Please see below for one of Artemis’ latest articles received by us this morning 12/08/2021:

Regulatory changes in China continue to cause uncertainty. Raheel Altaf, co-manager of Artemis’ global emerging markets strategy, explains how the investment process has helped to provide downside protection. He shares his outlook and sets out why he believes exceptional value can still be found.

Over the past 12 months there have been a series of regulatory changes in China covering a range of industries.

Why is China doing this?

The main reason for this lies in the government’s determination to develop China into a modern socialist economy. The objectives of common prosperity, green development and independence in key technologies and industries are at the heart of their long-term agenda and are designed to achieve the nation’s rejuvenation by the middle of this century. The developments have mainly taken place in ‘new economy’ sectors, such as internet platforms and e-commerce. These have grown rapidly, in part because of lax regulations. The situation is changing now. The catch-up in regulation aims to address loopholes to ensure fair competition and sustainable growth.

Effects felt across multiple industries

These developments have led to sharp falls in share prices of former strong performers. For example, in February, anti-monopolistic laws targeting internet platforms were announced. This put pressure on some of China’s ‘mega-cap’ internet stocks, in particular Tencent and Alibaba. In July, China ordered education firms to go non-profit and banned foreign ownership. Shares of education stocks such as Tal Education and New Oriental Education fell around 70% as a result. More recently there have been reports that regulation on gaming may be increased, leading to jitters in that sector.

Our approach

We have been concerned for several years that the risks in popular (and often unprofitable) new economy stocks in China were not well reflected in their share prices, which had reached excessive levels. So we have avoided investing in these companies, which has at times been costly for our fund’s performance.

Is now the time to buy them?

We would argue that valuations have certainly moderated but fundamentals are deteriorating. Our proprietary screening tool SmartGARP has been indicating to us that the growth in ‘value per share’ (a combination of earnings, cash flows, dividends, operating profits and net assets) in these companies has been slowing. This is the result of new regulations, but also other competitive pressures. These risks can derail high-growth stocks at the end of their cycle. Share prices have corrected, but with the fundamental outlook heading downwards these stocks appear expensive and have the potential for further weakness.

Analysts continue to downgrade their profit forecasts in these mega-cap Chinese internet companies. With many Asian companies expected to report their Q2 earnings in August, we remain watchful for how the current environment has affected companies’ profits.

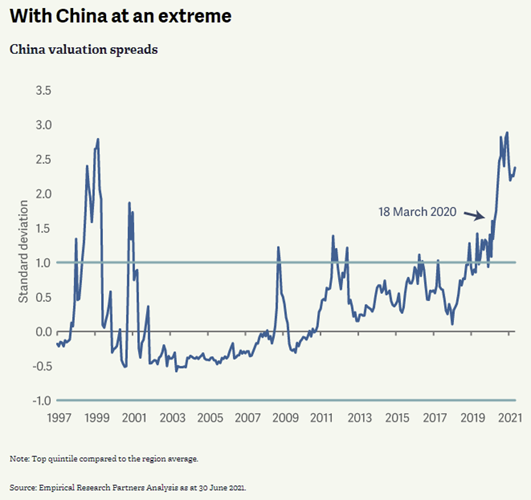

We have been commenting for some time on the stretched dispersion in valuations between low and high value stocks. The last six months have seen this start to reverse in many global markets.

In China, the valuation spreads reached extreme levels and the reversal only started at the end of January. There is therefore some way to go to catch up. Should China follow the same path as others, we expect a number of our holdings to see significant benefits.

Outlook

While continuing to avoid the mega cap internet stocks, we are still seeing attractive value in other less popular areas of the market, where the risk reward is highly favourable. Chinese banks (an overweight), as an example, have been a relatively safe haven recently. We expect markets to remain volatile, but remain confident that the favourable value per share of our holdings relative to the market is likely to be rewarded over time with better fund performance.

The fund’s value bias remains substantial. The Price/Book ratio of the fund is 0.8 and it offers a forward P/E of 6.3 vs 12.7 for the index (50% discount). The opportunity, in our eyes, remains an exceptional one.

Please continue to utilise these blogs and expert insights to keep your own holistic view of the market up to date.

Keep safe and well

Paul Green DipFA

12/08/2021