As you are probably aware by now, one of the key features of the PruFund range of funds is that the funds aim to provide a quoted gross investment return which they call the fund’s Expected Growth Rates (EGRs) and these are based on their long-term (15 years) market expectations whilst also providing a smooth investment journey. The performance of these funds typically tend to lag a rapidly rising market and also a rapidly falling market.

The PruFund’s EGRs are reviewed on a quarterly basis (although some series of funds are reviewed monthly) and Prudential have today confirmed that there are no changes to their EGRs at this time.

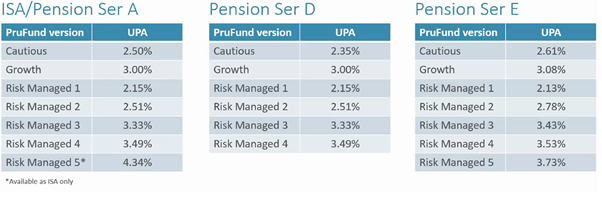

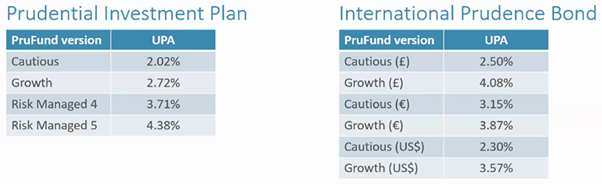

Prudential have also held their quarterly performance review of the PruFund range of funds and I am pleased to confirm the following upward Unit Price Adjustments have been announced:

Why has this happened?

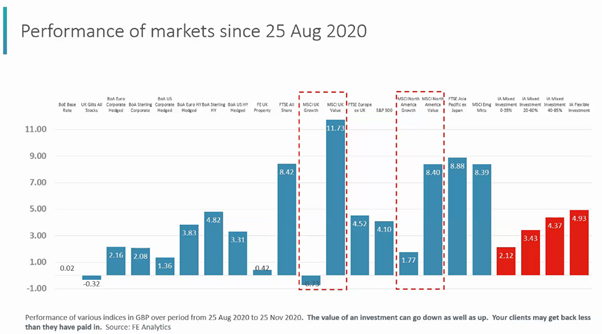

Since August, Capital Markets have broadly continued to recover, albeit, with considerable volatility, the recovery in markets since August can be seen in the chart below:

As you can see from the above, Value stocks have been one of the key drivers in returns generated in comparison to Growth stocks. Also, I think it is fair to say that the recent announcements of multiple vaccines have also helped drive some of these returns.

Summary

This is really good news and another step in the right direction. The fact that the EGRs have been maintained also goes a long way into showing that Prudential are standing by their long-term views of markets and the returns they aim to provide.

The key thing to remember is that although the PruFund range of funds aim to provide a smooth investment, they cannot defy gravity and when markets see rapid falls or rises, the PruFunds funds will eventually follow suit.

There will be greater detail provided by Prudential in their next Webex update which they will hold next week and we will endeavour to communicate this information to you as soon as possible.

Please continue to check our Blog content for advice and planning issues and the latest investment, markets and economic updates from leading investment houses.

Please keep safe and healthy.

Carl Mitchell – Dip PFS

IFA and Paraplanner

25/11/2020