Please see below for Brooks MacDonald’s MPS Monthly Market Commentary from August, received by us late yesterday 18/09/2020:

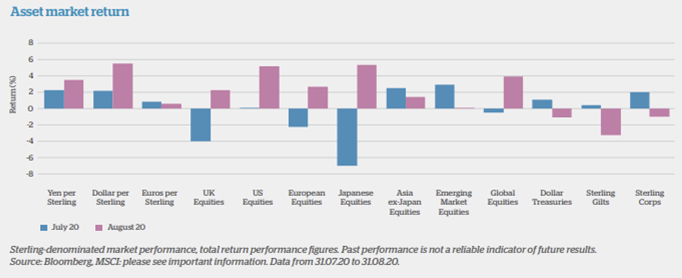

- Global equities resumed their upwards trajectory during August, as signs of economic improvement and positive developments on a COVID-19 treatment boosted optimism about a worldwide recovery. Further strains in US-China relations unsettled markets, although there was an apparent ease in tensions late in the month.

- UK stocks were up during the month, after it emerged that the economy expanded by a stronger-than-expected 8.7% in June from May1 . However, GDP shrank by a record 20.4% over the second quarter2 , which pulled the economy into a deep recession. A renewal of quarantine rules for people arriving in the UK from certain countries pressured stocks, particularly those in the travel sector. The composite purchasing managers’ index (PMI) rose to 60.3 in August from 57.0 in July3 , according to an early estimate.

- US equities were higher over August. Hopes of further government stimulus – yet to be finalised by month end – optimism about a vaccine and a continued rally in technology stocks propelled the S&P 500 and the Nasdaq Composite indices to record highs. The contraction in second-quarter GDP was revised to 31.7%, on an annualised basis, from 32.9%, although it remained a record slump4 . The composite PMI rose to 54.7 in August from 50.3 in July5 , an initial estimate showed. In a significant change to monetary policy, the Federal Reserve said that it would adopt a more flexible inflation target regime aimed at supporting employment and the economy.

- European markets moved upwards, helped by signs of economic improvement, particularly in Germany, and optimism about a COVID-19 treatment. However, the UK quarantine rules, which mostly affected European countries, unsettled investors. The composite PMI fell to 51.6 in August from 54.9 in July6 , an initial estimate showed.

- Japanese equities increased over August, although Prime Minister Shinzo Abe’s resignation, due to poor health, rattled the market late in the month. Stocks made a strong start to August as they tracked gains in US shares and as a weakening of the yen against the dollar boosted exporters. The rises came despite bleak economic news: GDP shrank by a record 7.8% over the second quarter, which pushed the country deeper into recession7 . The composite PMI was unchanged at 44.4 in August8 – remaining in contractionary territory – an initial estimate showed.

- Asia-Pacific stocks (excluding Japan) made gains over the month on continued signs of economic improvement, particularly in China. The US-China tensions restricted the increases. In China, a rise in exports and reduced factory price deflation in July boosted optimism about an economic recovery. The same optimism helped push South Korea’s Kospi Index to a two-year high during the month. Taiwan’s Taiex Index came under pressure after a sell-off in technology shares. Australia’s benchmark S&P/ASX 200 Index was little changed as optimism about a vaccine was largely balanced by continued worries about COVID-19 infections in the country.

- Emerging markets edged up over August, on optimism about a vaccine and as US-China tensions appeared to ease. Indian shares rose steadily, with vaccine hopes helping the BSE Sensex 30 Index to reach a six-month high. Brazilian equities dropped on renewed political uncertainty as the resignation of a number of top economic officials imperilled planned reforms. Equities fell in Argentina as the country battled rising COVID-19 infections.

- Benchmark yields on core developed market government bonds – including the US, UK, Japan and Germany – rose over the month. US benchmark 10-year Treasury yields hit a record low closing level of 0.52% on 4 August9 because of market concerns about an economic recovery, although they rose steadily over the rest of the month. In the corporate debt market, US investment-grade and high-yield spreads tightened further.

Brief and informative articles like these are an efficient way to take away key points regarding recent market developments globally.

Please keep reading our blogs regularly to give yourself a holistic and up to date view of the markets.

Keep safe and well,

Paul Green

17/09/2020