Please see the below market update from Brooks Macdonald received today.

BM Daily Briefing: Worst day for equity markets since March

What has happened?

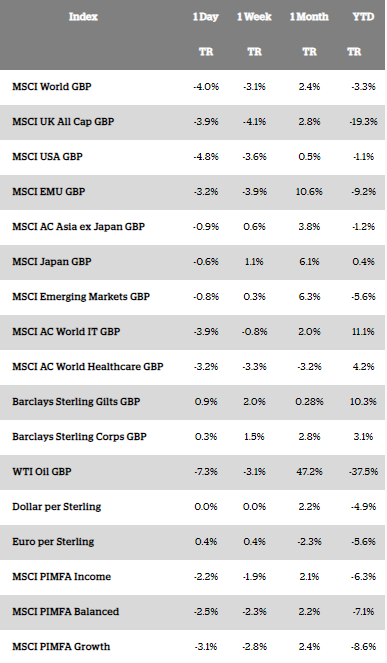

Yesterday the equity markets had their worst day since March as the Federal Reserve’s (Fed) grim economic projections combined with fears over a second wave. The US index fell by almost 6% with a lot of the sell-off occurring after European markets had gone home, European indices are more range bound today with the US futures moving off their lows.

Second wave fears ignite

The source of these second wave fears is the United States with California, Texas, Florida and Arizona all highlighted. All of these states have seen growing cases in the last fortnight and stoke fears that the rapid reopening in the United States is catalysing a resurgence of the infection. The total cases per million in theses states is similar to the levels we have seen in Italy and France which were hit hard by the pandemic so markets are wary not only of the growth rates but absolute numbers as well. Arizona has the highest case growth rate amongst US states with an average of 4.6% over the last 7 days. The resurgence raises two questions for the global economy, how fast is too fast to reopen an economy and what would these numbers look like if they did not occur in some of the warmest states in the US. The markets had little appetite to ponder either topic in detail and sold off rapidly and progressively as Thursday continued.

Will we see the US return to lockdown?

US Treasury Secretary Steven Mnuchin garnered a lot of headlines with his statement that “We can’t shut down the economy again. I think we’ve learned that if you shut down the economy, you’re going to create more damage.” Globally the economic impact of lockdowns has become a more important factor in decision making but this is yet to be tested with a true second wave. There is talk in Houston of reopening an emergency stadium hospital to accommodate hospital overflow. It may prove difficult for state governors to stick to the Federal reopening script if hospital capacity is under immense strain.

What does Brooks Macdonald think?

Our two big risks have been that of a second wave and US/China escalation. The data from the US certainly raises the risks of a second wave and makes progress towards a vaccine even more important. As this risk escalates expect markets to pay even closer attention to the successes in the Moderna and Oxford trials.

A good brief commentary from Brooks Macdonald on yesterdays market drops. As echoed through our recent posts, we do expect this volatility to continue. Keep checking back for regular up to date blog posts throughout this time.

Andrew Lloyd

12/06/2020