Please find below, a weekly market update received from Brooks Macdonald, yesterday evening – 20/06/2022

- US and European equity markets fell heavily last week as the Federal Reserve (Fed) u-turned on its forward guidance

- President Macron’s party has lost overall control of the National Assembly, challenging future legislative plans

- Fed Chair Powell testifies to Congress this week, keeping central bank policy front and centre

US and European equity markets fell heavily last week as the Fed u-turned on its forward guidance

Last week saw one of the worst weeks for equity markets in recent memory as last minute changes to central bank policy mixed with a poorer economic backdrop. The losses were widespread with few markets and sectors able to avoid the contagion. European peripheral bond markets fared better, as the market gained some comfort from the European Central Bank’s (ECB) emergency meeting to discuss how to tackle any fragmentation between national bond markets.

Whilst last week’s Federal Reserve meeting is out of the way, investors are still reeling from the last minute change in Fed forward guidance which saw a 75bp interest rate hike in June after such a hike had previously been ruled out1 . Forward guidance is extremely difficult at a time when the central bank is data dependent on what happens to inflation and economic growth, however a feeling that the words of Fed Chair Powell should be taken with a pinch of salt will only heighten volatility. This week Chair Powell will testify to both the Senate and House Committees where he is expected to be questioned on what the central bank is doing to control the inflationary spike in the US. Last week Powell said that a 75bp rate hike would not become a typical event however with forward guidance in question, this may not stop markets from pricing in such an outcome.

President Macron’s party has lost overall control of the National Assembly, challenging future legislative plans

The French legislative elections have seen President Macron lose overall control of the National Assembly. Whilst Macron’s party remains the largest overall party, any legislative items will require delicate coalitions to be formed. The elections saw a strong showing for far left and far right parties, splitting the centrist vote. Macron is likely to rely on votes from the fractured centre right parties to pass key items such as pension reforms however such legislation is likely to need to be watered down to pass through a complex web of political priorities.

Fed Chair Powell testifies to Congress this week, keeping central bank policy front and centre

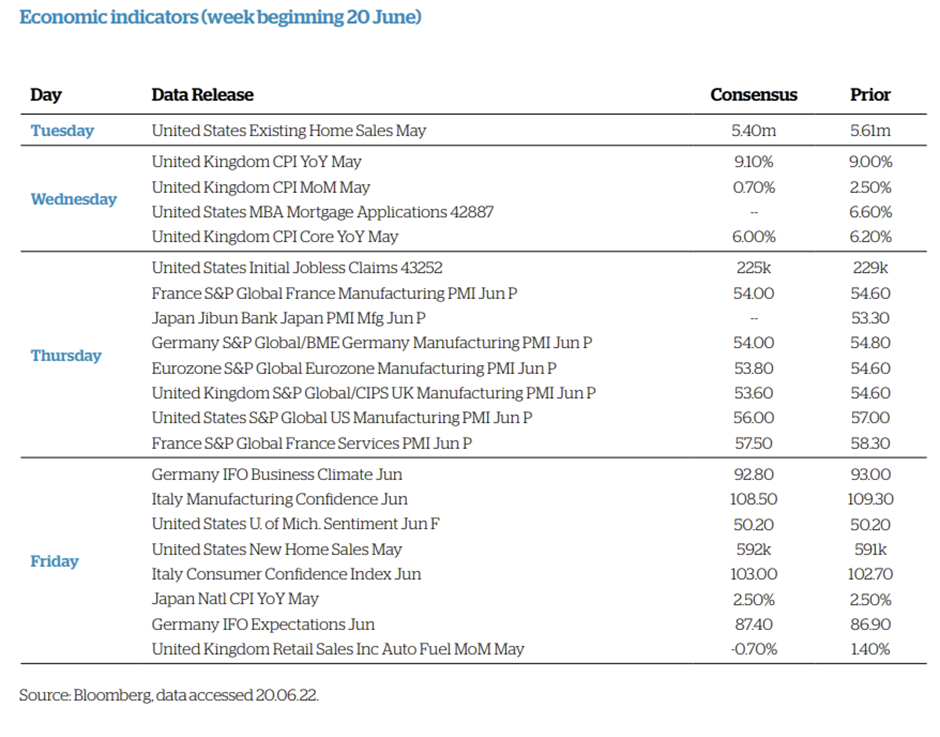

The recent market volatility has been driven by inflation data and the central bank reaction to that data. With the US closed on Monday, no US inflation releases this week, and Powell unlikely to err too much from his statements last week, we may be in for a calmer week. Now we are back to an era of emergency central bank meeting however, the chance of a surprise has greatly increased.

Please continue to check our Blog content for advice and planning issues and the latest investment, markets and economic updates from leading investment houses.

David Purcell

21st June 2022