Please see below article received from J.P. Morgan yesterday, which reminds us that green technology is our ticket to a more sustainable future. Despite this, 50% of the technology we need to reach the world’s net zero carbon targets is not yet commercially viable, according to the International Energy Agency.

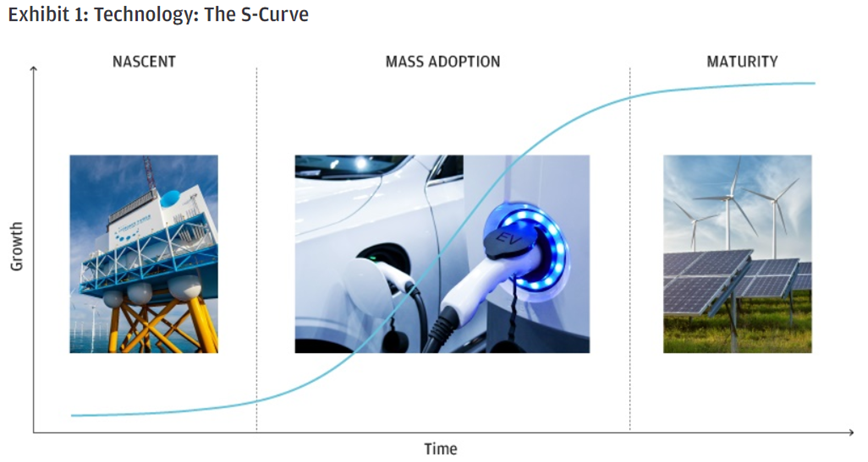

Meanwhile the other 50% is spread across both rapidly growing, innovative businesses, and more mature, profitable companies. As a result, green technology businesses find themselves at various points on what we call the S-Curve. This creates a range of very different opportunities for investors.

The S-Curve provides a framework for assessing almost every successful technology business since the first industrial revolution, with growth proceeding through three distinct phases – nascent technologies undergoing a burst of innovation, followed by exponential growth as mass adoption takes off, and finally reaching maturity.

Phase 1 – Nascent Technology

The nascent phase is the most volatile end of the curve. A new and innovative company faces a particularly wide range of possible outcomes, and the valuation will reflect the probability of these occurring. For example, a business may be valued at $1 billion today if investors believe there is a 10% chance it could be worth $10 billion in the future – but that valuation still implies a 90% chance it will be worth nothing. So while there can be massive upside if things go right, there is a significant risk it may not.

To move from the nascent phase to mass adoption, new technologies require a catalyst. In the green technology space, catalysts can include government initiatives, regulations, or consumer behaviour.

A good example is hydrogen technology – is it the future of decarbonising transport? The answer to this question may well depend upon the actions of governments. Following the COP26 summit, the US government made some encouraging statements about their plans for green hydrogen, which boosted stocks in the space. However, there still remain multiple fundamental issues, such as the volume of green power needed to produce meaningful quantities of hydrogen. Therefore, predicting whether this will be an area of focus for future government support is a fiendishly difficult task.

Those companies which do achieve mass adoption of their product can deliver windfall returns for early investors. Although it does not eliminate the risk of loss, diversification can be key to managing risk in this phase, as some technologies will simply never take off.

Phase 2 – Mass Adoption

Companies in this phase are those which have already hit their inflection point, leading to fast-growing revenues and a battle for market share.

In the green technology space, electric vehicles are the most visible mass adoption technology right now. Tailwinds here include government incentives and targets (the UK’s goal of banning the sale of new petrol and diesel cars by 2030, for example), as well as the growing number of charging points and advances in battery technology. With such forces behind them, it’s little wonder the likes of Tesla are enjoying huge revenue growth. Surely, it’s just a case of investing in a theme enjoying exponential growth and watching the returns flood in?

Not so fast. A technology theme may be thriving, but that doesn’t mean every company will be a winner. Far from it. In the mid-19th century, the railways were clearly set to be the backbone of Victorian Britain, but of the more-than 250 railway companies set-up, only a handful survived. In fact, a third of proposed rail tracks were never even laid. Some companies will be gaining market share, while others will see their costs spiral and profits suffer. Essentially we’re asking, who is going to be left standing?

There is another way to approach this phase of curve. A common saying is: during a gold rush, it’s best to be the one selling shovels. One way investors can get attractive exposure to the electric vehicles theme is through semiconductor companies, such as Infineon, which supply the chips all electric vehicles need to operate. Whether it’s Tesla, Volkswagen or another company that comes out as the dominant producer, they will all need semiconductors in their cars.

Phase 3 – Maturity

Once everyone who wants an electric vehicle has one, the industry will reach the mature phase of its growth. People may change their car every few years, as they do with their smartphones, but exponential growth will be over.

Wind energy is an example of a mature technology in the green space. Such businesses are no longer so reliant on government support, they generate predictable earnings streams, and many have high quality management teams. Wind farms often have power price agreements that can last for more than 25 years, which results in very stable cash flows.

One such leader in offshore wind is Denmark-based Orsted, a company that generates strong returns from its various projects and has been highly successful in winning large tenders. As investors, we’re interested in what we’re paying for such consistent earnings. This is where company quality becomes even more important, as just small improvements in cost of capital can dramatically increase project values and share prices.

Unlike early and mass adopters, pure economics is a larger driver of mature companies’ fortunes. We’re looking for attractive valuations, earnings visibility, and best-in-class management teams delivering profitable projects while reducing their cost of capital.

In Summary

Green technology isn’t just about trends, it’s about identifying the winners within those themes. For those companies which do grow to dominate the space, the rewards can be huge. Across the S-Curve, we focus on quality, valuation, and diversification – while also looking for the standout winners gaining momentum. Ultimately we aim to invest in the green technology companies that will power our transition to a more sustainable future.

Please check in again with us soon for more relevant content and insight.

Happy New Year.

Chloe

10/01/2022

.