Please see below Invesco’s most recent Investment Intelligence update, received earlier this afternoon. The commentary provides analysis of market performance over the course of 2020 and reflects on influential global events.

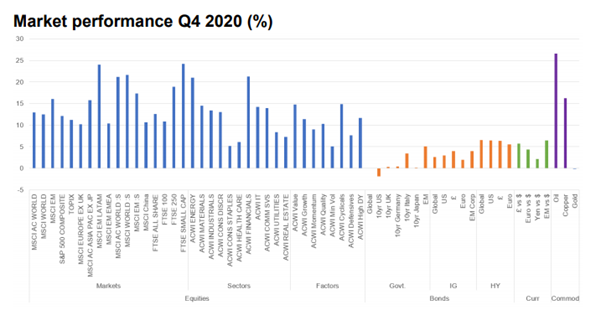

- Second and third waves of the coronavirus pandemic and their associated containment measures, progress on the vaccine front, US elections, Brexit and the monetary and fiscal backdrop were the main drivers of market performance during the fourth quarter. Investors chose largely to ignore the near-term negative economic consequences of a resurgence in virus cases in many parts of the world, notably the economic heavyweights of the US and Europe, preferring instead to focus on the much hoped for return to some sort of economic normality in 2021 that successful vaccine trials and their subsequent regulatory approvals and roll-out pointed to. As such it was hardly surprising to see that strongest performance during the quarter came from the most economically sensitive assets classes, such as equities, HY credit and commodities.

- Global equities had a very strong quarter, dominated by a 11.5% gain in November, rising 12.9% overall with DM (12.5%) continuing to lag EM (16.1%). Within DM there wasn’t much to choose between the major markets, with the UK (12.6%) and US (12.2%) ahead of Japan (11.2%) and Europe ex UK (10.2%). Mid (FTSE 250 18.9%) and Small caps (FTSE Small Caps 24.2%) led the way in the UK, well ahead of large caps (FTSE 100 10.9%). Sector mix and £ strength weighed on the latter. EM continued to see wide divergences in regional performance, with Latin America (24%) well ahead of EMEA (10.4%). Small caps (21.1%) outperformed significantly with DM (21.6%) ahead of EM (17.3%), a reversal of what we saw in broader markets.

- At a sector level there was a shift in market leadership during the quarter. Financials (21.3%) and Energy (21%), the two major sector laggards in the preceding quarters, topped the performance charts, even if that still left them at the bottom of the 2020 performance pile. Tech and techrelated sectors also outperformed, albeit only marginally so, with IT (14.2%) the best of them. Defensives struggled against a backdrop of improving economic sentiment, with Consumer Staples (5.2%) and HealthCare (6.1%) the main performance laggards.

- On a factor basis, Value (14.8%) had its first quarterly outperformance against Growth (11.4%) for two years. Quality (10.3%) and Momentum (9%) lagged, while Minimum Volatility (5%) brought up the rear.

- Globally government bond markets went nowhere (flat) for the second quarter in a row. 10yr yields were little changed for Bunds, Gilts and JGBs, but USTs saw yields 24bp higher (-1.9% TR) and contrasted with BTPs, which were down 35bp (3.4% TR) and hit all-time lows. EM Sovereign returns were the strongest of them all (5%) as yields fell 55bp.

- The risk-on backdrop supported credit markets, where the higher risk HY market (6.5%) comfortably outperformed IG (2.6%). Yields (IG -26bp, HY -119bp) declined to all-time low levels, while spreads narrowed further too (IG -35bp, HY -149bp). Within IG returns were led by £ IG (3.9%) and in HY US HY (6.5%) just edged out £ HY (6.4%). Euro denominated credit lagged in both IG and HY. The lower the credit rating the better, with BBBs (3.4%) outperforming in IG and CCCs and below (11.9%) in HY.

- Economic optimism and a weaker US$ boosted economically sensitive commodities, with Oil (26.6%) hitting its highest level since February, while Copper (16.2%) made an 8-year high. Gold (-0.1%) struggled as enthusiasm for the precious metal waned as ETF outflows picked up and real yields rose.

Another difficult quarter for the US$ with the US$ Index (-4.2%) having its worst quarter since 2017. It is now down -12.5% from its 2020 high and at its lowest level since early 2018. EM currencies (6.4%) led the way, closely followed by £ (5.7%), with sentiment towards the latter clearly boosted by the signing of a post-Brexit trade deal.

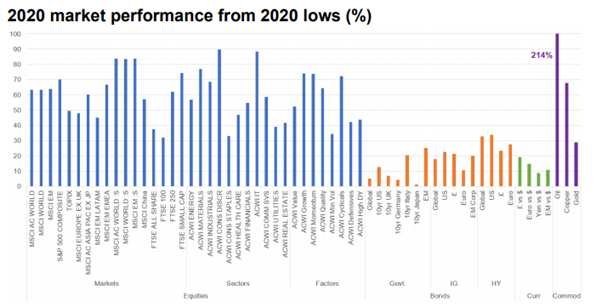

- An extraordinary year featuring a strong start, a rapid virus induced collapse and then a remarkable rally off the March lows. The result was that most markets delivered positive returns for the year, with many ending at or close to their 2020 and in a number of cases all-time highs.

- Standout performances in equity markets were US equities in DM and Asian equities in EM, led by China. At the sector level, IT and tech-related sectors, Consumer Discretionary and Comms Services, led the way, which underpinned strong performance from the Growth and Momentum factors.

- An extraordinary year featuring a strong start, a rapid virus induced collapse and then a remarkable rally off the March lows. The result was that most markets delivered positive returns for the year, with many ending at or close to their 2020 and in a number of cases all-time highs.

- Standout performances in equity markets were US equities in DM and Asian equities in EM, led by China. At the sector level, IT and tech-related sectors, Consumer Discretionary and Comms Services, led the way, which underpinned strong performance from the Growth and Momentum factors.

The potential approval of mulitple vaccines and the finality of Brexit may provide a more hopeful outlook for 2021. We will continue to publish relevant market data and news so please check in again with us soon.

Happy New Year.

Chloe

04/01/2021