Please see below for the latest Weekly Investment Bulletin from Brooks MacDonald, received by us yesterday 19/01/2021:

US markets are closed on Monday ahead of a busy week of politics, earnings and central bank meetings

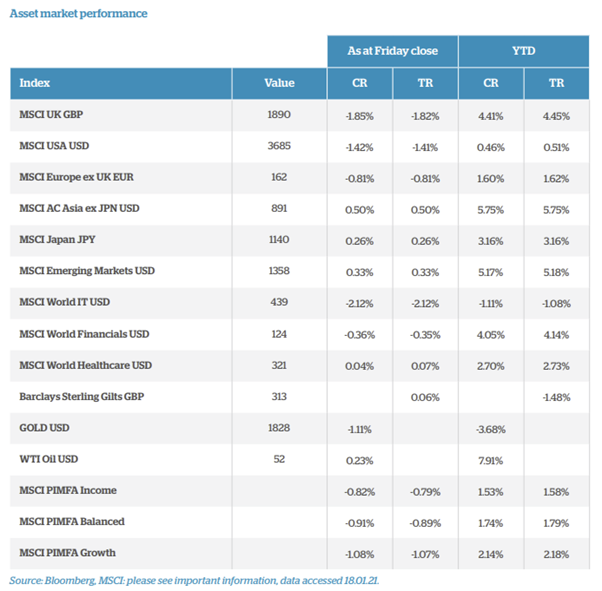

Last week saw most major equity indices decline as risk appetite waned after a strong start to 2021. The primary drivers of this were concerns over Federal Reserve tapering and fears that the new Biden administration may struggle to deliver the proposed fiscal stimulus. More positively, Chinese Q4 GDP showed a beat to the upside with the country growing by 2.3% year-on-year in 2020, a stark contrast to most other G20 nations which are expected to see significant declines.

Wednesday’s inauguration of Joe Biden as US President begins the politically important first 100 days in office

The week starts slowly with Martin Luther King Day meaning that US markets are closed. When they reopen however, politics in both the US and in Europe will dominate the headlines. On Wednesday, Joe Biden will be inaugurated as the next President of the United States and with it the politically important first 100 days will begin. The response to the coronavirus pandemic will be high on the new administration’s agenda with ambitious fiscal stimulus and vaccination goals being mentioned ahead of Wednesday. In February, the new President is expected to unveil a more comprehensive economic plan which will include infrastructure investment as well as policies to tackle climate change. Meanwhile in Europe, reports suggest that Italian Prime Minister Conte will survive a vote of no confidence today due to several abstentions. If these prove correct, this will reduce the near-term risk of fresh elections. Staying in Europe, the German Christian Democratic Union (CDU) have elected Armin Laschet as the new party leader, however it remains to be seen whether Laschet will be nominated as the chancellor candidate for the ruling CDU/CSU (Christian Social Union in Bavaria) coalition for September’s federal election.

Earnings season begins to gain traction this week with a string of banks and tech firms reporting

While we had a small number of earnings releases last week, including J.P. Morgan, this week sees a ramp up across both the US and Europe. The US tends to reach peak earnings momentum a little earlier than Europe so that region will be the focus for the rest of January. This week we have Bank of America, Netflix, Goldman Sachs, Morgan Stanley, Intel and IBM, so a range of sectors but a technology/bank focus. Coming into the season, large cap US equities are expected to see a year on year earnings decline for Q4 2020.

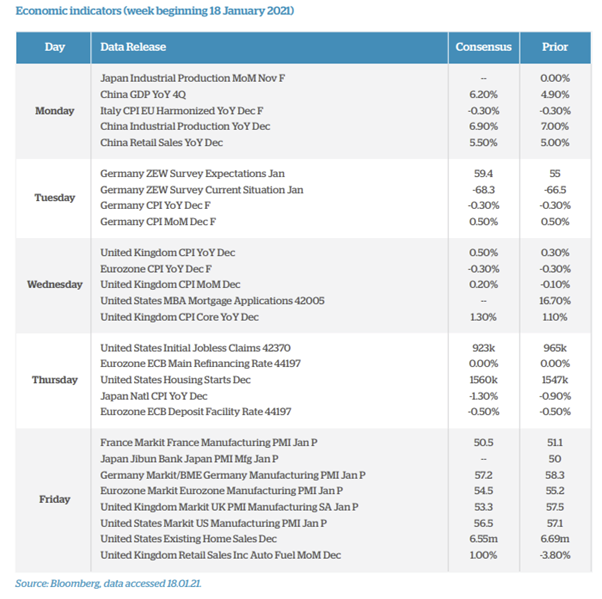

After a quieter start due to the US holiday, this week is likely to become far busier as US politics, European politics, earnings and central bank meetings all arrive. The European Central Bank is the major bank meeting this week and while no material change is expected, markets will be watching the rhetoric closely to see if there are any signs of tightening ahead.

Weekly updates like these are a useful method of frequently updating your holistic view of the markets, especially given the way the world is rapidly changing with Coronavirus.

Please continue to utilise these blogs to help inform your own views of the markets.

Stay safe and well.

Paul Green

19/01/2021