Please see investment bulletin below from Brooks Macdonald received this morning – 09/05/2022.

What has happened

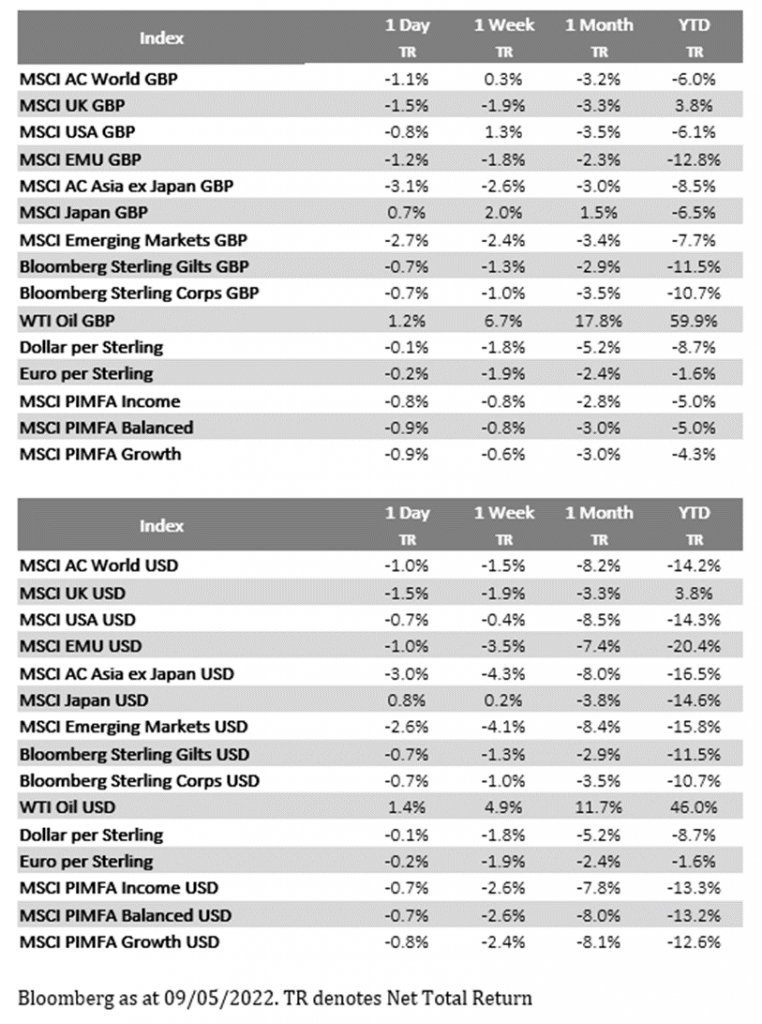

Last week saw equities fall with European equities underperforming as they caught up with the US losses the week prior. At a headline level, the US market was only slightly down however that masks huge day by day and intraday swings as investors repriced their economic expectations.

Central banks

The volatility last week was spurred by a series of major central bank announcements, beginning with the Reserve Bank of Australia that surprised the market by hiking more than expected. Whilst the US Fed and the Bank of England ultimately delivered in line with expectations, and one could argue that both had a slightly dovish tilt, the bond market sold off aggressively with the US 10-year Treasury yields rising by 0.18% last week. Despite the ECB not meeting, we saw similar moves in Europe with German bunds selling off and Italian bonds faring even worse as peripheral debt concerns start to come to the fore. This week we will hear from another round of central bank speakers who will add their perspective and nuance to the last week’s busy meeting calendar.

Economic data

With central banks clearly boxed in by higher inflation as well as fears over economic growth, data releases have increased importance at this time. This Wednesday will see the latest US CPI release which will provide a temperature check on price levels, with the core level (which excludes energy and food) particularly closely watched. Core CPI is expected to fall from 6.5% year-on-year in March to 6% year-on-year in April however this largely reflects ‘base effects’ as this year’s data increasingly becomes compared to more ‘normal’ rather than pandemic skewed months in 2021. Economic sentiment will be gauged with the ZEW survey for Germany and the Eurozone and the University of Michigan will update their consumer confidence numbers.

What does Brooks Macdonald think

With markets firmly focused on central banks and inflation, the US earnings season has drawn quietly to a (near) close with 90% of US companies having reported. In both the US and Europe, margins have remained robust with companies passing on inflationary pressures. All of this suggests that consumers are, for now, willing to pay up for goods and services. Of course the big question will be what happens when excess pandemic savings are run down, and the University of Michigan consumer confidence data may hold some clues as how US personal consumption will adapt.

Please continue to check back for our latest blog posts and updates.

Charlotte Clarke

09/05/2022