Please see below article received from AJ Bell yesterday morning, which provides analysis of the current market landscape and discusses potential investment opportunities.

As regular readers will know, one of this column’s favourite market sayings comes from fund management legend Sir John Templeton, who once asserted that: ‘Bull markets are founded on pessimism, grow on scepticism, mature on optimism and die on euphoria.’

Applying this test can potentially help investors spot where value and future upside opportunities can be found. It can also help avoid areas which are so popular they could be overvalued and capable of doing damage to portfolios.

It is hard to avoid investments everyone is talking about with great excitement and resist ‘fear of missing out’. Yet history suggests looking at assets, stocks or funds no one is interested in is the best way to make premium long-term returns.

The last 12 months are a fine example of how some careful, but not wilful, contrarian research could have yielded rich rewards. As the pandemic began to make its presence felt, share prices plunged, oil collapsed into negative territory and government bonds’ haven status meant their prices rose and yields fell. Cryptocurrencies were tossed aside amid the general panic, too.

Yet wind on a year, and equities have beaten bonds hands down, with commodities not far behind. Technology is no longer the leading equity sector and defensive areas such as healthcare are relatively out of favour. Commodities (with the notable exception of precious metals) are doing well and cryptocurrencies are going bananas, as evidenced by the flotation of America’s leading crypto exchange just last week, namely Coinbase.

Studious analysis of these trends may therefore help investors to spot value and dodge the traps that the coming 12 months and beyond may offer.

UP, UP AND AWAY

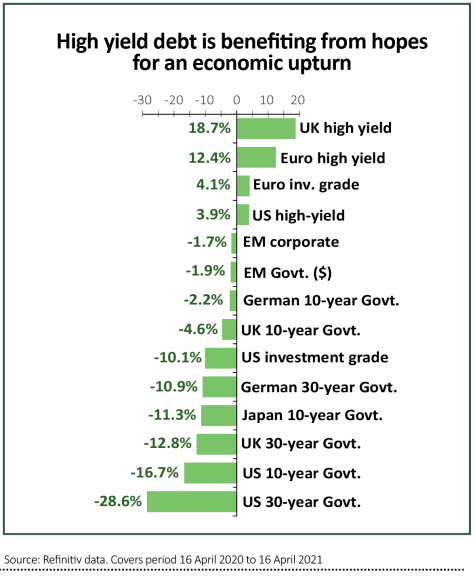

Incredible as this would have seemed a year ago, ‘risk’ assets are showing the best total returns in sterling-denominated terms over the 12 months, as equities and commodities easily outpace bonds. Within fixed income, the riskiest option – high-yield corporate paper – continues to lead government and investment-grade corporate debt.

Within equities, Asia and Japan are doing best, perhaps owing to the relatively limited impact of Covid-19 upon their populations’ health and their economy.

Emerging markets overall are coming in from the cold (in another win for contrarians), and America’s dominance of the geographic performance tables is waning a little, too.

By equity sector, it felt like technology was the only game in town a year ago, with defensive areas like healthcare also proving popular. Yet cyclical, turnaround sectors now lead the way, with defensives and income-generating bond proxies lagging badly.

All of this fits the prevailing narrative that the combination of vaccination programmes, government fiscal stimulus and ultra-loose monetary policy from central banks will see the economy through the pandemic and provide a firm base for a robust economic recovery.

So too do the losses on long-duration government bonds and the outperformance of high yield debt. The latter tends to correlate more closely to equities than it does fixed income. A strong economic recovery would help to bring financially stretched firms back from the brink and leave them better placed to meet their obligations.

NEXT STEPS

Analysis of those performance statistics means this column currently sees the major asset classes like this as we head into summer 2021, using Sir John Templeton’s four phases as a framework.

Euphoria – and optimism – are a lot easier to find than they were a year ago. This is not to say that markets are primed for a collapse, but it may not take much to shake them up a bit as a result.

Scepticism pervades fixed income and government debt, so anyone who fears disinflation or deflation more than inflation could take this as a cue to top up allocations.

Conversely, anyone who sees the world returning to normal pretty quickly could seek out value on commercial property stocks or funds, especially those with exposure to office space, while those portfolio builders who are wary of a market wobble – and suspect that central banks will respond with every greater monetary largesse – may note with interest the underperformance of gold and miners of precious metals.

Please check in with us again soon for further updates and news.

Stay safe.

Chloe

26/04/2021