Please see below for one of AJ Bell’s latest Investment Insight articles, received by us yesterday 09/05/2021:

In many ways right now, it looks like business as usual for the financial markets. Blow-out quarterly numbers from Google’s parent Alphabet, Apple and Facebook are taking their share prices to new highs and carrying the NASDAQ index along with them; the FTSE 100 is having another crack at breaking through the 7,000 barrier; and central banks seem in no rush to switch off the hose of cheap liquidity with which they are dowsing markets (unintentionally or otherwise).

And yet, as discussed last week, bonds are trying to rally, as is gold. This move in haven assets seems at odds with the prevailing optimism regarding global vaccination programmes, an economic upturn and higher corporate profits and dividends.

It can be too easy to read too much into such short-term moves, as nothing goes up (or down) in a straight line. One way to test the market mood is to check out what is going on at the periphery, as that is where advisers and clients are probably taking the most risk and therefore the asset classes and holdings they are most likely to liquidate first in the event that bullish sentiment starts to ebb.

Another is to look at the market darlings: the areas that are doing (or have done) best and are garnering the most coverage from analysts, press and commentators alike. If they are keeping on running, then all may still be well. If not, this may be the first inkling of trouble ahead, or at least a shift in the market mood.

Cryptic message

Both the Archegos hedge fund and Greensill Capital went down in March, despite the bullish market backdrop and expectations that the global economy is on the mend (see Shares, 29 March 2021). That still feels odd. Markets have so far done a good job of shrugging off those failures, however advisers and clients will remember markets kept rising after the first two Bear Stearns property funds collapsed in June 2008, but it did not take long for deeper problems to appear – so everyone must remain vigilant, especially as there are some signs that some of the hottest areas are starting to cool.

This can, for example, be seen in the fortunes of both Bitcoin and Special Purpose Acquisition Companies (SPACs), a phenomenon that has gripped the US market in particular. The Next Gen Defiance SPAC Derived Exchange-Traded Fund (ETF), which tracks a basket of over 200 SPACs, is down by more than a third from its high. This is perhaps less of a surprise when you consider the data from SPACinsider.com, which shows how 308 SPACs are looking for a target even though 263 have already floated. In the end, supply may be outstripping demand.

Setbacks in Bitcoin are nothing new and cryptocurrency supporters will be unperturbed, but the way the performance of Initial Public Offerings (IPOs) is tailing off around the world is worthy of note. Perhaps the quality of deals is going down as the prices are going up, or, again, supply is starting to catch up with demand.

Electric shock

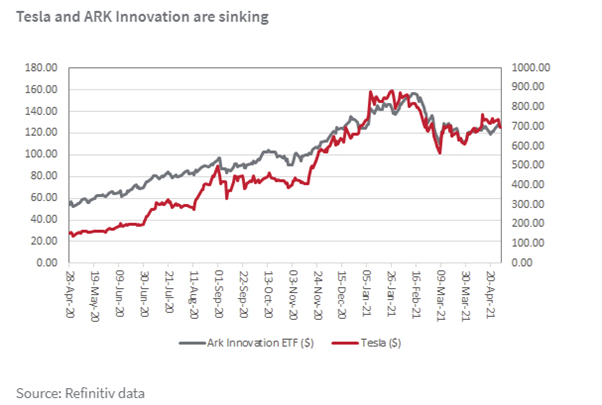

Advisers and clients are unlikely to have the time for, or interest in, the intricacies of stock-specific issues, but there can surely be no better proxy for the current bull market than Tesla. Yet even Elon Musk’s charge is, well, losing a bit of its power to impress and that is weighing on another momentum favourite, Cathie Wood’s ARK Innovation ETF, a $22 billion actively-managed tracker which aims to deliver the performance of 58 tech and growth stocks.

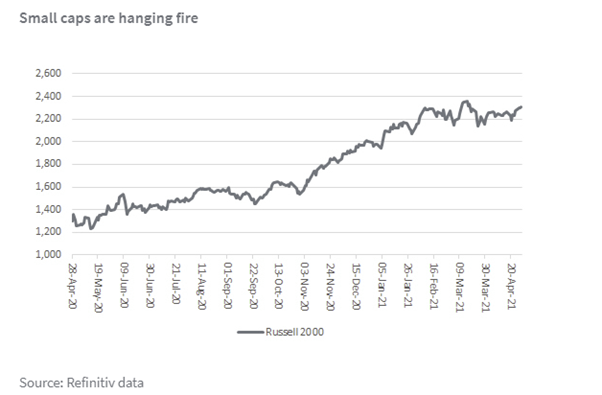

Even that classic gauge of both market sentiment and economic activity small-cap stocks are pausing for breath, although America’s Russell 2000 is yet to roll over.

All of this could be healthy. Again, nothing goes up in a straight line and some of these assets and securities were looking bubbly, at least in the eyes of some. A cooling-off may be no bad thing.

Equally, it could be just a sign that markets are moving on. Frontier and emerging equity markets still look to be showing upward momentum, a trend that would fit with the narrative of a global economic recovery and bullish investor sentiment – few areas are more peripheral than frontier arenas such as Vietnam, Morocco, Kenya and Romania.

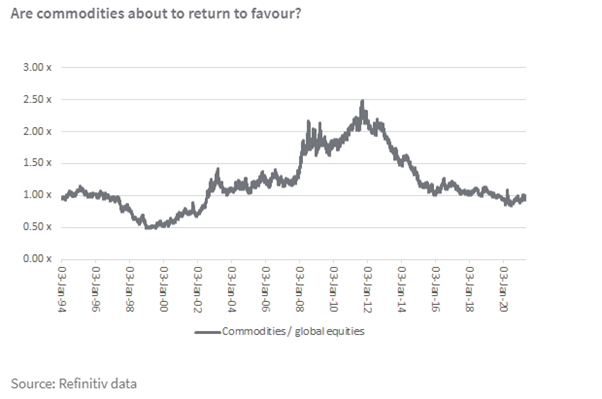

As such, we could just be seeing the next leg of the switch from defensives and growth to cyclicals and value. And if the upturn does prove inflationary, then there is a further trend to watch, one to which this column will return. This final chart shows the relative performance of commodities, as benchmarked by the Bloomberg index, against the FTSE All-World Equities index. Maybe real assets are on the verge of ending a decade’s worth of underperformance relative to paper assets, or at least paper claims on them?

Please continue to utilise these blogs and expert insights to keep your own holistic view of the market up to date.

Keep safe and well.

Paul Green DipFA

10/05/2021