Please see the below investment outlook received from J.P. Morgan today (Tuesday 23rd June):

In Brief

- In early June the market was pricing in a V-shaped recovery from the pandemic-driven economic contraction. We expect the recovery to be more gradual, with a few stop-starts along the way. Extremely low interest rates will help, but unemployment and corporate deleveraging could be a drag on growth.

- The extent of near-term uncertainty, as well as the potential for political risk to mount as we approach the US election, could generate more market volatility.

- For individual market sectors, the outlook depends on the path of the pandemic. If a full and sustainable reopening of the economy becomes possible, we may see a further rally for the most beaten-up sectors, coupled with a style rotation. For now, we believe it makes sense to maintain a nimble approach, with a focus on quality and an eye to ESG risks.

- Low-risk options for income seekers are increasingly scarce. Rather than stretching for yield, investors may be better off being selective within fixed income and using a wider range of income-providing asset classes, including real assets for those who can accept lower liquidity.

- Developed market government bonds look less and less likely to play their traditional roles of providing income and protecting portfolios in periods of market stress. Investors may need to look beyond the traditional 60:40 portfolio, with a greater role for alternatives and flexible fixed income strategies.

No one predicted that in the first half of 2020 the world’s economies would be brought to a virtual standstill by a global pandemic. Even had we have known the virus was coming, we would not have predicted that by mid-year the S&P 500 would have managed to climb back above 3000 (EXHIBIT 1).

We have global policymakers to thank for the market’s resilience. According to current analysts’ expectations, the policy response has helped one-year forward earnings expectations to find a floor and start to improve. In the sharp rally since 23 March, markets looked to be pricing that the combined actions of governments and central banks in recent months will have successfully absorbed the economic losses of Covid-19 to engineer the perfect V-shaped recovery (EXHIBIT 2).

While the policy response has been commendable, we believe the market’s expectation of the recovery in early June was too optimistic. It’s not that we believe people will permanently change their behaviour – we are social animals, after all. We just think it will take a little longer to get back to full normality.

Chief among our concerns is that the virus itself may linger and some need for social distancing will remain, in countries such as the US and UK, at least. In addition, high unemployment and a dramatic increase in public and private debt may serve to restrain spending in the recovery. We may also be at the beginning of a period of difficult political fallout as politicians seek to apportion blame for the crisis. The US election of 3 November could have important market implications. With the UK having left the EU but not yet having secured a new trade deal, Brexit might also – once again – generate volatility.

In summary, we acknowledge that the commitment from governments and central banks shouldn’t be underestimated. And, if more stimulus is needed, it will come. This makes us cautious about being underweight risk assets. But we need to see that policy action is influencing fundamentals. Valuations and uncertainty around the economic and earnings outlook make us cautious about advocating an overweight position in equities. We therefore think investors may benefit from having more than one toe in this rally, but not from jumping in with two feet.

In what follows, we provide greater information on our view of the shape of the recovery. We then consider three investment themes for the second half of the year:

1) Considerations for investors in the near term, given uncertainties and potential volatility

2) Options for investors in need of income

3) Rethinking a 60:40 portfolio in a world of zero bond yields

WHAT SHAPE WILL THE RECOVERY TAKE?

As shutdowns are eased around the world, forecasters are debating the likely shape of the recovery. The optimists point to a V-shaped recovery, the pessimists L-shaped, and the cautious look for something less linear, such as W, U or √.

In truth, it is very difficult to know at this stage. The risks aren’t black swans, they are known unknowns, but we simply don’t have enough information at this stage to form our judgment.

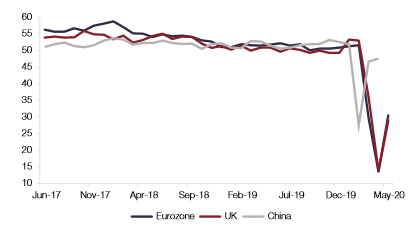

The first set of known unknowns relates to the virus itself. As the economic and fiscal costs have become apparent, politicians have hurried to ease shutdowns, whether the infection is under control or not. It is possible that the combination of a degree of ongoing social distancing, track and trace systems, and better hygiene practices will mean that the reopening happens without a reacceleration in infections. But there is also a risk that the infection rate will pick back up. Governments may be reluctant to re-impose shutdowns in such a scenario, but there will still be economic costs if people choose to socially distance voluntarily (EXHIBIT 3).

We are closely tracking how the virus progresses as well as using high frequency data to gauge the extent to which economic activity is normalising (EXHIBIT 4). To find the latest statistics on these, please refer to our On the Minds of Investors piece, Monitoring the global impact of Covid-19, which is updated twice a week.

As the weeks and months drag on, the more lasting consequences of the recession will become more evident. Policymakers globally have made a gallant attempt to limit the impact and absorb the losses of Covid-19. Grants and subsidies aimed to shift the losses on to government balance sheets. These, in turn, were shifted to central bank balance sheets as asset purchase programmes were expanded to absorb the additional issuance. Governments have been able to issue record high levels of government bonds, at record low interest rates.

Furlough, or short-shift schemes have been the cornerstone of the policy response in Europe (EXHIBIT 5). However, unemployment has still risen in the UK. The moves on the continent of Europe have been more moderate, but we suspect this is flattered by people not categorising themselves as unemployed because they are not actively looking for work due to either a need to look after children or a choice to remain socially isolated.

In the US – which hasn’t adopted widespread furlough schemes – unemployment rose to 14.7% in April though came down slightly in May to 13.3%. We would be considerably more worried about a double-digit unemployment rate were it not for the fact that the US social safety net has been made considerably more generous. Indeed, estimates suggest that 75% of those that have lost work are in fact better off given the additional USD 600 a week that has been added to unemployment benefits. This boost to benefits is set to expire on 31 July and, though an extension of some sort looks likely, it is likely to be less generous. We are therefore monitoring labour market data closely to gauge any shift in unemployment from those currently classified as temporary to permanent (EXHIBIT 5).

What will be the lasting consequence of higher levels of public debt? Is a new wave of austerity ahead? Public sector pay and benefit freezes – which were an important component of the spending restraint in the last expansion – seem unlikely given the degree of austerity fatigue in the population. Wealth taxes may be appealing given the resilience of asset prices, but these policies run into the practical problem that much of people’s wealth is stored in housing assets and held by individuals that are asset rich and income poor. One off ‘Pigouvian’ income taxes on higher earners are also being touted. We see it as more likely that finance ministers will forge ahead with plans to tax the large multi-nationals that obtain tax advantages by choosing favourable domiciles.

There is one global debt-reducing strategy we see as almost inevitable: interest rates will be held down for the foreseeable future. One suspects that policymakers are hoping for a repeat of the post-war period, in which a combination of yield curve control and financial repression kept the interest rate below nominal growth and helped erode government debt as a percent of GDP (EXHIBIT 6).

Lower interest rates will help corporates, which, on aggregate, have also experienced a significant rise in debt as a result of Covid-19. While we don’t expect governments to focus on deleveraging, the same may not be said for the corporate sector. Corporate deleveraging may constrain investment spending and employment growth and, in turn, the economic recovery.

So what is the letter most apt to describe the economic recovery? Our standard alphabet might not suffice but, in our view, expecting a symmetrical V is too optimistic. The recovery is likely to be more gradual, with a few stop-starts along the way. All the while, investors should be mindful of some sizeable tail risks lurking.

One such risk is China’s relationship with the world in the wake of Covid-19. Our opinion is that de-globalisation is easier (politically) said than done. China is highly integrated in global supply chains. As the 2019 trade war demonstrated, it is very hard to reduce trade links without causing significant economic harm in western economies. However, it does seem likely that China will come under scrutiny for regulatory standards, which may in turn raise inflationary pressures. Despite the economic realities, rhetoric towards China may intensify for short-term political reasons.

Nowhere is this more evident than in the US, which enters full election mode in the coming months. At this stage it is still difficult to say anything definitive about who will win, whether the victor will have full control of Congress, or the impact on markets.

The top priority for whoever emerges successful will be to manage the recovery as the economy restarts in earnest in 2021. Tough choices will need to be made about whether to push on with further stimulus or to try to tighten the purse strings as the recovery takes hold. President Trump had already flagged his desire for a second round of tax cuts prior to Covid19, but with US national debt-to-GDP now set to rise above 100% this year, further corporate tax cuts could face greater opposition. While Trump is yet to lay out a clear agenda for a second term, the tough-on-China and tough-on-trade stances that were at the core of the 2016 Republican campaign will remain a key tenet of his approach.

For the Democrats, as the most left-leaning candidates exited the primary race, so did their policies. Yet it is clear that presumptive nominee Joe Biden’s vision for corporate America is still very different to that of President Trump. Two topics that investors will need to monitor closely are a proposal to use anti-trust legislation to clamp down on ‘Big Tech’ and plans for corporate tax changes. Biden’s campaign team has also been keen to emphasise its candidate’s tough-on-China credentials. Historically, escalating trade tensions have favoured the higherquality US stock market relative to other regions, but a ramp-up in pressure on the tech titans would pose risks to US market leadership given the high weights to the technology and communication services sectors in US indices.

The second half of the year may therefore put us in the unusual position in which the political risk premium may be higher on US assets than on those of continental Europe, where the signs look increasingly positive. Though it still needs to be ratified by all EU member states, the European Recovery Fund is a significant step forward. Not only will it provide invaluable short-term help for countries like Italy but it provides a strong signal for the long term with regards to the fiscal integration that is much needed to complement the monetary union.

If the recovery in the US lags due to lingering Covid risks, and perceptions of political risk change, we could see downward pressure on the dollar.

CONSIDERATIONS FOR INVESTORS IN THE NEAR-TERM GIVEN UNCERTAINTIES

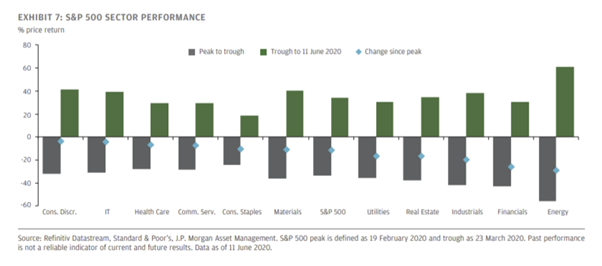

While the S&P 500 suggests a V-shaped recovery is priced in, at the sector level the narrative is more nuanced. From the start of the year to the S&P 500 trough in March, some of the most obviously affected sectors were hardest hit. Meanwhile, the likely winners from people remaining at home, other than for their food shop, outperformed.

The bounce-back since March has included some of the worst performers during the sell-off (EXHIBIT 7). For example, energy, autos, clothing retailers and restaurants have all outperformed during the rally, presumably on hopes of a partial rebound in activity as the economy starts to reopen. But some of the perceived beneficiaries of a world with more working and shopping from home, such as home improvement retailers, tech companies and industrial (including warehouse) properties have also rallied strongly. Meanwhile, despite improvement from their lows, airlines, hotels, department stores and retail properties remain among the weakest performers year to date.

What are the risks and opportunities from here under different potential scenarios:

Scenario 1: A full and sustainable reopening of the economy with social distancing no longer required. The most beaten-up sectors could rally further, while the sectors that have gained the most could be vulnerable to profit taking and rotation into cheaper companies as it becomes clear we won’t all work and shop from home forever. This would also likely coincide with a style rotation from large cap to small.

Scenario 2: An acceleration in infection rates leading to renewed shutdowns. At least part of the rally since March could reverse for most sectors, but those most exposed to further shutdowns could suffer the most as solvency concerns increase.

Scenario 3: Partial reopening of the economy but with some social distancing remaining in place. Sectors that might be able to reopen with some social distancing, such as department stores, autos and energy, could benefit further. Airlines, hotels and dine-in restaurants could struggle as solvency concerns increase. The most expensive stocks among the current winners could also suffer from valuation deratings and earnings disappointments, as unemployment remains elevated.

Which scenario plays out depends largely on the path of the virus itself, which is unknown. Given this uncertainty, we think it makes sense to avoid potential value traps, where solvency concerns could increase further. But we also think it makes sense to avoid the most expensive companies, where there is a lot of good news already in the price.

We also think this recession will increase the momentum behind sustainable investing. Robust ESG screening processes should capture the risks to corporate earnings from potential changes to taxes and other political interventions. The crisis has underscored the benefits of screening companies on nonfinancial metrics such as corporate governance and human capital management. We believe companies will increasingly be rewarded for demonstrating responsible capitalism given that there are, unfortunately, likely to be more lasting consequences of this recession for lower income and minority groups. Finally, although governments will be strapped for cash coming out of this recession they will also been keen to support infrastructure projects that can fuel the recovery. We expect these projects to be focused on the shift to a zero-carbon economy. The European Green deal is one such example.

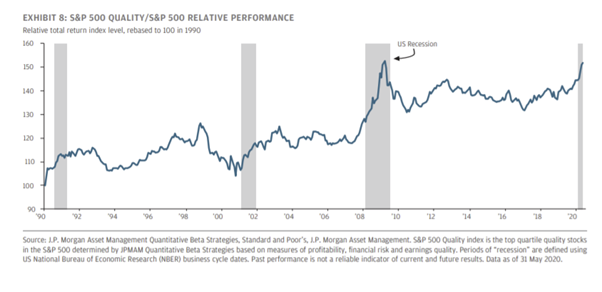

An active, nimble approach, with a current focus on quality companies (EXHIBIT 8), a keen eye on valuations, and consideration of ESG risks, therefore appears the best way of navigating the uncertainty facing investors.

SEEKING SUSTAINABLE INCOME

Central bank actions so far this year have performed the essential role of keeping government borrowing costs low but, for those seeking income, the negative side effect is that lowrisk income options are increasingly scarce.

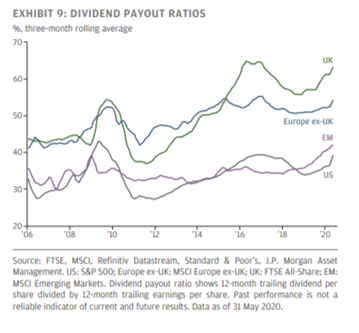

Investors have been turning to higher risk asset classes, including equities, for income over recent years, yet dividend cuts have become a hot topic as companies look to shore up balance sheets against the shock from Covid-19. While we acknowledge that many companies – particularly those who are receiving government support – may find it difficult to maintain payouts over the coming months, it is essential not to mistake what, for many firms, will be a cyclical issue for a structural one. On a regional basis, we see US dividends as most resilient. The lower dividend payout ratio of the US market provides companies with more flexibility to maintain dividends in periods of weaker earnings. Higher use of buybacks provides a buffer for companies to cut before dividends are hit. Regulatory pressure on banks, in particular, has also been lower so far in the US than in Europe.

Riskier parts of fixed income, such as corporate credit and emerging market debt, are other areas that may warrant attention when hunting for income. The Federal Reserve’s decision to buy both investment grade and high yield credit for the first time helped to pull spreads back from their widest levels in March, but credit spreads still sit significantly above their levels of the start of 2020. Central bank purchases in both the US and Europe should provide something of a backstop for corporate bond prices in the second half of the year, although we advocate an increasingly selective approach as investors move further down the quality spectrum and the need to differentiate between (more temporary) liquidity issues and (more permanent) solvency issues becomes more important.

Outside of fixed income, real assets may also have a larger role to play in portfolios as an alternative income source. While asset prices in areas such as infrastructure have not been immune to the pressures seen in public markets so far this year, income streams have broadly remained stable. But, of course, investors will need to be able to accept lower liquidity as the trade-off for moving into these types of asset classes.

The risks of overstretching for yield when hunting for income have been made very clear by the market volatility so far in 2020. Higher levels of income can only be achieved via higher levels of risk in some shape or form. Rather than ramping up risk to achieve a fixed yield target, income-seeking investors may be better off using a wide range of asset classes to build well-diversified portfolios that are in line with their risk appetite, and accepting the level of yield available as a result.

60:40 WHEN BOND YIELDS ARE NEAR ZERO

Perhaps the clearest investment challenge that will endure well beyond Covid-19 is that of how to construct a portfolio in a world of very low government bond yields.

Government bonds have traditionally played two roles in a portfolio. One is to provide a steady and stable source of income. The other is to protect a portfolio in times of market stress. Traditionally, recessions would coincide with central banks cutting interest rates, sending bond prices higher at a time when stock prices were falling. This reduced the overall scale of capital loss in bear markets.

As we look ahead, developed world government bonds don’t look like they will serve either purpose. Even long-duration government bonds provide very little – if any – income in much of Europe. And unless central banks entertain the idea of taking interest rates into negative territory (or deeper negative territory, for those already deploying negative interest rates) then bond prices cannot rise much in periods of market stress.

Meanwhile, shifting to, say, a 90:10 allocation or substituting government bonds for high yield bonds would help boost return prospects but result in a portfolio that was far less able to weather bouts of volatility.

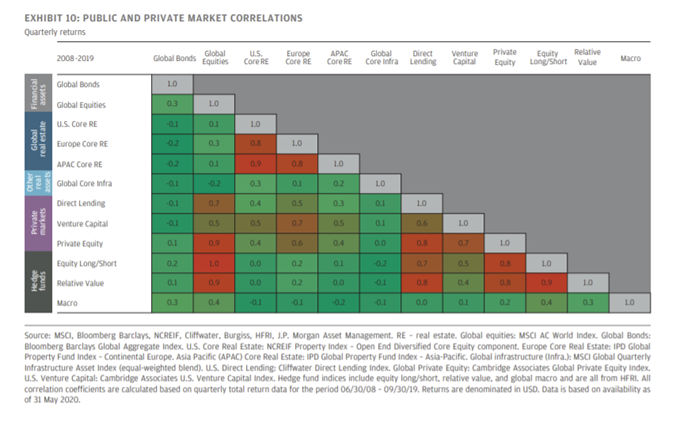

The challenge is therefore to find assets that have low correlation to stocks and ideally provide income along the way. While there are still highly rated government bonds – such as Chinese government bonds – that offer modest positive yields, in our view it may be better to look to the alternative markets. EXHIBIT 10, taken from our Guide to Alternatives, shows the asset correlations. Within liquid strategies, macro funds have tended to do a good job of providing downside protection. Less liquid options include direct real estate and core infrastructure, which both have relatively low correlations to stock markets and offer relatively strong income.

J.P. Morgan is a global leader in financial services, offering solutions to the world’s most important corporations, governments, and institutions in more than 100 countries. This in-depth analysis of markets by a world leading financial services organisation can prove valuable as we venture into the unknown as Coronavirus restrictions are gradually loosened and we attempt to return to ‘normal’.

We still believe now as much as ever that gaining a consensus view of the markets by reviewing the opinions of a variety of market leaders is key. Market behaviour is very much on a knife edge right now, and it is important that we frequently review these views so that we are well informed and in turn can keep you up to date.

Paul Green

23/06/2020