Please see below, an article from Tatton Investment Management, analysing the key factors currently affecting global investment markets. Received this morning – 06/10/2025

Nothing shuts down the stock markets

Global stocks bumped up last week, despite the US government shutdown. Perhaps markets expect a resolution, or perhaps only a mild economic impact. When US government shutdowns are short, they rarely hurt the economy too much. The last long shutdown (December 2018-January 2019) had a delayed impact on stocks, but investors don’t seem as concerned now (they suspect it will be more like the 1995 shutdown).

The clamour in Washington contrasted with a quiet Labour party conference in Liverpool, where the most important takeaway was what wasn’t said: Chancellor Reeves declined to rule out tax rises. The least economically disruptive hikes would be income or VAT, but they would be unpopular. At least the Treasury’s stamp duty suspension for new London stock listings should help bring liquidity back to our beleaguered market. With the FTSE 100 hitting another all-time high, we issue our usual reminder that UK growth and profits aren’t as bad as the media suggests.

More encouraging was the US Supreme Court’s stay of execution for Fed governor Lisa Cook. The next legal flashpoint will be the November ruling on tariffs. Investors don’t like tariffs, but they have brought in much-needed tax revenues – so a ruling against them could hurt US bond yields and, by extension, stocks.

Over the weekend in Japan, Takaichi Sanae was elected the new and first female leader of the ruling Liberal Democratic party, which is set to make her prime minister. Stock markets reacted with a 4% rally, while the Yen lost about 2%. Given her pro fiscal stimulus, and anti central bank independence stance, the market reaction has set the scene for her surprise success, decisively and without delay.

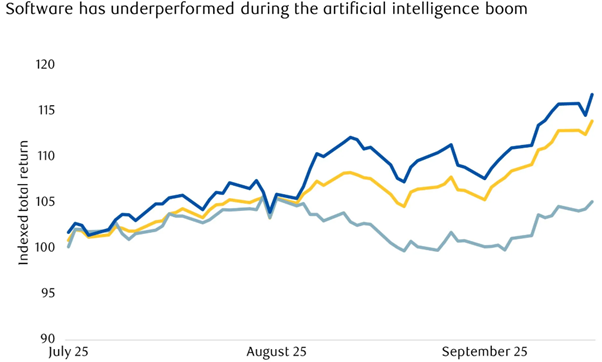

US Q3 corporate earnings will now come into focus, and are expected to rise 8.2%. Companies usually downgrade expectations to engineer a ‘beat’ which boosts their share price. Analysts aggressively cut Q3 earnings amid earlier tariff uncertainty, and companies stopped issuing guidance. Lacking guidance, analyst forecasts remained static. That lowers the chance of a ‘beat’ (as does a drop in AI-related profits) which makes an earnings boost to stocks less likely.

There was also discussion of leveraged buyouts, following the Saudi-backed deal for EA. But we note that the actual amount of leverage was small compared to the deal’s price.

Markets are ignoring politics and awaiting earnings; we’re in the in-between space. But stocks are powering ahead anyway, suggesting a bit of speculation. We shouldn’t be surprised if we see a pullback in the coming weeks, considering the removal of favourable liquidity conditions.

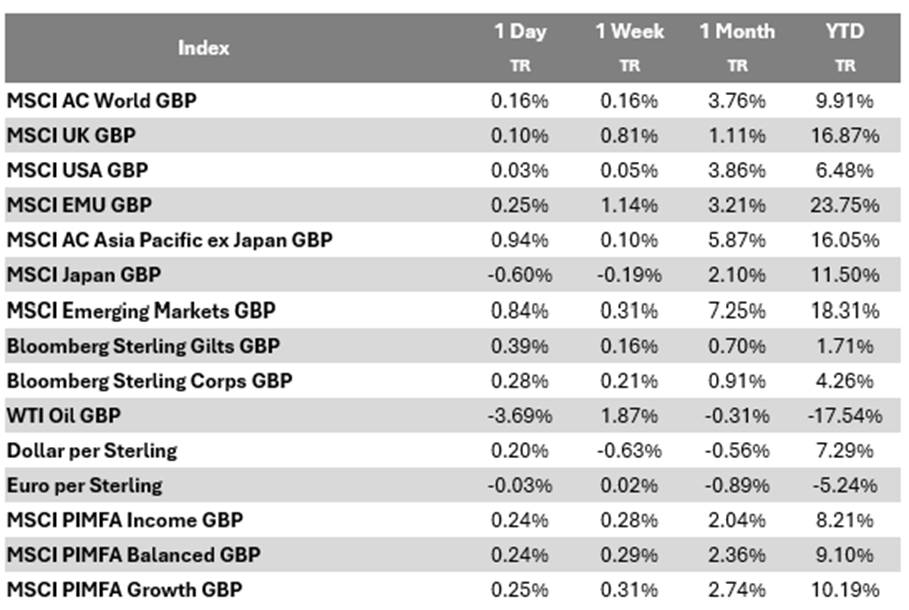

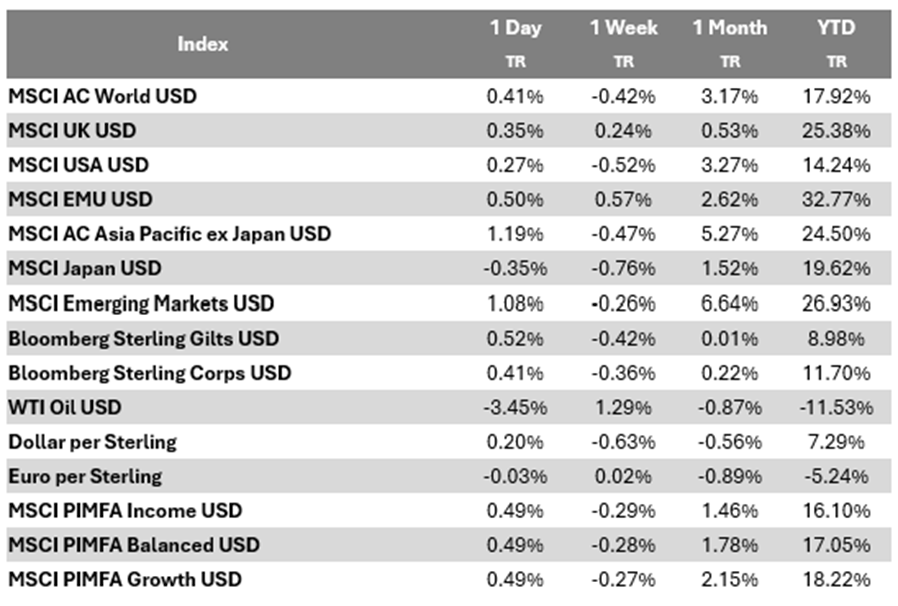

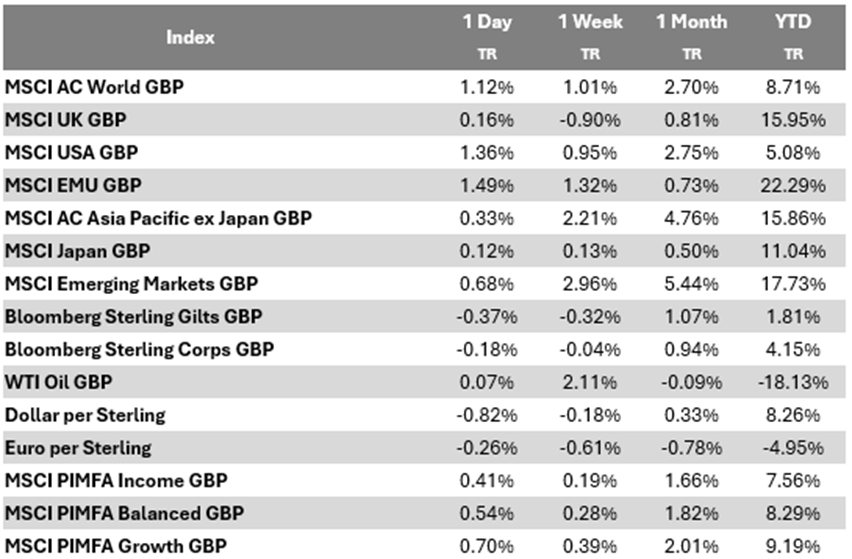

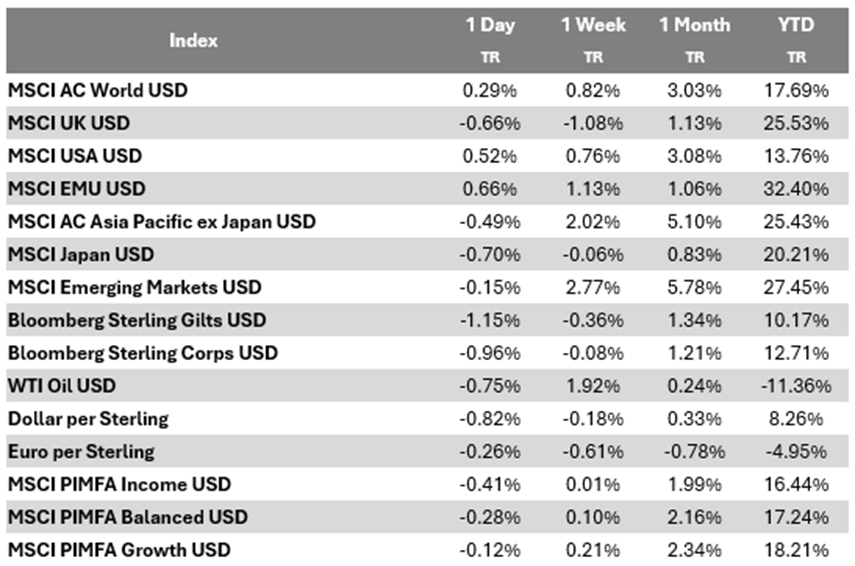

September Asset Returns Review

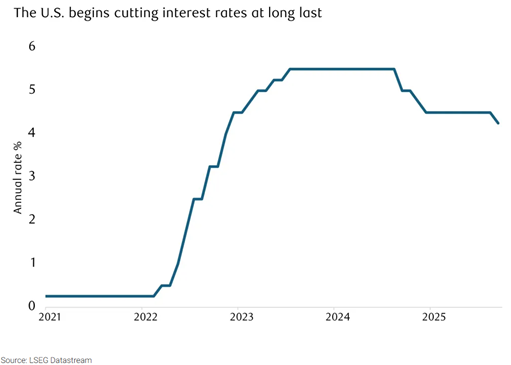

Global stocks gained 4% in sterling terms last month, while bonds added 0.7%. Risk appetite is strong across all major equity markets. That is despite a tightening of financial liquidity for seasonal and US treasury-related reasonings. The Federal Reserve’s dovish turn in September (a 0.25 rate cut and more signalled ahead) pushed up growth expectations, resulting in a 4% gain for US stocks and an outperforming tech sector.

Smaller US stocks were buoyed by the Fed’s cut, but underperformed through September overall. Stronger growth expectations raised long-term inflation and rate expectations, weighing on small-cap valuations. The ‘Magnificent Seven’ rallied for most of the month, but sold off in the last week due to end-of-quarter rebalancing and fears about AI investment’s sustainability.

The UK and Europe rallied by less than the US but are outperforming year-to-date. We think the UK economy is better than media commentary suggests.

The Fed’s dovishness is at odds with other central banks, which are signalling a tighter outlook and are probably right. The Bank of Japan is on the opposite end, signalling a rate rise in October amid stronger growth and inflation. Japanese stocks gained 2.8% and look strong.

China was yet again the best performer, gaining an incredible 9.1% through the month, despite persistent economic weakness. Chinese positivity is largely about Beijing’s stimulus drive, but stocks are supported in the near-term by strong liquidity conditions (both government and private).

Stronger Chinese growth expectations also pushed up copper prices last month. But gold was the standout commodity, with prices up 12.1% last month. This is sometimes taken as a sign of geopolitical anxiety, but gold has been rallying for years for a variety of reasons. The main release for investors’ political anxiety continues to be the dollar, which weakened again in September. For UK investors, the dollar’s weakness takes the shine off US equity’s impressive rally since “Liberation Day”.

Politics not derailing Japan

Japanese stocks pulled back from their highs last week, but their recent rally looks well supported. We’ve been positive on Japan for a while, thanks to corporate reforms boosting profitability and the competitiveness of Japanese exports. Both share buybacks and dividends are up this year, reflecting strong cash generation. Global investors are catching onto these improvements and sensing a bargain, due to Japan’s low equity valuations.

It’s not all sunshine: the recent trade deal with the US still includes a 15% tariff for Japan, and the government faced a new leadership contest on the weekend. Bond yields have increased 0.5 percentage points this year – a bigger sell-off than anywhere else.

Sanae Takaichi – one of the leadership candidates and an acolyte of former Prime Minister Shinzo Abe – has called for greater fiscal spending. But while fiscal stimulus helped in Abe’s era of zero inflation, Japanese inflation has been above 2% for three years. The Bank of Japan (BoJ) were split on whether to raise rates in September, but bond markets are pricing in a hike this month. The BoJ is tightening, but is still dovish relative to the underlying economy. That’s intentional, as the bank wants to kickstart a process of wage inflation.

That might sound odd, but Japan has historically struggled to embed wage rises. Koizumi – the other government leadership candidate – wants to explicitly tie wage rises to inflation, which could help consumer confidence (although undermine monetary stability). July’s 5.25% average wage rise was the highest pay bump in 34 years. This isn’t hurting profit margins either – suggesting incentivised employees are becoming more productive.

National pay negotiations in the spring will be crucial. Tariffs and government instability are headwinds, but domestic growth is coming through and a positive cycle is taking hold. For Japanese stocks, the cycle of reform, growth and confidence is more important than policy.

Please continue to check our blog content for the latest advice and planning issues from leading investment management firms.

Marcus Blenkinsop

6th October 2025