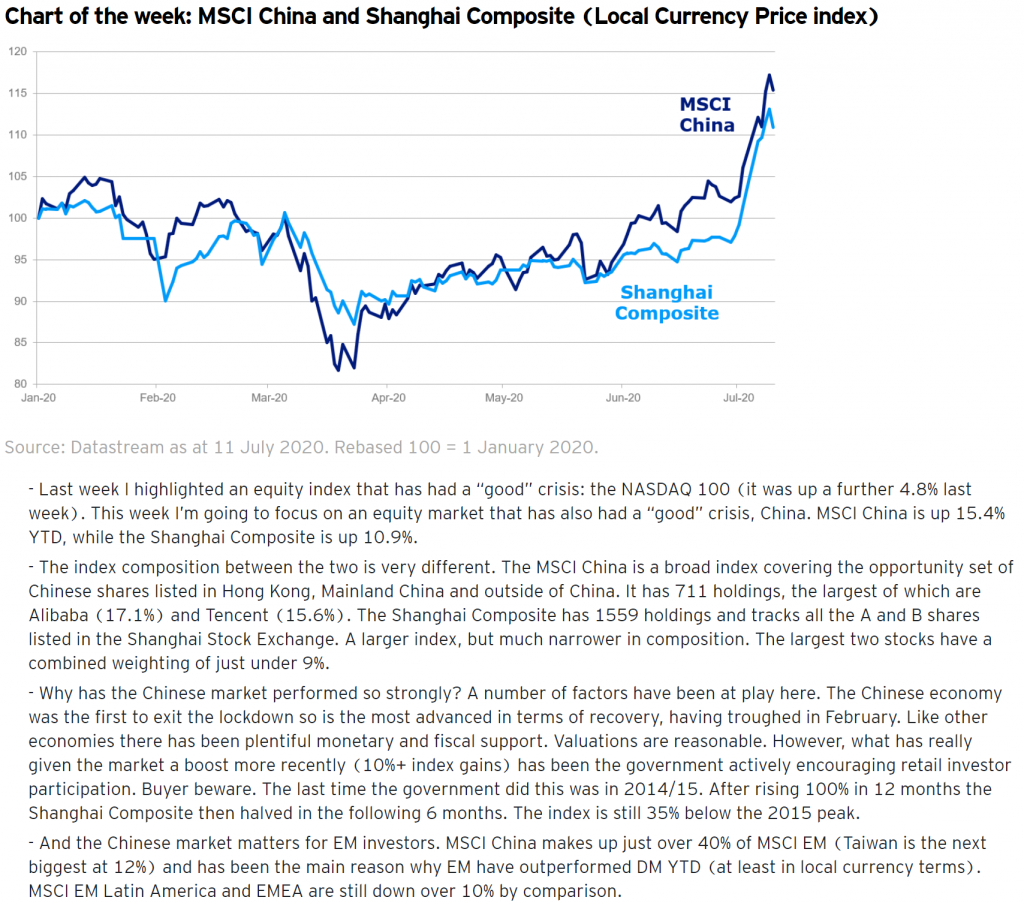

However, that has not been enough to pull the rug from under risk assets, which continued to move higher. More defensive assets, such as government bonds and gold, also gained. Equities led the way with EM at the forefront, helped by a strong rally in Chinese equities (see chart of the week for more background to this). DM, on the other hand, had more mixed fortunes. US leadership continued as index tech and tech-related heavyweights pushed higher, but Japan was lower. Unsurprisingly Momentum and Growth factors dominated from a style perspective. Credit outperformed government bonds, but with IG better than HY. Commodities made further gains, with Gold breaking through $1800 for the first time since 2011 and in touching distance of an all-time high. The US$ weakened further. In the UK, the FTSE All Share declined under 1%. Moves in fixed interest were fairly limited, with IG the best of the pack. £ edged higher against the US$.

Please continue to check our Blog content for the latest investment, markets and economic updates from leading investment houses.

Please keep safe and healthy.

Carl Mitchell – Dip PFS

IFA and Paraplanner

13/07/2020