Please see below ‘Markets in a Minute’ article received from Brewin Dolphin yesterday evening, which provides analysis of the markets’ reaction to high inflation, despite the widely held opinion that it is transitory and will subside.

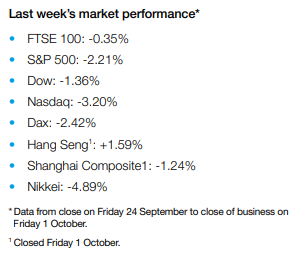

Most major stock markets fell sharply last week as fears about rising inflation and slowing economic growth weighed on investor sentiment.

The pan-European STOXX 600 tumbled 2.2% as eurozone consumer prices jumped to their highest level since September 2008. The FTSE 100 slipped 0.4% after the Bank of England’s governor said UK gross domestic product (GDP) would not recover to pre-pandemic levels until early next year.

In the US, the S&P 500 fell 2.2% amid uncertainty around the raising of the debt ceiling and difficulties surrounding the passing of the $1trn infrastructure bill. Reports of supply constraints also drove several companies’ share prices lower.

The gloomy mood spread into Asia, where Japan’s Nikkei 225 crashed 4.9% and China’s Shanghai Composite ended its holiday-shortened trading week down 1.2%.

Tech stocks drag Wall Street lower

Equities started this week in the red, with the S&P 500 and the Nasdaq down 1.3% and 2.1%, respectively, on Monday (4 October) driven by a rotation out of technology stocks and rising bond yields. Shares in Facebook tumbled 4.9% as its Instagram, WhatsApp and Facebook services suffered outages.

The selloff weighed on UK and European indices, which had already been dragged down earlier in the day by the announcement that trading in Evergrande shares had been suspended. The decision by OPEC+ to raise crude oil output by 400,000 barrels a day in November was also in focus.

On Tuesday, the FTSE 100 appeared to have shaken off Wall Street’s wobble, gaining 0.6% at the start of trading.

Eurozone inflation hits 13-year high

Figures released last week revealed the impact that soaring energy prices are having on inflation in the eurozone. In September, inflation accelerated to an annual pace of 3.4%, the highest level since 2008 and above the 3.3% forecast by economists. Energy costs were the biggest driver, soaring by 17% year-on-year. Core inflation, which strips out food and energy prices, also hit a 13-year high of 1.9%, according to the data from Eurostat.

Christine Lagarde, president of the European Central Bank, told the European Parliament earlier in the week that inflation could exceed the central bank’s forecasts, which have already been increased twice this year. “While inflation could prove weaker than foreseen if economic activity were to be affected by a renewed tightening of restrictions, there are some factors that could lead to stronger price pressures than are currently expected,” she said.

Nevertheless, Lagarde stuck to the official forecast that high inflation would prove transitory and that the rebound in energy prices and supply chain bottlenecks would ease in 2022.

It came after data showed German consumer prices rose by 4.1% in September from a year ago – the highest level in almost 30 years.

UK economic recovery delayed

The supply chain crisis means the UK’s economic recovery is likely to be delayed. Bank of England governor Andrew Bailey said GDP will not recover to pre-pandemic levels until early next year – up to two months later than was anticipated in August. He added that the Bank would keep a close watch on inflation expectations and the labour market.

Figures from the Office for National Statistics (ONS) showed GDP surged by 5.5% in the April to June quarter, better than its initial estimate of a 4.8% increase. The ONS said there were increases in all main components of expenditure, with the largest from household consumption following the easing of coronavirus restrictions.

However, monthly ONS figures showed the recovery largely stalled in July, growing by an estimated 0.1% from the previous month. There are concerns consumers will tighten their belts in the face of rising energy bills.

US consumer confidence falls

Over in the US, consumer confidence dropped in September for a third consecutive month, as the spread of the Delta variant and higher prices continued to dampen sentiment. The Conference Board’s index fell to 109.3 from a revised 115.2 in August, the lowest in seven months and far worse than the 115.0 expected by economists in a Bloomberg survey.

The present situation index, based on consumers’ assessment of current business and labour market conditions, fell to 143.4 from 148.9 and the expectations index, based on consumers’ short-term outlook for income, business and labour market conditions, fell to 86.6 from 92.8.

This came after the University of Michigan’s preliminary consumer sentiment index edged up in early September but remained close to a near-decade low. The report said high prices drove the declines in buying conditions for durable goods such as appliances and cars, adding “consumers have become much more concerned about rising inflation and slower wage growth and their negative impact on their living standards.”

Despite this, consumer spending rebounded by 0.8% in August following a 0.1% decline in July, according to the Commerce Department. The personal consumption expenditures (PCE) price gauge, which the Federal Reserve uses for its inflation target, rose by 0.4% from a month earlier and by 4.3% from a year earlier – the largest annual increase since 1991.

Please check in again with us soon for further news and relevant content.

Stay safe.

Chloe

06/10/2021