Please see below, an article from Tatton Investment Management, analysing the key factors currently affecting global investment markets. Received this morning – 07/07/2025

Markets bask in the sunshine

Markets broke all-time highs last week. Small and mid-cap stocks outperformed the ‘Magnificent Seven’ – and even UK stocks climbed to new heights, despite the government’s policy u-turn.

The rise and fall of UK bond yields showed investors support Rachel Reeves – seen as the chief architect of Labour’s fiscal rules. People don’t like tax cuts but bond investors do; they agree that the best growth support will be lower interest rates. Gilts buyers won’t allow the treasury any borrowing headroom, and believe Reeves will keep to her fiscal promises so, after Starmer’s wobbly support, the difference between UK and US yields actually narrowed slightly.

The FTSE 100 hit an all-time high, partly thanks to US private equity groups’ interest in discounted (in price-to-earnings valuations) UK stocks. That calculation isn’t affected by the relatively minor yield increase.

By comparison, bond markets are nonchalant about US fiscal indiscipline. Trump’s “One Big Beautiful Bill Act” (OBBBA) will stretch the deficit but investors care more about growth. US sentiment was helped by Thursday’s strong labour market report, broadening the stock market rally to smaller companies. International investors were sceptical when it was just the Mag7 rallying, but the broader rally is a clear return to US economic positivity. This could reverse some of 2025’s US capital outflows, benefitting the dollar. Institutional investors and hedge funds have recently positioned against the dollar, so a short squeeze could easily ensue, pushing it higher.

But the longer-term trend is still against the dollar. OBBBA makes US bonds vulnerable. Trump persuaded Republican budget hawks to back his tax cuts with promises of tariff revenue, but he could easily lower tariffs ahead of next year’s mid-term elections. OBBBA’s Medicaid cuts are also hurting public health insurance providers, evidenced by Centene’s 40% share price drop.

Generally, equity markets have opened the week slightly down, mildly disappointed on the trajectory of tariff talks. The July 9th deadline has effectively been moved to August 1st but Trump’s nasty side might be back. He is sending a “take-it-or-leave-it” ultimatum to many countries. On Friday, he promised additional tariffs (70% on China) and then, on Sunday, added a further to 10% to “Any country aligning themselves with the Anti-American policies of BRICS”. [which now comprises Brazil, Russia, India, China, South Africa and from last year Egypt, Ethiopia, Indonesia, Iran, Saudi Arabia and the United Arab Emirates]. More hopefully, Europe appears to be making headway with trade negotiations. Meanwhile, deals that might boost equities may hurt bonds as investors will fear lower revenues. This week promises to be interesting.

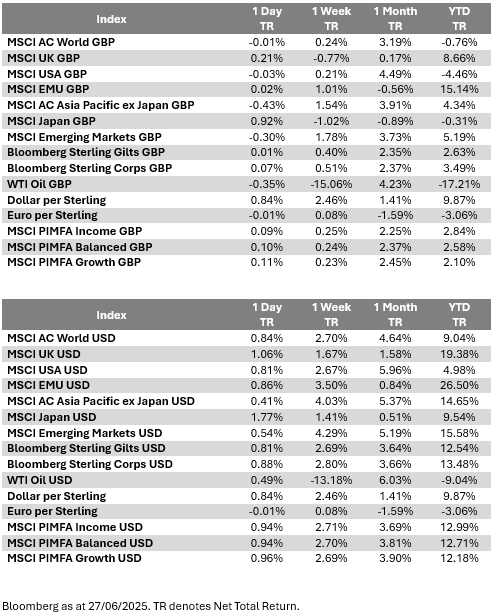

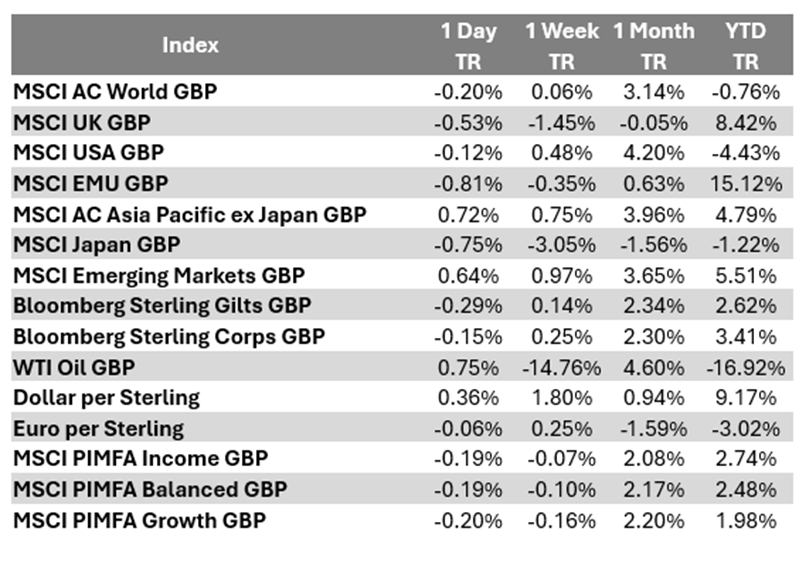

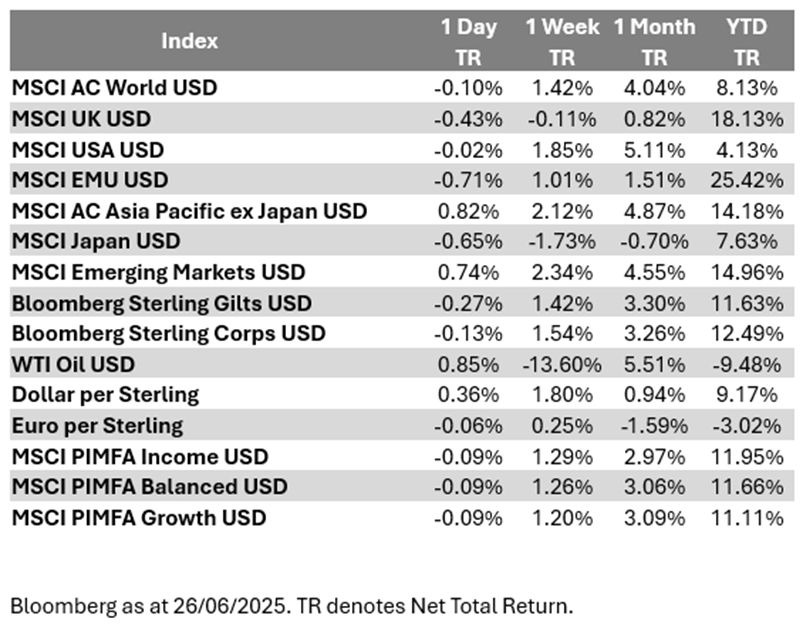

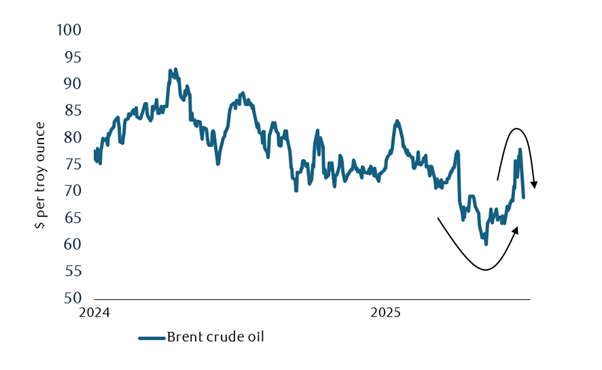

June asset returns review

June was a remarkably strong month for markets, despite geopolitical volatility. Global stocks climbed 2.8% in sterling terms and all major equity markets finished higher. You would never have guessed there was an Israel-Iran war from looking at the returns table. Polymarket’s odds on Iran shutting the Strait of Hormuz went above 50% at one point – coinciding with a $75 per barrel oil price peak – but oil traders correctly predicted de-escalation after Iran’s symbolic strike on an empty US base. Oil prices climbed 4.6% through June but gold prices (which rise in times of panic) fell 2.1%.

US stocks were among the best performers (up 3.4%) after better-than-expected corporate earnings. In sterling terms, though, the US underperformed in Q2 thanks to dollar weakness. On the flipside, euro and sterling strength helped UK and European equities last quarter – though both were virtually flat in June. Defence stocks benefitted from the 5% defence spending commitment at the end of the month.

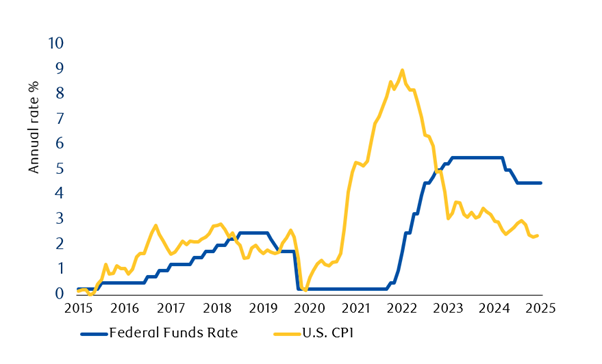

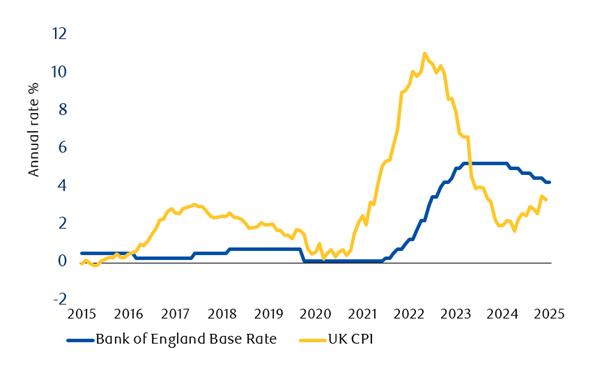

Dollar weakness helped ease global liquidity, as did the move down in US bond yields. The Federal Reserve and Bank of England both signalled interest rate cuts ahead – and markets (thankfully) ignored Trump’s threats against Fed chair Powell. Looming tariffs have tied the Fed’s hand on rate cuts, but markets now expect several before the end of the year.

Emerging markets’ outperformance (up 4.3% through June – beating all other regions) was another sign of investors’ confidence. EM companies are benefitting from the weak dollar, which makes their dollar-denominated debt easier to service. China also gained 2.5% despite continued economic weakness and the government’s inability to stimulate demand, though its economy and markets have become detached from the western world. China’s gain is a sign that markets expect more tariff reprieve after the 9 July deadline for Trump’s moratorium.

Our 2025 outlook: what’s changed?

At the start of the year, most investment houses expected US outperformance to continue. We were less convinced, given US policy risks (tariffs and the fiscal deficit) and European potential. That has broadly played out, but we were surprised at the speed of Trump’s market disruption. By April, it became clear that tariffs would hurt US demand most, while Washington’s international antagonism ironically benefitted growth elsewhere (by getting Europe to invest).

US stocks rapidly recovered from the “Liberation Day” sell-off, after Trump backed down and company earnings proved resilient. The dollar didn’t recover, though, which is why US returns are still negative year-to-date for UK investors.

The US economy mostly maintained its momentum (though the data has been skewed by a pre-tariff buying spree) but there are now clear signs it is slowing. The labour market is cooling, which doesn’t suggest a recession but dents US exceptionalism. The Federal Reserve sees tariffs as a growth negative and markets are pricing in interest rate cuts – despite a near-term fiscal expansion through tax cuts.

UK and European growth was weak, but that allowed the ECB to cut rates four times. Chinese growth continued to disappoint, as Beijing seems unable to stimulate demand US tariffs hit exports.

While we don’t see a US recession, there’s not much to get excited about. Tax cuts will bring a minor boost, but they are mostly extensions and the fiscal multiplier will be small. The fiscal multiplier on EU defence spending could be much higher. That won’t come until next year, but markets will likely front-run the benefits.

Although many expect mild US tariff inflation, wages are slowing – sapping disposable income and denting consumer confidence. Rates are still high in absolute terms and refinancing is hurting companies. These risks might not dent US stock market optimism, but we expect they will be seen in continued dollar weakness.

Please continue to check our blog content for the latest advice and planning issues from leading investment management firms.

Alex Kitteringham

7th July 2025