Please see below ‘Markets in a Minute’ article received from Brewin Dolphin yesterday afternoon, which provides current market updates on a global scale.

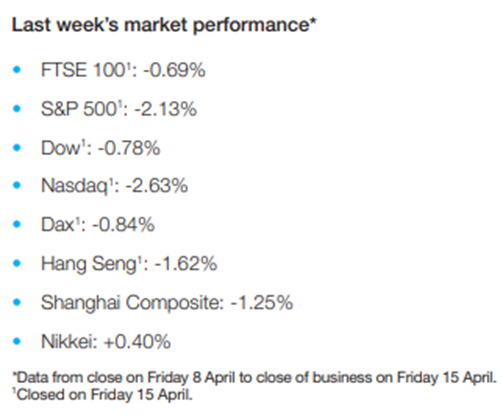

The release last week of the first major US corporate earnings reports of 2022 was accompanied by a lacklustre few days for global equities.

In Europe, the STOXX 600 and the Dax ended their holiday-shortened trading week down 0.3% and 0.8%, respectively, as data from the US and UK showed a further spike in inflation. The FTSE 100 fell 0.7% as energy stocks declined and the pound strengthened against the dollar.

The S&P 500 tumbled 2.1% as disappointing retail sales figures and concerns about inflation weighed on investor sentiment. The financials sector underperformed after first quarter results from banking giant JPMorgan Chase missed analysts’ estimates.

In Asia, Japan’s Nikkei 225 added 0.4% after Bank of Japan governor Haruhiko Kuroda said the economy would continue to recover despite surging commodity prices. China’s Shanghai Composite declined 1.3% as cases of Covid-19 continued to climb in Shanghai, fuelling concerns about supply chain disruptions.

IMF cuts global growth forecast

Stocks were mixed on Tuesday (19 April) as traders returned from the Easter long weekend. The FTSE 100 ended the trading session down 0.2% after the International Monetary Fund (IMF) slashed its forecasts for global gross domestic product (GDP) growth to 3.6% for 2022 and 2023, down from 4.4% and 3.8% previously. The IMF said global economic prospects had been severely set back, largely because of Russia’s invasion of Ukraine. The UK is set to be the worst performing G7 economy year, with GDP increasing by just 1.2% amid the rising cost of living and tax increases.

The STOXX 600 also declined on Tuesday, whereas Wall Street stocks made solid gains as investors digested a slew of corporate earnings. The FTSE 100 took its cue from Wall Street to start Wednesday’s trading session up 0.1%.

US retail sales miss forecasts

Last week saw the release of the latest US retail sales figures, which revealed sales in March rose by just 0.5% month-on-month. This was the slowest pace in 2022 so far and lower than the 0.6% increase forecast in a Reuters poll.

The bulk of the increase was driven by sales at service stations, which surged by 8.9%. This came after prices at the pump soared to an all-time high amid Russia’s war against Ukraine (US retail sales are not adjusted for inflation). Excluding gasoline, retail sales fell by 0.3%.

The report from the Commerce Department also showed online store sales fell by 6.4% after declining 3.5% in February, the first back-to-back fall since the last two months of 2020.

US import prices accelerate

US import prices rose by the most in over a decade in March as the Russia-Ukraine war increased petroleum prices. Import prices rose by 2.6% from the previous month, the largest rise since April 2011, according to the Labor Department. On an annual basis, prices surged by 12.5% after advancing 11.3% in February.

This came after data showed consumer prices rose at their fastest rate for 41 years in March, increasing by 8.5% year-on-year. Meanwhile, producer prices rose by 1.0% in March from the previous month, roughly double estimates, and by a record 9.2% year-on-year.

With inflationary pressures persisting, investors will be keeping a close eye on this week’s speeches from Federal Reserve officials for any further guidance on how aggressively policymakers will raise interest rates this year.

UK inflation hits 7%

Here in the UK, inflation hit a fresh 30-year high in March as fuel prices surged. Consumer prices rose by 7.0% year-on-year, up from 6.2% in February and ten times the 0.7% increase seen in March 2021, according to the Office for National Statistics. Transport fuel prices surged by 30.7% from a year ago, and prices of other items such as furniture, cooking oil, clothing, second-hand cars and hotels all rose at a double-digit annual rate. Core inflation, which excludes energy, food, alcohol and tobacco, rose by 5.7% year-on-year.

The figures could add further pressure on the Bank of England to accelerate the pace of interest rate increases. The Bank has increased the base rate three times since December from 0.1% to 0.75%. Its next monetary policy decision is scheduled for 5 May.

China’s economy slows in March

China’s economy slowed in March after a strong start to 2022. Data from the National Bureau of Statistics revealed GDP grew by 4.8% in the first quarter from a year ago, beating expectations for a 4.4% gain and above the 4.0% growth seen in the fourth quarter of 2021. However, figures for March showed annual retail sales fell by the most since April 2020, down 3.5%, as coronavirus restrictions were imposed across the country. The jobless rate rose to 5.8%, the highest since May 2020.

The Chinese government is sticking to its zero-Covid policy despite growing fears about the hit to the economy. Fu Linghui, a spokesperson for the National Bureau of Statistics, warned of “frequent outbreaks” of Covid-19 in China and an “increasingly grave and complex international environment”. On Monday, China’s central bank said the country would step up financial support for industries, firms and people affected by coronavirus outbreaks. It has published a list of 23 measures that include lending guidance for banks, general pledges for more credit or other financial support, and making it easier for companies to expand the crossborder use of the yuan.

Please check in again with us shortly for further relevant content and news.

Chloe

21/04/2022