Please see article below from AJ Bell Investcentre – received 23/08/2020

Are Commodities Primed to Shine Again?

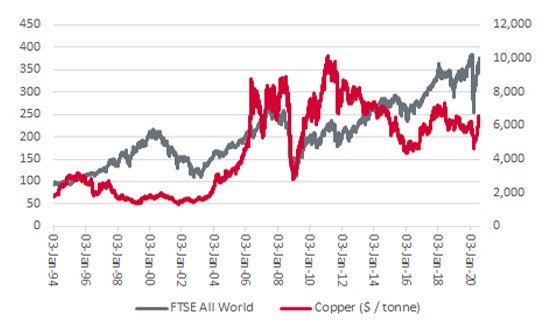

Copper’s surge from its spring lows to a three-year high at around $6,500 a tonne is an eye-catching development and one that will quicken the pulse of those advisers and clients who are exposed to miners, cyclical stocks or even equities more generally.

The metal is malleable, ductile and a terrific conductor. As such, it has many industrial uses – ranging from construction to automotive production to wiring to integrated circuits – and as a result, the metal is nicknamed ‘Doctor Copper’, because it is often seen as a good guide to the globe’s economic health. Advisers and clients also seem to treat copper as a useful indicator, since surges in copper seem to coincide with periods of strong performance from the FTSE All-World index and periods of weakness in both also seem to tally (although we must accept that the past is no guide at all to what may happen in the future).

A rally in ‘Doctor Copper’ could be an encouraging sign for equity markets

Source: Refinitiv data

After a minor retreat from its July high, advisers and clients who are bullish on the global economy and equities will be looking to copper to make fresh ground, while sceptics will be waiting for a longer, deeper slide in the metal’s price.

On a wider basis, commodity prices more generally have rallied from the lows plumbed in spring, when investors fled pretty much all risk assets thanks to fears about what the pandemic may mean (fears which could yet be borne out). The Bloomberg Commodity index – which tracks the ‘spot’ price of 24 raw materials ranging from copper to aluminium, gold to silver, hogs to crops and oil to gas – is up by almost a third since late March.

“The Bloomberg Commodity index is up by almost a third since late March but that pales next to the 51% surge seen in America’s S&P 500 equity benchmark over the same time period.”

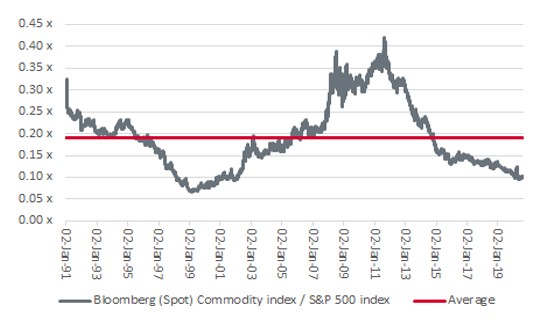

However, that pales next to the 51% surge seen in America’s S&P 500 equity benchmark over the same time period and the chart shows that commodities’ performance badly lags behind that of American stocks for a good decade or more.

This is intriguing, as commodities and commodity-related stocks dominated for much of the first decade of this millennium, to the extent that ExxonMobil (XOM:NYSE), Petrochina (HK:0857), BHP Billiton (BHP) (as it was then), Petrobras (PETR4:BVMF) and Royal Dutch Shell (RDSB) were among the 10 largest stocks in the world by 2010, as ranked by market capitalisation. Investors were clambering over themselves to buy commodity and commodity-related and China-related stocks, in the view that the Middle Kingdom would continue to grow at a rapid clip, driving both global economic activity and raw material demand in the process.

That narrative came unstuck fairly quickly. Oil – for one – has never reclaimed the heights it reached in 2007–08 and the Bloomberg Commodity index now trades close to the all-time relative lows against the rampant S&P 500 benchmark, reached when technology, media and telecoms (TMT) stocks were in very bubbly form in 1999.

“The Bloomberg Commodity index now trades close to the all-time relative lows against the rampant S&P 500 benchmark, reached when technology, media and telecoms (TMT) stocks were in very bubbly form in 1999. Yet sentiment was similarly in favour of tech in 2000 (when commodities, miners and oils promptly beat tech stocks hands down for a decade).”

Commodity prices trade near their lows on relative basis against the S&P 500 index

Source: Refinitiv data

That begs the question of whether we are now seeing another period when tech stocks are getting overheated and commodity stocks are being underappreciated. Investor sentiment is clearly lopsidedly in favour of tech, in the view that growth is scarce and companies that are capable of generating strong increases in earnings on a secular basis are inherently more valuable than raw material producers where price is their only weapon and end demand is uncertain.

Yet sentiment was similarly in favour of tech in 2000 (when commodities, miners and oils promptly beat tech stocks hands down for a decade) and in favour of raw materials in 2010 (when tech stocks promptly got their own back for the next ten years). Could investors be about to be sandbagged by a similar switch in the next decade, restoring faith in commodities as a worthwhile diversifier and a potential provider on uncorrelated returns as part of a diversified portfolio?

It is possible that the foundations for their renaissance are in place, especially as the best cure for low prices is low prices, as they destroy supply and boost demand. Granted, we are seeing demand destruction right now thanks to the recession that followed the pandemic. But we are seeing supply-side destruction too, as miners and oils alike rein in capital expenditure, focus on cash flow and curb production in many areas.

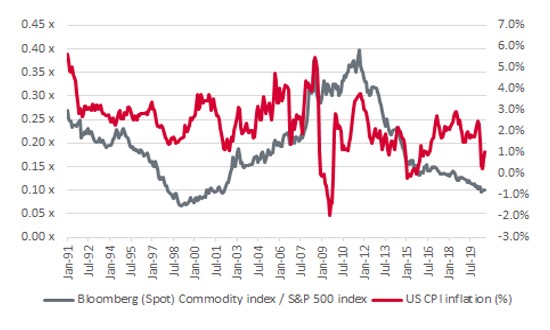

“Cheap assets can get a lot cheaper if nothing happens to change perception and bulls of commodities need a catalyst that will get other investors interested. One possible such catalyst would be the (quite unexpected) return of inflation.

But cheap assets can get a lot cheaper if nothing happens to change perception and bulls of commodities need a catalyst that will get other investors interested – as Jim Grant once wrote, “Successful investing is about having people agree with you… later.” One possible such catalyst would be the return of inflation. This would be all the more powerful as it would be so unexpected at a time when the depth and duration of the recession is the main market topic of discussion today and most investors seem frightened of a downturn and deflation above all else.

A resurgence of inflation could be one trigger for renewed interest in commodities and commodity-related stocks

Source: Refinitiv data

This column noted two weeks ago (Shares, 6 August) how inflation expectations are slowly ticking higher in the US, thanks to massive amounts of fiscal and monetary stimulus. If this trend continues, commodities could benefit, as the final chart suggests, although higher inflation expectations are likely to be needed to prise some investors away from their beloved tech stocks.

These articles are a useful way to get a good insight of the markets from different investment companies, this particular part of AJ Bell is a stock broker.

Please continue to check back for our regular blog posts and updates.

Charlotte Ennis

24/08/2020