Please see the below article from JP Morgan received early this morning:

‘By 2030, we expect the increase in annual Chinese spending power to be larger than the current size of the German and UK economies combined.’ – Mike Bell & Tilmann Galler

Rising incomes in Asia will probably be the most important economic and investment story of the 2020s. Asia is home to 60% of the world’s population, with China and India each accounting for about 18% of the global total. As incomes rise, the Asian middle class is expected to grow by about 1.2 billion people by 2030, significantly boosting consumption. As a result, we think Asia is an investment opportunity that’s simply too big to ignore and warrants a larger place in many portfolios.

China

Visitors to Shanghai would be forgiven for thinking that China’s development is mostly behind it. Growth has already been spectacular, with China’s share of global GDP rising from just 2% in 1990 to about 16% in 2020. What’s more, China is responsible for 35% of global demand for luxury goods. So it’s understandable that there’s a common perception that China is already rich.

However, travelling east of the developed coastal regions provides a very different picture of the country – and the ongoing potential for economic catch-up is clear. While there are certainly many Chinese billionaires, average GDP per capita is only around USD 10,000 (Exhibit 1).

Ongoing urbanisation will drive further increases in productivity and incomes

Exhibit 1: Urbanisation, nominal GDP per capita and population size

Urbanisation rates, %, and GDP per capita, USD, bubble size is population

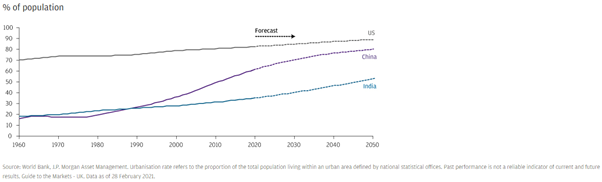

That figure represents impressive growth, from only USD 1,000 in 2000, but remains a long way behind developed economies such as the US. As inland regions urbanise (Exhibit 2) and develop, productivity will rise, such that China is expected to grow by about 4.4% per year on average in real terms over the next decade, despite an outright decline in the working age population. That means GDP and incomes should be about 50% larger by 2030.

There’s still plenty of urbanisation ahead in Asia

Exhibit 2: Urbanisation rates over time

% of population

An expected increase in incomes from about USD 10,000 per person to USD 15,000 per person may not sound that much by western standards. But multiply that increase in incomes by 1.4 billion people and you get an idea of the scale of the opportunity: a real increase in consumption of about USD 7 trillion. That’s an increase in annual Chinese spending power larger than the current size of the German and UK economies combined. This presents considerable growth opportunities in a wide range of goods and services — from premium food brands to insurance, healthcare and online tutoring.

Trade tensions are likely to persist between the US and China, and China is likely to be under increasing pressure to meet higher environmental and labour standards. But Beijing’s most recent five-year plan demonstrates the action the Chinese government is already taking in these areas, including an ambition to be carbon neutral by 2060. It’s also worth remembering that exports to the US account for only 3% of Chinese GDP. Investors who refrain from investing in China because of trade tensions are likely to be waiting a very long time, and risk missing out on the bigger picture of rising Chinese consumption.

India

While China’s economy is likely to grow by the largest amount in absolute terms, India is likely to deliver the fastest growth rate of any major country over the next decade. With over 480 million Indians under the age of 20 — considerably more than the entire 370 million population of North America — the working age population of India is set to grow strongly. From a much lower base of GDP per capita of only around USD 2,000 (Exhibit 1), we expect real growth of 6.9% per year on average over the next decade. That should lead real incomes to approximately double over the next decade. Again, while that may not sound like much, it could mean there are about a billion Indians in the middle class in 10 years’ time, with incomes increasing to a point at which many more households can afford higher-quality food products and financial services such as life insurance.

Overall, we think investors with a long-term investment horizon will benefit from focusing on the incredible opportunity presented by rising incomes and consumption in China, India and the rest of Asia.

The income opportunity

The global financial crisis followed by the Covid-19 pandemic pushed developed market bond yields significantly lower. Investment grade bond yields in the US and Europe are close to historical lows and 26% of developed market government bonds have a negative yield.

As a consequence, an increasing number of investors need to look beyond their home region to find positive real yields for the fixed income part of their portfolios. From that perspective, Asian bond markets look compelling. Asian investment grade bonds offer a yield pickup of between 2% and 3% over US and euro bonds, while fundamentals look relatively robust.

As in the developed world, debt in Asia has increased because of the pandemic, but total debt to GDP is still close to or below the level of most G7 countries. So investors willing to take the currency risk can add higher-yielding Asian bonds with an average rating of single A. Despite a higher correlation to equities than developed market government bonds, Asian bonds are still able to provide diversification benefits for portfolios (Exhibit 3).

Asian bonds provide higher yields, while still offering some diversification

Exhibit 3: Yields and correlations of fixed income returns to equities

% yield and 10-year correlation of monthly returns with MSCI AC World

Chinese renminbi bonds look particularly appealing. China’s early success in containing the Covid-19 pandemic knocked its economic cycle out of sync with the rest of the world, and with the Chinese central bank providing a less expansionary monetary policy response compared to developed economies, we would expect correlations with developed market assets to remain low for the time being.

In the past, restricted access and limited currency convertibility prevented Asian bond markets from playing a major role for global investors. But with the rising financing needs of the region, this is changing rapidly. Following the opening of the USD 15 trillion local renminbi bond market to overseas buyers, yield-starved international bond investors now have the opportunity to invest in Chinese bonds with yields north of 3%. Net cumulative foreign purchases of Chinese bonds have already accelerated by over USD 400 billion in the past four years. As has been seen since the opening of the local equity markets, index providers are beginning to reflect the growing importance of Chinese bonds, with increasing weights in bond indices likely to generate significant amounts of passive inflows in the coming years. For investors, it might be worth getting ahead of those flows.

Equity valuations

It’s not only within fixed income that valuations look more attractive in Asia than in the developed world. MSCI Asia ex Japan trades on a forward price/earnings ratio (PE) of about 16x, below Europe and significantly cheaper than the 22x earnings for the US. Valuations in India are similar to the US, but we expect the Indian economy to grow at 6.9% over the next decade, compared with 1.8% for the US. China, on about 16x earnings, is cheaper than Europe, despite the fact that we expect China’s economy to grow at 4.4%, compared with 1.3% for Europe, over the next decade. In short, long-term growth is available at a more reasonable price in Asia than elsewhere in the world.

The growth opportunity in equities

The combination of favourable demographics and fast-growing incomes continues to support the strategic investment case into Asia. Nevertheless, sceptics could argue that over the past 10 years Asian equities have not lived up to the high expectations investors had for this fast-growing region. Asian equities ex Japan have underperformed developed market equities by more than 2% per annum since 2011 – proof that high GDP growth doesn’t always translate into superior equity market performance. So why should it be any different in this new decade?

After a period of disruptive forces including the end of the commodity supercycle, trade conflict and a strong US dollar, fundamentals are shifting significantly in Asia’s favour.

We identify three structural trends that should support Asia:

- Technology adoption. Worldwide technology spending is projected to reach USD 3.9 trillion in 2021. IT hardware and semiconductor companies in China, Taiwan and Korea have become global market leaders in their industries. The rise of artificial intelligence, the move to electrical vehicles and autonomous driving, and the global rollout of 5G technology will keep demand for hardware made in Asia high. India has become a hub for the market-leading IT services companies, benefiting from an estimated 6-8% increase in digital transformation spending worldwide per year over the next four years. Outside the US, Asia is the only region with a large representation of the tech sector in its equity markets. The IT sector and the communication sector combined represent a third of the overall market cap.

- Middle class miracle. By 2030, roughly two thirds of the global middle class will live in Asia, and they are projected to spend an additional $18 trillion annually. Since 2009, Asian companies with a strong domestic focus have quadrupled their earnings, outperforming more export-oriented businesses. It’s also remarkable that domestic-focused earnings have shown significantly less volatility (Exhibit 4). Policymakers in the region will be eager to ensure that Asian companies get their fair share in satisfying future domestic demand. The new RCEP (Regional Comprehensive Economic Partnership) free trade agreement, which covers 10 ASEAN countries and China, Japan, Korea, Australia and New Zealand, can be seen as one step towards incentivising more intra-regional trade and production.

- The A-share opportunity. In equity markets, China is still punching below its weight (Exhibit 5). By the end of the decade, China will likely be the largest economy in the world. One of the main obstacles for foreign investors used to be the lack of access to the full opportunity set of listed Chinese corporations. But the opening of the local stock market to foreign investors in August 2016 propelled inflows from foreign investors. Foreign ownership of onshore Chinese equities has increased to 3.8% of total market cap. Although this represents an almost trebling in foreign equity holdings in the past four years, foreign ownership levels are still way below the 27% seen in the US or 55% in the UK. So China A-shares still have a lot of catching up to do. A fast-growing domestic economy and the prospect of higher index inclusion in the future will likely continue to attract foreign capital and support demand for A-shares in the coming years.

Domestic-focused earnings have grown strongly

Exhibit 4: Domestic vs. Exports-Oriented Asian companies

MSCI AC Asia Pacific ex-Japan, earnings per share, Jan. 2009 = 100

China’s weight in bond and equity benchmarks is well below its share of global GDP

Exhibit 5: China’s weight in global GDP, equities and bond markets

% of world GDP and market capitalisations

Conclusion

Favourable trends in urbanisation and the rapid growth of the middle class provide a strong growth backdrop for the region. Better containment of the pandemic and a more moderate policy response mean investors can access higher bond yields and superior earnings growth potential within equities at more reasonable valuations than elsewhere.

The improving accessibility of local Asian bond and equity markets, together with the growing depth of investable securities and liquidity, is further enhancing the attractiveness of the region for investors. Our 2021 Long-Term Capital Market Assumptions suggest Asian equities have the potential to outperform developed markets by 2.2% a year over the next 10 to 15 years. Mounting signs that the US dollar bull market is fading further reinforce our view that the next 10 years might go down as the Asian decade.

Please continue to check back for more of our regular blog content including market updates and insights like this article.

Andrew Lloyd

15/03/2021