Please see the below update from Brewin Dolphin received late last night:

Most global markets fell back slightly over the past week, retreating from record highs set in the first trading week of the year. The falls came after a strong run for global markets that has, unsurprisingly, led to some profit taking. Also weighing on markets has been some disappointing economic data caused by new or expanded lockdowns.

For example, UK retail sales figures released last week saw the worst annual growth since 1955. US initial jobless claims increased sharply last Thursday, hitting their highest level in five months. US retail sales declined for a third straight month and manufacturing activity in the New York state slowed. Then the University of Michigan consumer sentiment index was weaker than had been expected. It is no surprise that markets have adopted a little more of a ‘risk off’ tone.

Last week’s markets performance*

- FTSE100: -2%

- S&P500: -1.47%

- Dow: -0.91%

- Nasdaq: -1.54%

- Dax: -1.86

- Hang Seng: +2.49%

- Shanghai Composite: -0.10%

- Nikkei: +1.35%**

*Data from close on 8 January to close of business on Friday 15 January.

Inauguration week starts on a cautious note

It was a quiet start to the week yesterday, as US markets were closed for Martin Luther King Jr Day. In Europe, markets were mostly higher; the pan-European STOXX 600 rose by 0.20%, France’s CAC 40 closed 0.44% higher at 13,848.35 and the Italy’s FTSE Mib gained 0.53% to 22,498.89.

In Asia, most markets lost ground, but China was the exception. The Shanghai Composite and Hang Seng indices both rose after China reported robust GDP data that confirmed it was the only major economy to expand in 2020.

In the UK, the FTSE100 closed down 0.22% at 6,720.65, while the FTSE250 eked out a gain of 0.12%.

China leads global recovery

China’s ongoing recovery continued apace at the end of last year. It recorded GDP growth of 2.3% for 2020 as a whole but growth accelerated in the fourth quarter, with its economy expanding by 6.5% compared to a year earlier. It was its fastest rate of growth in two years.

China’s growth was largely export driven, although government support for infrastructure projects also gave the economy a boost.

But even China is showing signs of pain during these difficult days. Retail sales came in below expectations, rising by 4.6% in December from a year earlier. While this is impressive by global standards, it was below expectations for 5.5% growth.

We expect China to continue to lead the global recovery in 2021, although growth should be more evenly spread around the world, assuming the roll out of vaccines proceeds smoothly.

Bond yields rising

Yields were a little lower on the back of this news, but not much. That is despite the very sharp increase in yields we have seen so far this year. This has been a topic of much speculation as the prevailing narrative had been that rates will stay low for the foreseeable future. However, very recently the market has begun to anticipate that monetary policy cannot remain this accommodative forever.

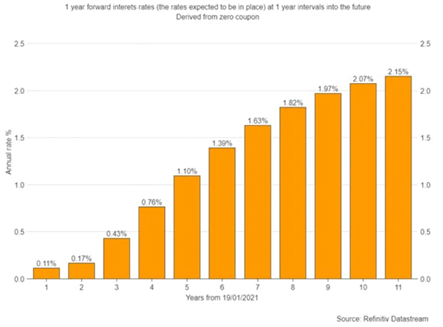

Currently forward interest rates presume that rates stay on hold for the next two years, but then begin to steadily rise. Implied rates have increased significantly over the beginning of the year, mainly in the US. Now those expectations have nudged outside the upper end of the Fed’s forecast range. The chart below shows the market implied interest rate for each year into the future.

Adding to the pressure on bond yields recently has been the fact that some forecasters have brought forward their expectations around the timing of the Fed beginning to slow down its bond purchases, or quantitative easing (QE).

Atlanta Fed president Raphael Bostic, who is about to become a voter on the FOMC, recently said that if the economy bounces back quickly, the Fed may be able to start paring back QE later this year. During the so-called ‘taper tantrum’ of 2013, the 10-year Treasury shot up around 130 basis points in just a few months. There are certainly some parallels between then and the backdrop today, so the bond market is highly sensitive to any discussion about the Fed altering the pace of its bond buying, which is currently at $120 billion per month.

Biden’s stimulus proposal

One of the factors weighing on the bond market is the prospect of extra fiscal stimulus. President-elect Biden announced his plan for spending, and it is eye-watering, at $1.9trn.

He has said he wants $2,000 stimulus cheques for individuals in addition to the $600 cheques already passed by Congress. It also includes $400 a week in emergency unemployment benefits, payable until September, and preventing a cliff-edge cut-off for jobless payments previously scheduled for March.

More controversially he also wants to more than double the minimum wage. This probably isn’t a serious proposition. It’s more of an effort to establish an anchor from which he can give a little ground and still be left with something meaningful at the end of the negotiation.

Inflation expectations on the up

Fundamentally, it has been rising inflation expectations that have been the driving force behind higher yields. Inflation is likely to look as if it is increasing over the coming months, but appearances will be misleading. Year-on-year energy prices will appear to have risen sharply in March when current oil prices are compared to those from a year ago, when prices actually went negative! But this is just a base effect.

There will also be some inflation caused by the reimposition of VAT in some jurisdictions. Statistical factors even imply that there is wage inflation in the current market because job losses in a large number of low-paid roles means that average wages are higher now than they were in 2019. None of these are real inflation, and policy makers will be able to safely ignore them – although headline writers may not.

Overall core inflation remains subdued, but it would be very unusual for it not to rise a little given the increase in manufacturing activity we have seen. In the longer term, more inflationary pressures may build, but for now a gentle increase in inflation gives us a preference for inflation-linked bonds over conventional bonds and reinforces the importance of having some precious metals exposure as a useful hedge.

Brief market updates like this help us get a quick overview of the markets and we share them in the aim of keeping our readers informed.

Today will be a historic day given that, across the pond, it is President Biden and Vice President, Kamala Harris’ Inauguration. VP Kamala Harris will today make history as the first female, first black and first Asian-American US Vice President, a great step towards a more inclusive and diverse future!

Hopefully, we could see positive market movements on the back of this, however, the markets are unpredictable (as have been the events of the world over the past 12 months).

Keep checking back with us for more updates like this.

Andrew Lloyd

20/01/2021