Please see the below article from Church House Investments, providing analysis of the key factors currently impacting markets. Received yesterday – 14/09/2022

Have you ever slogged your way up a large hill and reached what you thought was the summit, only to discover that this was a false horizon and that you will have to push on higher? This is how markets felt in August.

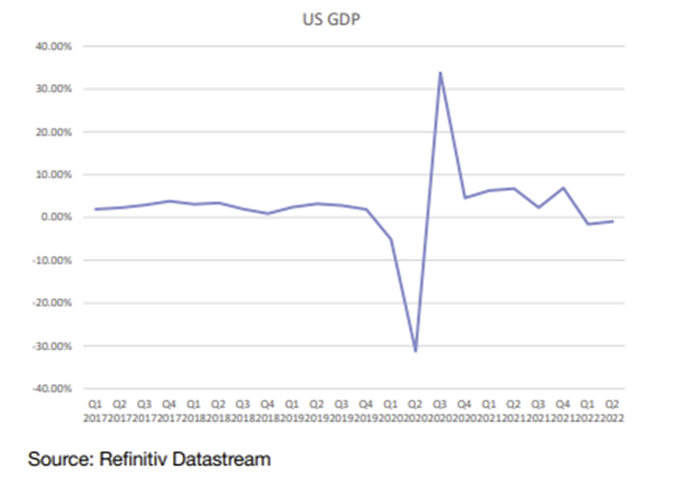

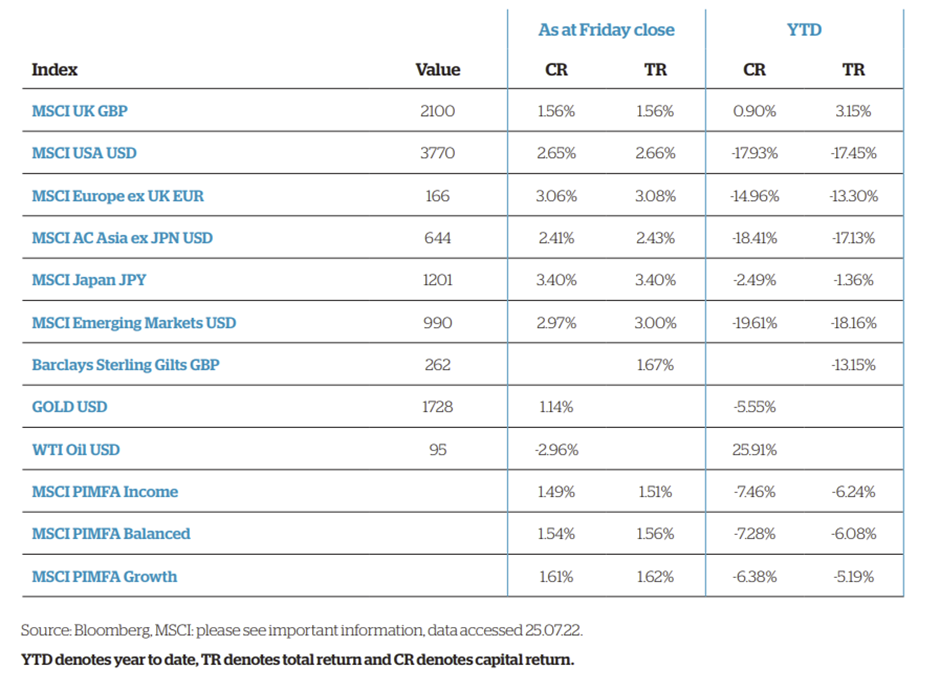

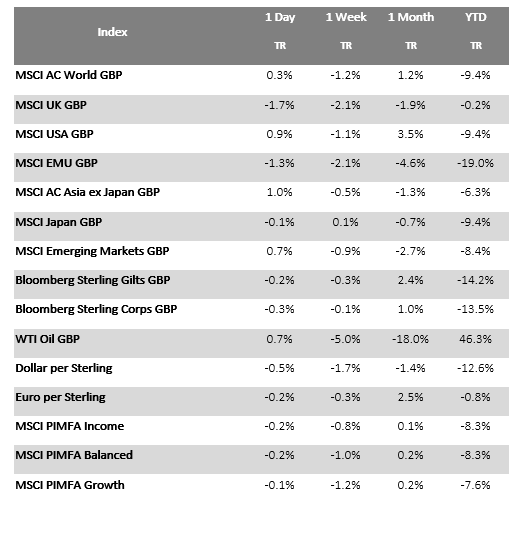

After a rotten first six months of the year, there was a brief moment of respite when it looked as if the worst of the pain might have been felt with the panic sell-off in June and that things were at least not getting any worse than feared. This was swiftly extinguished by Putin turning off the gas taps to Europe, seemingly permanently this time, and Jay Powell (Chair of the Fed) flagging ongoing sharp interest rate increases at his Jackson Hole keynote address. Risk assets, from equities, to debt and most else in between, fell back again in late August and investors were again left licking their wounds.

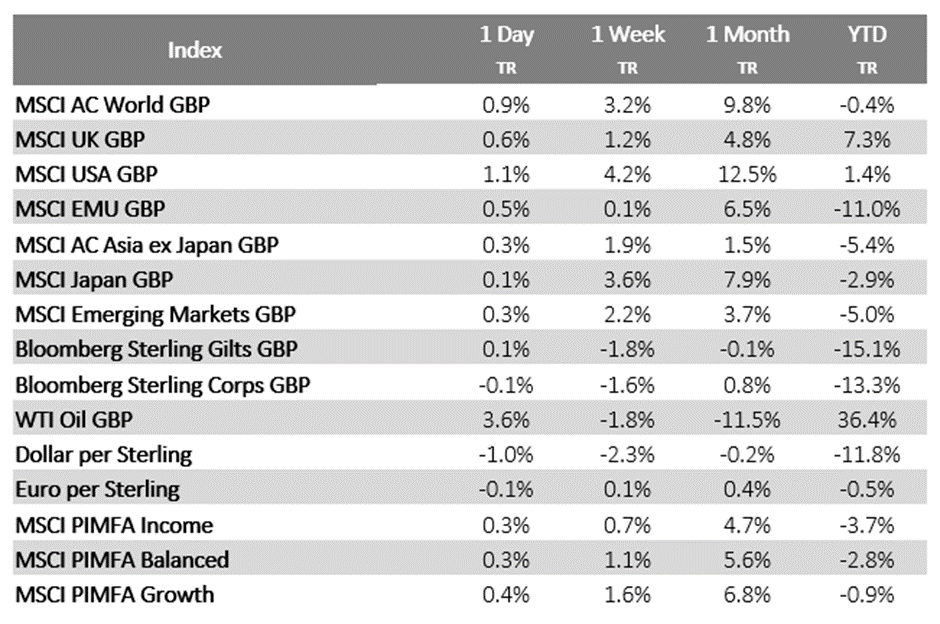

Fundamental to weak equity markets in 2022 has been the weakness of sovereign and corporate debt markets. Gilt yields (that move inversely to their price) have tripled in 2022 and now stand at over 3%, levels not seen for any meaningful period since pre-2012 (remember that golden Olympics?). Falling prices of (theoretically) risk-free UK Government bonds (no comment on our new PM’s fiscal promises!) are always going to have a negative effect on assets higher up the risk spectrum, from corporate bonds, right the way up to small-cap equities (at the top of the risk scale). Sovereign bonds yields are unlikely to steady until the market feels that it has a handle on inflation and the path of interest rates. This is not to say that investors need (or could ever have) certainty on the path of inflation and rates, but the negative surprises need to stop coming.

In the midst of all this doom and gloom I am going to be controversial and give some points for optimism. Firstly, one has to suspect that with Nord Stream now fully shut down, Putin has played his ace card. Of course, he can continue to commit atrocities in Ukraine, but short of invading another European nation or threatening nuclear war, Putin’s power to hurt a Western world that has severed all possible ties with Russia has to be past its peak.

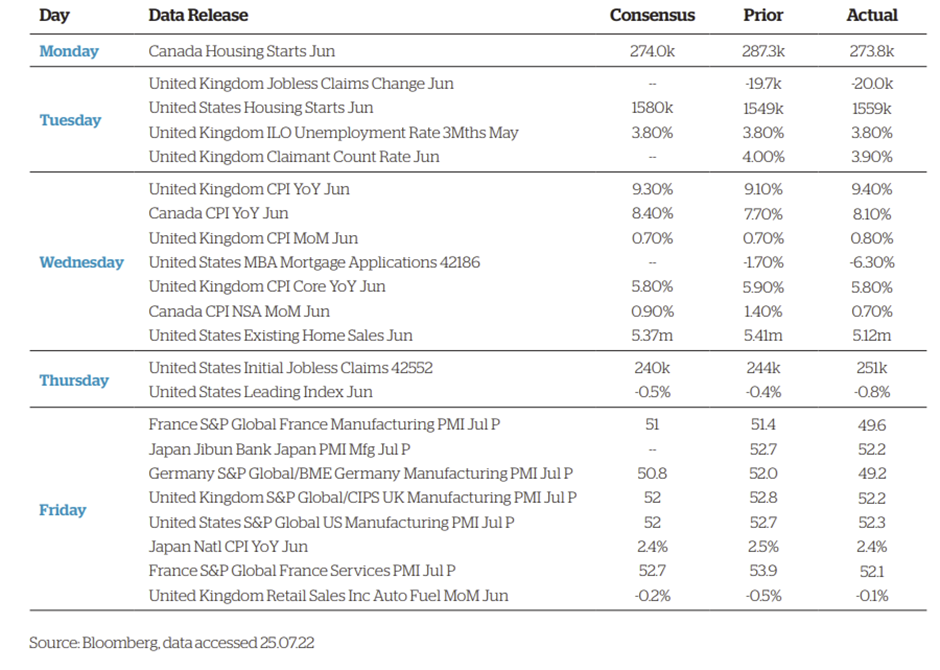

Secondly, the ex-Putin contributing factors to rising inflation are showing signs of calming. Anyone who has filled their car up recently will be relieved that the oil price has begun to retreat, while the price of industrial metals such as aluminium, iron ore and copper are sharply lower in the last six months. Shipping still takes longer than pre-pandemic, but the bottleneck is clearing – the time it takes to ship cargo across the arterial China-US route has fallen in 16 of the last 17 weeks. Cheaper commodities and quicker shipping should help to ease input cost inflation which, in turn, will reduce pressure to increase prices to the end consumer. All of this will take time to wash through and there is no hiding from the pain that high energy bills will cause to consumers this winter, but one look at the BBC News website will tell you that this is already widely known and priced into asset prices.

Market confidence is fragile and investors remain jittery. Despite significant declines in equity valuations across the board, few buyers have put their head above the parapet. However, it is interesting to see that some enterprising investors have stepped in recently, particularly in the UK technology sector, where valuations had reached notable lows. Over the last few weeks we have seen private equity bids for three UK-listed technology businesses: Aveva, Micro Focus and GB Group. While we were not shareholders in any of these businesses, we found these bids heartening vindication that all is not lost and that there are bargains to be had amidst the overwhelming negativity. At Church House we focus on the fundamentals of individual businesses, looking for unique companies that we believe can grow at steady rates over the long-term. From time-to-time fear will prevail in markets and we get opportunities to invest on behalf of our clients in such outstanding businesses at more than reasonable prices – now appears to be just such a time.

Please continue to check our blog content for advice and planning issues from us and leading investment houses.

Alex Kitteringham

15th September 2022