Please see the below article from JP Morgan received this morning:

So far this year, value stocks have been able to recover some of their underperformance from the previous year. Nevertheless, the valuation gap between value and growth is still close to historical highs. A strong but uneven recovery in global growth, robust inflation, and active fiscal policy are all likely to continue to act as a tailwind for value stocks over the medium term. But investors should keep in mind that growth stocks also continue to benefit from strong structural tailwinds, such as technology adoption. With this in mind, we examine the basic drivers of value outperformance, and look at how value could perform in three different near-term economic scenarios.

Understanding recent market behaviour

Growth investors are looking back at a golden decade of returns. In the past 10 years, global growth stocks have outperformed value stocks by 146% in US dollar terms. This outperformance accelerated dramatically in 2020, as the change in consumer behaviour sparked by Covid-19 lockdown measures benefited growth companies in the technology, media and online-retailing sectors.

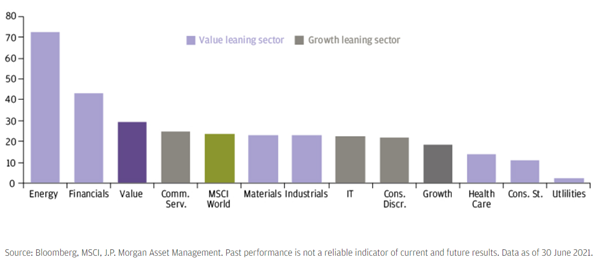

However, global style dynamics changed after the announcement that a Covid-19 vaccine had been developed and economies could begin to be reopened. Financials and energy stocks – two of the biggest sectors in value indices – have been the biggest contributors to value outperformance. But, as Exhibit 1 shows, the value universe is not homogenous. Within value there are highly cyclical sectors, but there are also defensive sectors, such as consumer staples and utilities, which have significantly underperformed this year. So not all value sectors have benefited equally from the improved economic outlook.

At the same time, cyclical growth sectors, such as communication services (media), IT (semiconductors) and consumer discretionary, have performed relatively well. So recent market performance suggests we need to take a nuanced view in the value vs. growth debate.

Exhibit 1: MSCI World sector returns since 9 November 2020

% total return in USD

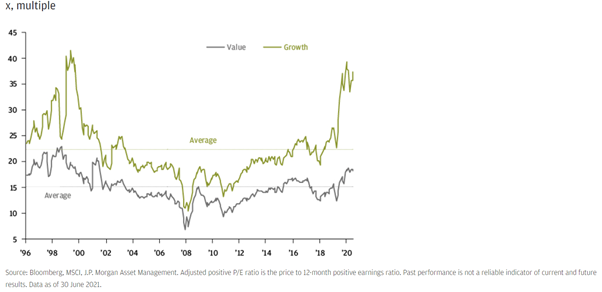

The size of the opportunity

At the halfway point of this year, the price-earnings ratio (P/E) of global growth stocks stood at 36x adjusted earnings. This compares to 24x for the broad market, and a 25-year historical average P/E for global growth stocks of 22x. As Exhibit 2 shows, this degree of valuation premium was last seen during the technology boom of 1999–2000. The P/E differential between growth and value is now the widest in the last 21 years, and significantly above the average long-term differential.

Exhibit 2: MSCI World Growth and MSCI World Value adjusted positive P/E ratios

It’s tempting to argue that mean reversion will lead to a period of value outperformance. However, the evidence over a number of years suggests that betting solely on mean reversion in style investing can be treacherous if fundamentals don’t play out. For example, weak GDP growth, low bond yields and technology adoption were fundamental tailwinds for growth stocks throughout the last cycle.

The question now, therefore, is whether the underlying fundamental forces are changing. One of the best-known key variables for relative performance between value and growth is the 10-year US Treasury yield. In the past decade “lower for longer” in bond yields was a synonym for anaemic GDP growth and the failure of central banks to reach their inflation target. By contrast, periods of rising bond yields have been associated with reflation of the economy and value outperformance (see Q3 2021 Guide to the Markets – UK page 65 / Guide to the Markets – Europe page 63).

We emphasise that, historically, value outperformance has required both real GDP growth and rising inflation. In the past 15 years, the correlation between global manufacturing purchasing managers’ indices (PMIs), as a proxy for GDP growth, and the relative performance of value stocks is positive (Exhibit 3). But a current correlation of 0.15 is not significant enough to prove that value only needs economic activity to accelerate in order to outperform growth.

On this basis, investors who are sanguine on GDP growth should probably lean more into small caps than into value, while investors expecting falling PMIs should consider an overweight to large caps. From a regional perspective, eurozone equities have benefited more from periods of rising PMIs then UK equities, which makes sense if you consider the relatively higher weighting towards cyclical industries in the eurozone.

Exhibit 3: Economic activity as a driver of relative performance

15-year correlation of style/region relative performance with global manufacturing PMI

However, when rising inflation expectations are added to the mix, the signal for value outperformance is more compelling. As Exhibit 4 shows, the market’s expectation of five-year average inflation, starting in five years’ time, has had a significant positive correlation with the relative performance between value and growth. In reflationary periods, where excess demand and rising commodity prices have caused inflation expectations and bond yields to rise, value has tended to outperform growth.

The relatively high representation of financials, energy and materials stocks in the value universe helps to explain why value has reacted positively to reflationary economic outcomes. On a regional basis, therefore, rising inflation expectations would be expected to favour UK equities over US equities, due to the higher weighting of financials, energy and materials in the UK index.

Exhibit 4: Inflation expectations as a driver of relative performance

15-year correlation of style/region relative performance with US 5y5y inflation swap yield

A more reflationary post-pandemic policy mix

We believe that a reflationary backdrop is more likely than at any point in recent years. Growth and inflation are being stoked by what we perceive to be a lasting change in the attitude of governments towards fiscal policy in the wake of the Covid-19 pandemic. Having got a taste for spending, and encouraged by low financing costs, governments increasingly see fiscal policy as a tool to promote growth and achieve policy goals rather than simply as a tool to help stabilise growth across the economic cycle. Governments in the US and across Europe have plans for multi-year sizeable infrastructure plans. Today’s expansionary fiscal and monetary policy is not only promoting growth, but also inflation.

Economic scenarios and investment implications

While reflation is our central economic scenario, we acknowledge that the outlook is still highly uncertain. In our mid-year outlook we identified three scenarios, which are outlined below in order of probability, along with the potential ramifications for value and growth:

Synchronised global growth: In our core scenario the recovery broadens out globally and becomes more synchronised over time. Supply bottlenecks continue to cause rising commodity prices and inflation concerns linger. Central banks taper asset purchases in 2022 but keep rates low. Fiscal policy remains expansionary but pivots to infrastructure projects. Yield curves continue to steepen.

In the synchronised global growth scenario, value has the potential to continue to outperform. Financials should benefit from the improving economic outlook and rising bond yields. High oil prices and rising gasoline demand should help the energy sector to outperform. A change in the scope of fiscal policy from pandemic support to infrastructure and environmental spending should also be beneficial for value.

Goldilocks: Inflation moderates quickly as supply disruptions ease and wage growth slows. Commodity prices cool as spending tilts to services and China tightens policy. Central banks remain accommodative for longer, encouraging further fiscal expansion. Large asset purchases continue. There is no further curve steepening. US bond yields peaked in March.

In the goldilocks scenario, central banks are right that inflation is only transitory, while growth moderates from current levels. Falling commodity prices will hurt energy and materials stocks, while bond yields are no longer supportive for financials. Structural growth trends will return to the fore, and relative performance could swing back in favour of growth stocks.

Stagflation: Acute supply problems lead to an unpleasant mix of moderate nominal growth and high inflation. Central banks are forced to tighten more quickly than anticipated. Debt sustainability concerns in an environment of rising rates end the period of fiscal expansion. The yield curve bear flattens.

While a stagflation scenario is a clear negative for equity markets and for financials, the impact on value vs. growth performance is less clear. Defensive value stocks with stable cash flows, low operating and financial leverage, and high dividend yields – such as utilities and consumer staples – tend to outperform.

Summary

The global shift to a more active expansionary fiscal policy is changing the macro environment to one of higher growth but also higher inflation. This backdrop is providing investors with an opportunity to take advantage of the wide valuation discrepancies we are seeing between value and growth. In our central near-term economic scenario of synchronised global growth and rising inflation, we would expect the performance gap between value and growth to close further. However, we acknowledge the secular undercurrents to this cyclical narrative. Technology adoption will remain a tailwind for growth stocks and climate ambitions may act as a medium-term headwind for traditional energy stocks and certain industrials. As a result, we would argue for a rebalancing towards value, rather than a wholesale shift. Value is back in the game, but growth is not out.

Please continue to check back for our regular blog updates.

Andrew Lloyd

16/06/2021