The Great Glut: A historic supply and demand shock in the oil market

JP Morgan posted a great article earlier this week about the current oil situation (see below);

Rising production and collapsing demand due to the COVID-19 pandemic is creating an unprecedented glut in the oil market. As a result, we are currently witnessing a pronounced supply and demand shock that has driven oil futures below zero for the first time.

At the current pace of production, the world will run out of storage for oil by the middle of the year compounding the imbalance in the market and adding to the pressures faced by producers to slash prices to sell their inventories. As a consequence, energy stocks have been the worst performer year-to-date in global equity markets, while credit spreads of sub-investment grade energy companies have widened dramatically, signaling increasing concerns about the solvency of the sector.

The major oil producing countries, known as OPEC+, have now agreed to cut production starting in May to try to avert the crisis. But will their action be enough to balance the oil market? And what are the implications for investors?

An unprecedented drop in oil demand

The COVID-19 pandemic has led to the implementation of rigorous measures globally to contain the spread of the virus. Travel restrictions, social distancing and stay-at-home orders have reduced global oil demand by an estimated 5.6 million barrels per day (mb/d) in the first quarter of 2020 compared to the same period last year. With the full force of the containment measures expected to continue into May the situation in the oil market may deteriorate further in the near term.

Peak destruction in oil demand is expected in April and May, with an average decrease of 20mb/d. Even in a scenario where global COVID-19 containment policies are gradually lifted by the end of May, the U.S. Energy Information Agency (EIA) is estimating a loss of oil demand in 2020 between 5.2mb/d to 9.3mb/d. To put this number into perspective, in 2009 – the year of the last global recession – oil demand decreased by 0.8mb/d.

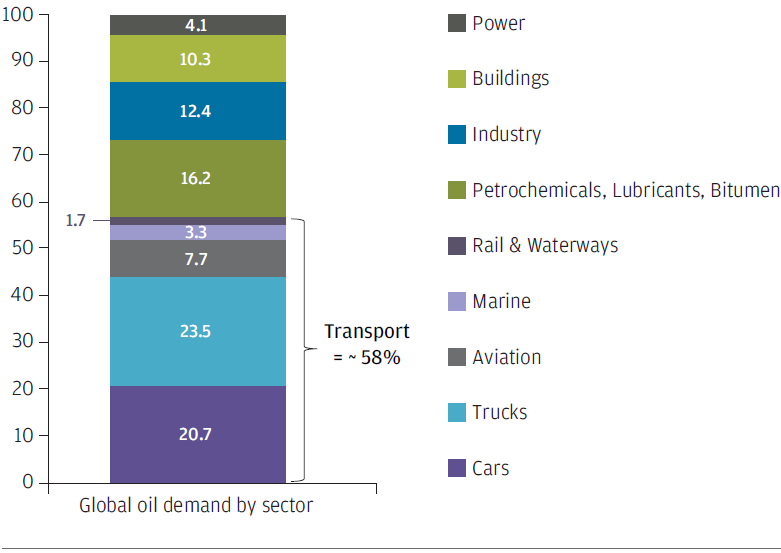

Exhibit 1 shows that almost 58% of global oil demand is derived from fuel for transportation. The impact on demand, and thus the oil market, is significantly worse than in normal recessions because of the widespread implementation of travel restrictions, which has reduced global air traffic by 30%. Quarantine measures have also caused a significant drop in road traffic, by roughly 40%, leading to a large drop in demand for petrol and diesel.

EXHIBIT 1: GLOBAL OIL CONSUMPTION BY SECTOR

% of total oil demand

Source: British Petroleum, J.P. Morgan Asset Management. Data shows an estimate of global oil consumption by sector for 2020 from the BP Energy Outlook 2019. Data as of 31 March 2020.

Storage capacity issues in the U.S. created a previously unknown experience of a negative price in the oil futures market. Futures for the month of May 2020 fell sharply as producers effectively paid others to take their oil inventories. Halting production is not feasible for some producers since it could permanently damage their oil fields. Giving, or paying others to take, away their oil for one month may have been the preferred option for the long run health of their business.

Record deal to cut production

The imbalance in oil markets came to the fore in early March, when Russia and Saudi Arabia couldn’t agree on production cuts. In fact, quite the opposite took place as Saudi Arabia, in retaliation, started a price war by giving rebates on their crude oil exports and announced an increase in production starting in April. However, the steep fall in oil demand and rapidly rising inventories have now convinced the world’s top producers to reverse course.

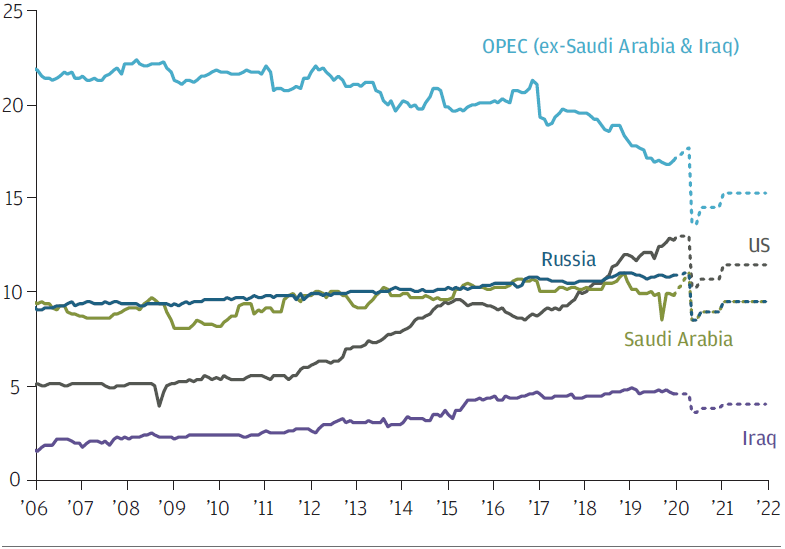

On Easter Sunday, the members of the Organization of the Petroleum Exporting Countries (OPEC) and the main non-OPEC oil producing countries (known as OPEC+) agreed to a historic cut in production to contain the oil glut. Oil production will be cut by 9.7mb/d beginning on 1 May. After that, the group will taper the cuts in July by 2.1mb/d and in January 2021 by another 2.0mb/d. The remaining 5.6mb/d cut will be in place until the agreement expires in April 2022. To put the cuts into perspective, Exhibit 2 shows the main oil producers and their level of current production.

EXHIBIT 2: CRUDE OIL PRODUCTION BY COUNTRY

Million barrels per day (mb/d)

Source: EIA, Refinitiv Datastream, J.P. Morgan Asset Management. 2020 and 2021 data using dotted lines are J.P. Morgan Asset Management estimates based on announced cuts. Data as of 15 April 2020.

Despite the historic size of the announcement it is only a partial step towards the drop in oil consumption as the world’s major economies grind to a halt. An immediate rebalancing of the oil market was never realistic since many higher cost non-OPEC producers would have avoided a large share of the required production cuts. Oil inventories will therefore continue to rise in the short term, likely putting further pressure on storage capacity and oil prices over the next couple of months.

If producers stay compliant to the agreement, and if the major global economies start to ease containment measures form mid-year then fuel and oil demand should start to rise and oil market fundamentals could improve in the second half of the year. However, there remains a large ‘if’.

Even if virus containment measures ease in the coming weeks, the world is going to be awash in oil for some time – economies may be slow to get back up and running to a pace that would warrant a strong increase in demand, especially when it comes to international travel.

What does this mean for investors?

Equity and credit investors in energy can expect a couple more difficult months ahead, with fundamental headwinds and challenging newsflow. Corporate earnings will likely have further to fall and preserving liquidity will remain a main task for the time being.

While sectors such as airlines, logistics and selected industrial (such as chemicals) traditionally benefit from low energy prices, they also face bigger challenges on the demand side of their businesses. Low oil prices will also put pressure on commodity-exporting emerging markets, such as Russia, the Middle East and Latin America. However, this benefits importers in Asia, especially India, whose current account deficit position could benefit from cheaper oil.

It is often in challenging times like these when the foundations of the next upswing are laid. The weak players are dropping out and exploration companies are significantly reducing their capital expenditure. Today’s cancelled projects will be missed in three years’ time. So, companies that survive the “Great Glut” may be able to look forward to a more balanced oil market in the next five years than they have experienced in the previous five.

A good update from JP Morgan giving us an insight to the current oil situation. JP Morgan have great technical and market resources available to them and continuously provide useful insights.

Hopefully now we’ll see a drop in prices at the pumps!

Andrew Lloyd

23/04/2020