Please find below, the Daily Investment Bulletin received from Brooks Macdonald this morning – 11/08/2022

What has happened

Risk appetite was emboldened by one of the largest downside misses to headline CPI in recent history. The equity gains were broad-based with cyclical sectors and technology shares leading the charge as investors wagered that the Fed would need to be less aggressive on monetary policy.

US CPI Report

US headline CPI came in at 8.5% year-on-year against expectations of a 8.7% increase and a 9.1% reading for June. If you zoom into the detail, the monthly change was actually negative at -0.02% which is the first monthly fall in over 2 years. As expected, the main driver of this was decline in energy prices and specifically gasoline which was -7.7% lower over the month alone. Core inflation was expected to rise on a year-on-year basis but actually stayed flat at 5.9%, further helping to boost sentiment. Whilst some of the more volatile components of the CPI readings are showing signs of peaking, broad inflationary pressures undoubtedly remain and will take time to filter through to lower median CPI. The Atlanta Fed divides up CPI into ‘flexible’ and ‘sticky’ elements and whilst the flexible reading fell sharply last month, the sticky reading actually saw gains. Words of slight caution but this is unlikely to deter the market which is very much in risk on mode.

Fed reaction

Bond markets moved quickly to reduce the probability of a 75bp rate hike at the September Fed meeting, with the futures market pricing in a coin toss between that and a 50bp hike. 10-year Treasury yields also fell initially however more hawkish Fed speak ultimately led to the benchmark yield broadly flat for the day. Chicago Fed President Evans said that inflation remained ‘unacceptably high’ and forecast that ‘we will be increasing rates the rest of this year and into next year’. President Kashkari said that he expected a 4.4% Fed interest rate at the end of next year and stressed the commitment of the Fed to bringing down inflation.

What does Brooks Macdonald think?

The Fed reaction, warning against inflation complacency, makes absolute sense. The Fed cannot afford for market or consumer inflation expectations to start to rise again after the recent falls. For the time being, investors are happy to look through the more hawkish messaging, expecting this to reversed as we enter 2023 and recessionary risks rear their heads. With central bank forward guidance seemingly dead for the rest of 2022 at the very least, inflation data remains the key determinant of market sentiment, on that basis yesterday is undoubtedly a strong positive for risk assets.

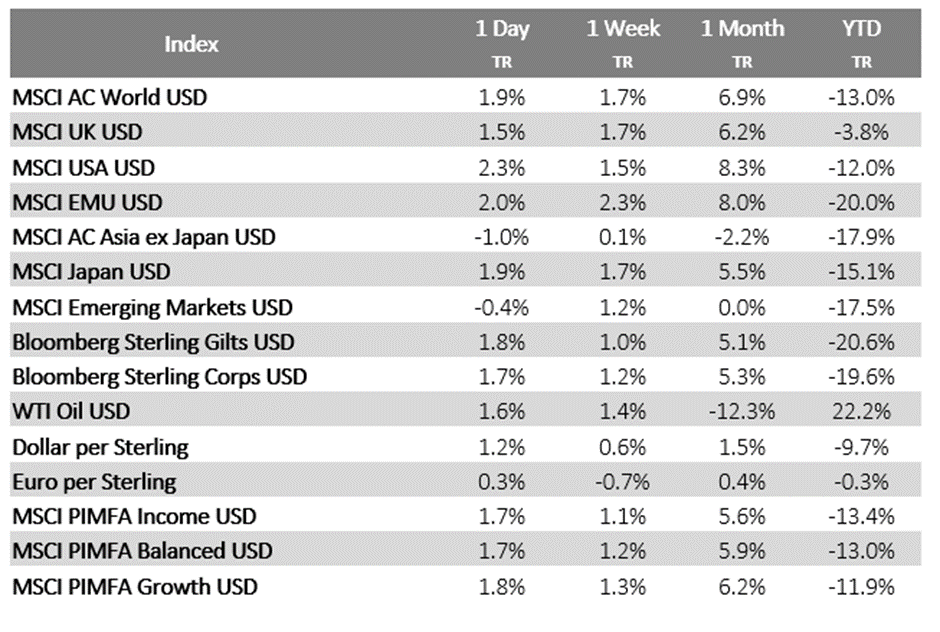

Bloomberg as at 11/08/2022. TR denotes Net Total Return

Please continue to check our Blog content for advice and planning issues and the latest investment, markets and economic updates from leading investment houses.

David Purcell

11th August 2022