Please see below ‘Markets in a Minute’ article received from Brewin Dolphin yesterday evening, which provides an overview of current market behaviour in reaction to global economic developments.

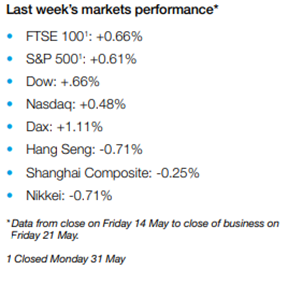

Most global stock markets edged higher last week as oil prices surged and data pointed to strong economic growth in the months ahead.

In the US, the S&P 500 ended its four-day week up 0.6% after crude oil prices climbed to their highest level for more than two years, boosting energy stocks. Share prices were also lifted by Friday’s weaker-than-expected US nonfarm payrolls report, which helped to alleviate fears of a shift in the Federal Reserve’s policy stance.

Over in Europe, the STOXX 600 added 0.8%, Germany’s Dax rose 1.1% and France’s CAC 40 gained 0.5% after the final purchasing managers’ survey for the eurozone suggested GDP would rise strongly in the second and third quarters. The UK’s FTSE 100, which was closed last Monday for the spring bank holiday, rose 0.7% despite concerns that the Delta variant of Covid-19 would delay the final lifting of lockdown restrictions.

The extension of the Covid-19 state of emergency in several prefectures in Japan weighed on the Nikkei 225, which declined 0.7%. China’s Shanghai Composite slipped 0.2%, ending a three-week run of gains.

Investors shrug off weak Chinese data

Most indices managed to hold on to gains yesterday (Monday 7 June) despite weaker-than-expected Chinese trade data. China’s imports grew by 51.1% in May from a year earlier, below the 54.5% growth predicted by analysts in a Bloomberg poll. Exports slowed to 27.9% in May from 32.3% in April, missing analysts’ forecasts of 32.1% growth.

Nevertheless, Asian markets closed in the black on Monday, with the Shanghai Composite and Nikkei 225 advancing 0.2% and 0.3%, respectively. The panEuropean STOXX 600 also erased earlier losses to close up 0.2%. News that UK house prices rose to a new peak in May boosted housebuilders, helping the FTSE 100 finish Monday’s session 0.1% higher.

UK and European shares were broadly higher at Tuesday’s open, although a fall in German factory output knocked 0.1% off the Dax.

US adds fewer jobs than expected

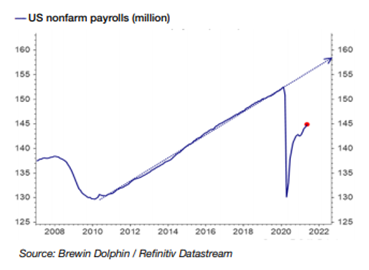

Last week saw the release of the closely watched US nonfarm payrolls report, which revealed the US added 559,000 jobs in May – fewer than the 675,000 extra jobs that economists were expecting. Economists had already lowered their forecasts following the huge miss in April when 278,000 jobs were added versus an expected one million jobs.

Labour participation in May was also lower than expected at 61.6%, below the pre-pandemic level of 63.4%. The number of unemployed stood at 9.3m, far higher than the pre-pandemic level of 5.7m.

However, the report wasn’t all doom and gloom. Job growth in May was driven by the services sector, with leisure and hospitality adding 292,000 new jobs, which is a further sign that the economy is normalising as vaccines are rolled out. In addition, the unemployment rate fell from 6.1% to 5.8%, and the number of permanent and temporary layoffs declined.

Overall, the report showed that while the US jobs market is improving it isn’t ‘overheating’, which would likely be the trigger for the Fed to tighten its monetary policy.

Eurozone services sector growth surges

Growth in the eurozone’s services sector hit a three-year high in May as lockdown restrictions eased. IHS Markit’s eurozone services PMI rose to 55.2 from 50.5 in April, marking the third successive month of expansion. Ireland and Spain saw the fastest growth, while Germany saw the slowest.

The composite PMI, which also includes manufacturing, surged to 57.1 in May from 53.8 in April, while business optimism for the year ahead hit the highest level for more than 17 years.

Chris Williamson, chief business economist at IHS Markit, said: “The service sector revival accompanies a booming manufacturing sector, meaning GDP should rise strongly in the second quarter. With a survey record build-up of work-in-hand to be followed by the further loosening of Covid restrictions in the coming months, growth is likely to be even more impressive in the third quarter.”

UK house price growth hits double digits UK annual house price growth rose to 10.9% in May – the highest level in nearly seven years. On a monthly basis, prices rose by 1.8% following a 2.3% rise in April. The average house price is now £242,832, an increase of £23,930 over the past 12 months, according to Nationwide.

The lender said the UK’s housing market has achieved a complete turnaround over the past 12 months. A year ago, activity collapsed in the wake of the first lockdown with housing transactions falling to a record low of 42,000 in April 2020. Activity surged towards the end of last year and into 2021, reaching a record high of 183,000 in March.

Robert Gardner, Nationwide’s chief economist, said the extension to the stamp duty holiday isn’t the key factor behind the spike in transactions, although it is impacting the timing.

“Amongst homeowners surveyed at the end of April that were either moving home or considering a move, three quarters (68%) said this would have been the case even if the stamp duty holiday had not been extended,” he stated. “It is shifting housing preferences which is continuing to drive activity, with people reassessing their needs in the wake of the pandemic.”

We will continue to publish relevant content and news as the vaccination drive in the UK is extended to include those aged 25 or over.

Stay safe.

Chloe

09/06/2021