Please see below the latest ‘Markets in a Minute’ article from Brewin Dolphin received late yesterday afternoon – 25/05/2021

Stocks mixed as Fed hints at asset purchase taper talks

Global equities were mixed last week as investors weighed signs of an economic rebound in Europe against the Federal Reserve’s so-called ‘taper talk’.

The S&P 500 and the Dow fell 0.4% and 0.5%, respectively, after minutes from the Fed’s April policy meeting suggested it might start to discuss reining in its accommodative monetary and fiscal policy. The Nasdaq added 0.3% after Friday’s flash US composite PMI output index surpassed expectations.

Over in Europe, signs that the economy is rebounding helped the pan-European STOXX 600 end the week up 0.4%, although gains were held back by concerns about rising inflation. The UK’s FTSE 100 slipped 0.4% as inflation surged and the pound rose against the dollar.

Japan’s Nikkei 225 added 0.8% on higher-than-expected export growth and a surge in manufacturers’ business confidence. China’s Shanghai Composite lost 0.1% as retail sales growth slowed and cases of Covid-19 rose in several provinces.

Equities rebound as tech shares outperform

Stocks recovered some of last week’s losses yesterday as inflation fears receded and technology shares rose.

The tech-heavy Nasdaq was up 1.4% at Monday’s close, while the Dow rose 0.5%, led by Microsoft, Cisco, Apple and Intel. The S&P 500 added 1.0%, with the communication services, information technology and consumer discretionary sectors outperforming.

Gains in technology stocks also boosted stocks in Europe, although several markets were closed for Whit Monday. The pan-European STOXX 600 was up 0.1% and France’s CAC 40 added 0.4%. The FTSE 100 climbed 0.5% to 7,052 as the pound stabilised following a warning from China against excessive speculation in commodities.

The FTSE 100 was down 0.1% in early trading on Tuesday as investors mulled figures that showed UK public borrowing in April was the second highest on record. At £31.7bn, it was £15.6bn less than in April 2020, when the government borrowed £47bn to tackle the pandemic. It was also lower than the Office for Budget Responsibility’s forecast of £39bn.

Fed officials discuss potential taper talk

Minutes from the Federal Reserve’s meeting in late April, released last Wednesday, reflected an overarching dovish sentiment but suggested some Fed officials thought the US central bank should start talking about tapering asset purchases relatively soon.

“A number of participants suggested that if the economy continued to make rapid progress toward the committee’s goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases,” the minutes said.

Currently, the Fed is buying $120bn of Treasury securities and agency mortgage-backed securities each month. It has pledged to continue at this pace until it sees “substantial further progress” towards its inflation and employment targets. The meeting was held before inflation data showed a surge in the US consumer price index for April.

Elsewhere, figures released on Friday showed IHS Markit’s flash US composite output index reached a record high of 68.1 in May – well above April’s reading of 63.5 and higher than the consensus forecast. The services business activity index reached 70.1 in May, up from 64.7 in April, marking the fastest pace of growth on record. The manufacturing PMI also rose to 61.5 from 60.5 the previous month.

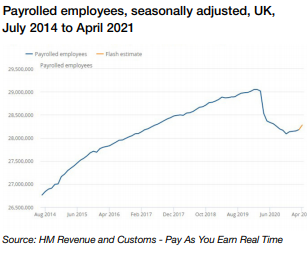

UK jobs market is picking up Last week’s employment data showed the UK labour market is picking up. The number of payrolled employees increased by 97,000 between March and April, the fastest pace since the start of the pandemic. Overall, there were 28.3m payrolled employees in April 2021, which was 257,000 fewer than 12 months ago.

The UK unemployment rate unexpectedly fell to 4.8% for the three months to March, down from 4.9% in February, while the number of job vacancies hit the highest level since the start of the pandemic. Median monthly pay increased by 9.8% year-on-year and is now higher than pre-coronavirus levels.

The labour market data was released the day before figures showed the annual rate of inflation in the UK more than doubled in April to 1.5% from 0.7% in March. Higher petrol prices and gas and electricity bills drove the increase.

Eurozone business activity soars

Business activity in the eurozone grew at its fastest pace in more than three years in May as Covid-19 restrictions were eased. IHS Markit’s flash composite eurozone PMI rose to 56.9 from 53.8, the highest reading since February 2018 and the third successive month of output growth. The services sub-index increased to 55.1 from 50.5, while the manufacturing sub-index came in at 62.8, down slightly from 62.9 in April. All three readings were above analysts’ expectations.

The research also showed new order growth surged to the highest since June 2006, resulting in backlogs of uncompleted orders rising to a degree not surpassed since the series began in November 2002. IHS Markit said this underscored “the growing shortfall of current output relative to demand”. Meanwhile, the roll out of the vaccine meant optimism about the year ahead was the brightest since comparable data began in 2012.

Please continue to check back for our latest blog posts and market updates.

Charlotte Ennis

26/05/2021