Please see below for Brooks MacDonald’s Daily Investment Bulletin received by us yesterday 28/07/2021:

What has happened

Equities had a weaker session yesterday with defensive equities outperforming technology stocks in particular. Some of this weakness in technology can be attributed to the concerns that China might continue to expand regulation after their foray into educational technology earlier this week.

Chinese technology

Markets have long had a concern around technology regulation in the US where a Democrat White House could try to curb the perceived overreach of big technology. Investors had downgraded this risk due to the economic impact of the pandemic but also a belief that the US would be unlikely to do anything too aggressive in case Chinese companies gained a competitive advantage. With China ‘going first’ on technology regulation this not only increases risks around Chinese securities but removes one of the arguments as to why the US would stay quiet on technology regulation for now. Meanwhile in the US, technology earnings saw some winners and losers with Alphabet rising 3% in the after-market but Microsoft losing an equal amount after it’s cloud-services business saw less growth than expected.

Federal Reserve

Now to the week’s major event, the Federal Reserve’s latest policy statement which is due out at 7pm UK time tonight followed by Fed Chair Powell’s press conference. Policy risk is at its highest at points of transition and the Fed will need to tread a delicate path today. The tapering genie is out of the bottle and will almost certainly be a conversation topic at the meeting however the extent to which Powell majors on this will give an important steer to the market. The rising risks around the delta variant and lower global growth expectations have both contributed to a less positive market backdrop ahead of tonight’s announcement. The statement will also need to address inflation where we have seen another upside beat to price levels in the June CPI numbers but inflation expectations have been falling in the bond market. Some of this reduction in inflation expectations is due to a belief that the Fed will not be afraid of raising rates over the next two years so there is a complex interplay that Powell will need to consider.

What does Brooks Macdonald think

Due to the rising uncertainties around the pandemic and economic growth, we expect Powell to stop short of warning that tapering is imminent. This meeting may well therefore serve as a placeholder until either the Jackson Hole Economic Symposium in August or indeed the meeting in September.

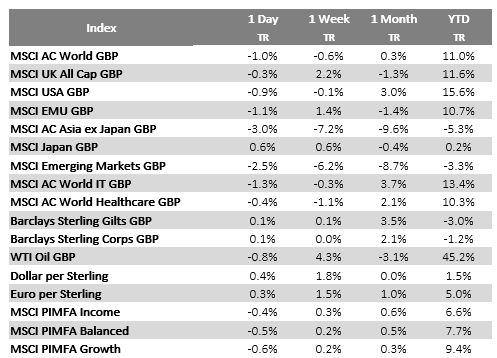

Source: Bloomberg as at 28/07/2021. TR denotes Net Total Return

Please continue to utilise these blogs and expert insights to keep your own holistic view of the market up to date.

Keep safe and well

Paul Green DipFA

29/07/2021