Please see below, Brooks Macdonald’s ‘Daily Investment Bulletin’ which provides a brief update on global investment markets. Received this afternoon – 28/09/2023

What has happened?

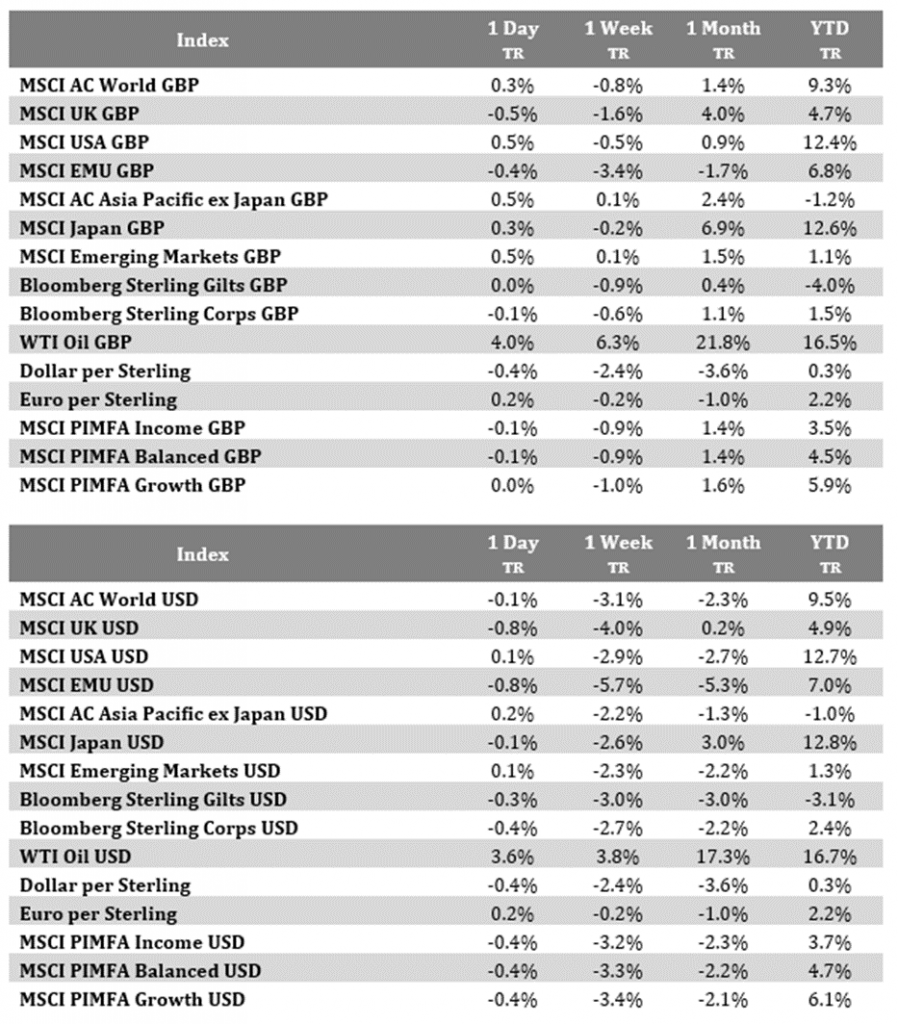

US bond yields continued their grind higher yesterday with the US 10-year Treasury yield now at 4.61% after another rise in oil prices stirred fears of a higher for longer inflationary backdrop. With these moves the US dollar has also been appreciating further, with the dollar index almost back to levels seen in November last year. US equities managed to stay flat for the day, but this conceals a high level of intraday volatility and general uncertainty.

Bond moves

Bond markets are certainly leading broader financial markets now with bonds seeing another heavy selloff yesterday. The Bloomberg aggregate global bond index, a widely used measure of the broad bond market, reached its lowest price level of 2023 as the benchmark 10-year and 30-year Treasury prices fell. These moves are quickly moving into the real economy with the US 30-year mortgage rate now at 7.41%, the highest level since December 2020. While the lag is relatively short, mortgage rates do act with a delay so there is likely further upside to these rates in the coming weeks. European bonds were also under pressure with 10-year bund yields hitting a 10-year high and Italian bonds underperforming after the Italian government unveiled a 4.3% expected deficit for 2024.

Oil Prices

The latest move higher in bond yields, which move inversely to prices, has been catalysed by growing inflation expectations caused by the uptick in energy prices. Brent crude closed above $96 per barrel yesterday, a fresh high for 2023. The US oil benchmark, WTI, saw an even greater percentage climb yesterday with the price moving to a one-year high of $93.68. While recent moves have been spurred by supply cuts, yesterday’s moves reflected lower-than-expected storage levels in the Cushing oil reserves.

What does Brooks Macdonald think?

Robust US economic data has been a key pillar of the soft-landing narrative in recent months however the recent consumer confidence data, and yesterday’s card spending data, suggests that the US consumer is showing signs of slowing. The US consumer discretionary sector has declined by almost 10% over the last fortnight as investors start to price in a heightened risk of a hard landing.

Please continue to check our blog content for advice and planning issues and the latest investment, markets and economic updates from leading investment houses.

Alex Kitteringham

28th September 2023