Please see below the latest ‘Markets in a Minute’ article from Brewin Dolphin received late yesterday afternoon – 16/03/2021.

Equities reach new highs as bond yields retreat

Global equities performed strongly last week, as bond yields retreated and investors turned their attention to encouraging economic data.

Most of the major US benchmarks reached new all-time highs. The Dow soared 4.1%, while the Nasdaq gained 3.1% and the S&P 500 added 2.6%. Tesla and other high-growth stocks enjoyed strong gains as fears about higher interest rates subsided.

Stocks in Europe were boosted by the passing of US president Joe Biden’s $1.9trn stimulus bill, as well as the European Central Bank’s pledge to speed up its emergency bond purchasing programme to counter rising borrowing costs. The pan-European STOXX 600 gained 3.5% and Germany’s Dax surged 4.2%.

The FTSE 100 ended the week nearly two percentage points higher, after data showed UK economic output fell by 2.9% between December and January – less than economists’ forecasts of a 4.9% contraction. Over in Asia, China’s Shanghai Composite slipped 1.4% amid concerns that authorities could reduce stimulus measures as the economy recovers.

Last week’s market performance*

- FTSE 100: +1.97%

- S&P 500: +2.64%

- Dow: +4.07%

- Nasdaq: +3.09%

- Dax: +4.18%

- Hang Seng: -1.23%

- Shanghai Composite: -1.40%

- Nikkei: +2.96%

*Data from close on Friday 5 March to close of business on Friday 12 March.

Wall Street rallies ahead of consumer spending spree

US stocks rallied on Monday as the roll out of stimulus cheques over the weekend fuelled expectations of a consumer spending spree. After a whipsaw session, the S&P 500 ended the day up 0.64%, reaching a new all-time high of 3,968.77. The Nasdaq rose 1.1% after technology shares recovered lost ground.

European shares ended Monday on a mixed note, following negative headlines around the Continent’s vaccination efforts and the safety of the AstraZeneca-Oxford vaccine. The STOXX 600 was flat at 423.1, while Germany’s Dax slipped 0.3%.

The FTSE 100 dipped 0.2% as commodity stocks, including BP, Royal Dutch Shell and BHP, underperformed. Bank of England governor Andrew Bailey said he expected inflation to approach the 2% target soon, but that he was cautious about whether the trend was sustainable amid continuing economic uncertainty. Ipsos MORI’s latest political monitor found 43% of Britons think the economy will improve over the next 12 months, while 41% think things will get worse.

The FTSE 100 was up 0.6% at Tuesday’s open, with investors optimistic that the US Federal Reserve will maintain a dovish stance on interest rates at its meeting this week.

US economic data cheers investors

Last week saw a raft of encouraging economic data from the US. Initial weekly jobless claims fell to their lowest level since November, at 712,000. Continuing claims dropped to 4.1m, their lowest level in a year. This helped to fuel a jump in the University of Michigan’s preliminary consumer sentiment index from 76.8 at the end of February to 83.0 in March.

The US is also progressing well in its roll out of Covid-19 vaccines, administering a new high of five million doses over the 6-7 March weekend. On Thursday, Biden told states to make all American adults eligible for vaccines by 1 May and set a goal of 4 July for gatherings to celebrate ‘independence’ from the pandemic. On the same day, Biden signed into law the $1.9trn American Rescue Plan Act, which provides $1,400 direct payments to individuals making up to $75,000 annually, $350bn in aid to state and local governments, and $14bn for vaccine distribution.

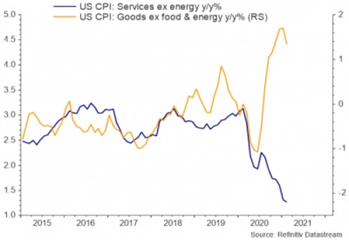

Last week’s US consumer price index (CPI) revealed an acceleration in the headline CPI, driven by rising commodity prices. Goods inflation rolled over slightly on a year-on-year basis in February, but services inflation continued to move lower.

The data highlights how the pandemic has, in aggregate, negatively impacted services demand while bolstering demand for tangible goods.

UK economy shrinks less than expected

The UK economy shrank by less than feared in January, despite the country re-entering lockdown. Gross domestic product was 2.9% lower than in December, according to the Office for National Statistics. Economists polled by Reuters had expected a contraction of 4.9%.

Following the latest data, economists are now predicted a 2% contraction in the first quarter of 2021 – half the 4% hit forecast by the Bank of England only last month. Retail sales figures also brought some cheer, with sales growing by 1.0% year-on-year in February following a 1.3% decline in January.

On the flipside, exports of goods to the EU slumped by 40.7% in January, while imports plunged by 28.8%. These are the largest drops on record, although there was a delay in gathering some data and there were signs of a pick-up towards the end of the month.

Chinese market continues sell-off

The sell-off in Chinese stocks continued last week, resulting in the CSI 300 posting its sharpest correction since the height of the Covid-19 crisis in March last year.

Alongside this sell-off has been a global rotation away from growth stocks into value stocks. In the last couple of years, China has increasingly become a growth-exposed equity market. Electric vehicle maker NIO has sold off almost 40%, and ecommerce companies Pinduoduo and Meituan have both sold off more than 30%.

Concerns about liquidity and credit stimulus are driving the sell-off. To prevent asset bubbles and contain ballooning debt, it is expected that the authorities will raise interest rates and restrict credit. However, with China heading into the centenary of the Chinese Communist Party in July, it is likely that the authorities will go slow in terms of withdrawing stimulus.

The so-called ‘national team’, which includes the sovereign wealth fund, state affiliated brokers, and the national social security fund, will also be on hand to limit the downside to major corrections.

Another quick update from Brewin Dolphin, regular market updates like this are useful for keeping up to speed with developments in the markets.

Please continue to check back for our regular blog posts and updates.

Charlotte Ennis

17/03/2021