Please see this week’s Markets in a Minute update below from Brewin Dolphin, received yesterday afternoon – 21/10/2025.

U.S. and China trade negotiations continue

Fresh trade talks between Presidents Trump and Xi were announced last week – how have the markets responded to the news?

Key highlights

- A pause for reflection: Investors have shifted from chasing the market rally to assessing the risks.

- Credit “cockroaches”: Isolated loan defaults, such as those at U.S. firms First Brands and Tricolor Holdings, are worth monitoring, but solid bank earnings provide reassurance.

- The gold rush: Gold prices rallied amid ‘safe haven’ demand and an ongoing ‘debasement trade’

From exuberance to evaluation

After months of relentless gains, global markets took a breather last week.

Investors have shifted from exuberance to evaluation, reassessing whether stretched valuations can hold amid emerging signs of credit stress, renewed trade tensions between the U.S. and China, and concerns over a potential artificial intelligence (AI) bubble.

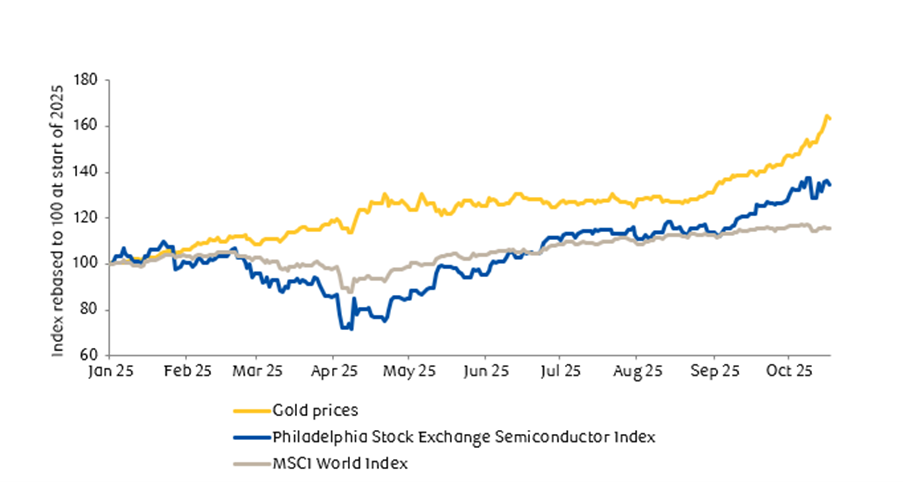

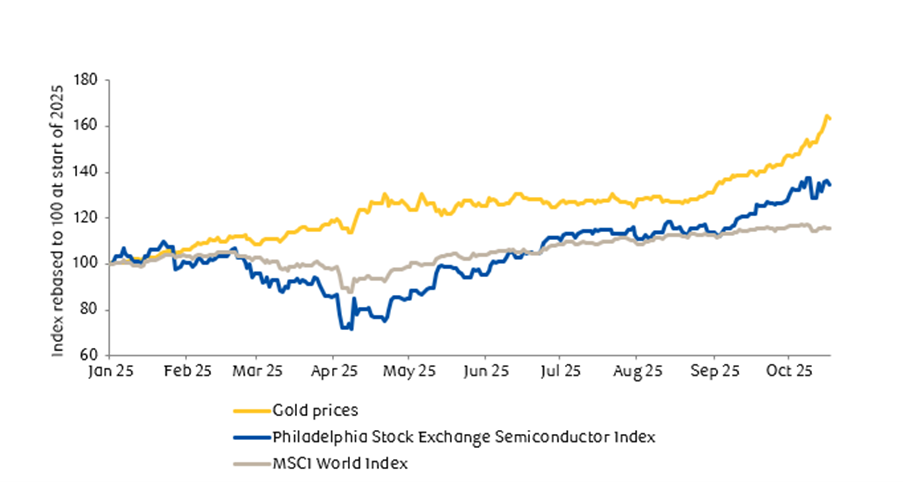

Stocks took a little breather as gold marches on

Source: Bloomberg

While caution has crept back in, the broader picture remains constructive, with solid corporate earnings, resilient consumer sentiments, and more Federal Reserve (the Fed) easing on the way.

The change in market tone began with renewed worries about credit quality in U.S. banks. The defaults at First Brands and Tricolor Holdings raised concerns about lax credit standards, potential deterioration in credit quality, and loan loss provisions at financial institutions.

To make things worse, two regional U.S. banks, Zions Bancorp and Western Alliance Bancorp, said they were victims of fraud in relation to loans to funds that invest in distressed commercial mortgages. This revived memories of the regional banking turmoil in 2023, and understandably investors have become nervous. JPMorgan Chase CEO, Jamie Dimon, made a goosebump-inducing analogy, which added to the unease: “When you see one cockroach, there are probably more”.

So far, the credit events feel like unconnected incidents. But when Jamie Dimon talks about cockroaches, it amplifies a long-lingering nervousness about the vast growth of private credit and the need to refinance real estate loans. The fact that the private market is so opaque makes it hard to know how strong credit quality is.

Encouragingly, the early earnings results from U.S. regional banks offered some reassurance. Reports from Truist Financial, Regions Financial, and Fifth Third Bancorp showed lower-than-expected provisions for credit losses. Several lenders also highlighted resilient consumer spending and stable deposit bases. Many regional lenders have also improved capital buffers since 2023.

Beyond the regional lenders, major U.S. banks delivered a strong earnings season, reinforcing the view that the financial system and the U.S. economy remain resilient. The biggest U.S. banks reported healthy net interest income, robust trading revenues and continued loan growth, underpinned by solid consumer spending. There are reasons to believe that the recent credit jitters are idiosyncratic rather than systemic.

Still, recent developments are a reminder that the aftershocks of higher interest rates can reverberate through smaller banks, weaker companies and credit markets. For the Fed, it helps further the argument for easing policy rather than keeping financial conditions too tight for too long.

Trade tensions are meant to escalate, then de-escalate

Renewed tariff exchanges between the U.S. and China added another layer of complexity to investors.

President Donald Trump has threatened additional 100% tariffs on Chinese goods after China tightened export controls on rare-earth materials. Yet, in typical fashion, President Trump struck a softer tone in a Fox Business interview, saying that “tariffs are not sustainable” and expressing confidence that “we’ll be fine with China”.

The markets’ interpretation is that by setting the next tariff increase deadline for 1 November, President Trump is clearly leaving room and time for negotiation. There’s still a chance, and expectation, that he’ll meet President Xi Jinping in South Korea within weeks, which leaves optimism that both sides are ready to de-escalate.

The AI story remains powerful despite talks of a bubble

The AI-driven rally that propelled stocks to record highs has paused for breath. Talk of an AI bubble is front and centre. It’s actually good to see this scepticism when optimism runs high.

Concerns over valuations, concentration and the circular nature of some AI deals have triggered some profit-taking, especially after months of extraordinary gains. Yet, the fundamentals of the AI story remain intact. Earnings from ASML and TSMC reaffirmed that demand for AI-related infrastructure – from semiconductors to equipment makers – remains robust. There’s still clear visibility of and longevity for the tangible capital investments going into AI.

That said, there are pockets and signs of froth (a lesser and milder version of a bubble) – for instance, huge intraday stock price surges from large established companies following AI deal announcements and investors chasing momentum stocks.

AI start-up valuations are also sky high despite many being loss-making at this stage. AI will no doubt be a transformative technology, but there are lingering concerns over whether all the money will generate adequate returns.

With AI capital expenditure (capex) ramping up, and the Fed cutting interest rates again, there are parallels with the late 1990s tech boom. We think the AI-driven rally could well go further and we want to have at least benchmark exposure to that. Stretched valuations keep us from being more bullish on this.

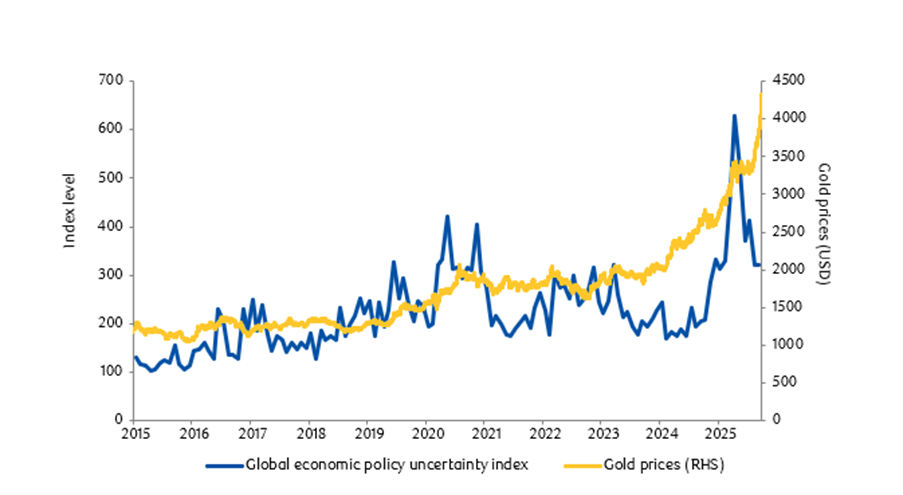

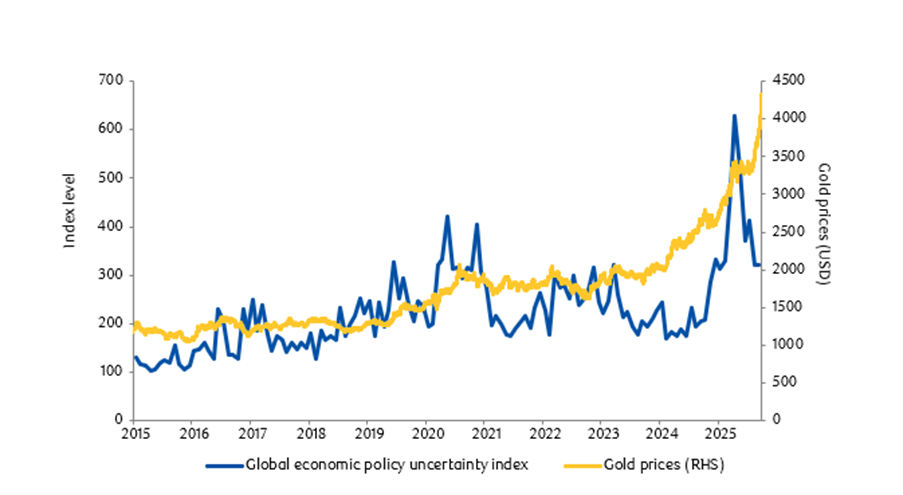

All that glitters… is gold

In this climate of cautious sentiment, gold has been the standout performer. The precious metal has surged to US$4,356 per ounce, buoyed by macro uncertainty, institutional distrust, central bank buying and lower U.S. interest rates.

Gold prices made new highs despite the sharp fall in economic policy uncertainty

Source: Bloomberg

Buying gold is described as the ‘debasement trade’, a hedge not only against inflation but also against ballooning fiscal deficits and long-term currency value erosion. Meanwhile, government bonds have found renewed demand as investors price in further Fed easing and weaker growth.

Taken together, the week’s development marked a shift from complacency and euphoria to caution. Valuations are stretched, economic uncertainty persists, and trade tensions remain.

It’s understandable that investors are taking a more measured stance after such a strong run since April, but the broader backdrop is okay. Corporate earnings are still solid, consumers are resilient, and the Fed is likely to continue easing. Markets are doing what they should, which is consolidating after exuberance, digesting new information and recalibrating expectations.

The AI investment cycle continues to provide a structural anchor, while gold and government bonds are fulfilling their roles as hedges in times of uncertainty.

Please continue to check our blog content for advice, planning issues and the latest investment market and economic updates from leading investment houses.

Charlotte Clarke

22/10/2025