Please find below, an update in relation to share prices, received from AJ Bell yesterday – 23/01/2022

Well, that didn’t take long. The Fed began to pump less Quantitative Easing (QE) into the financial system in November and the stock market’s wheels have started to wobble after barely two months of less cheap money, let alone move to withdraw it.

Investors are already starting to ask themselves how much the US Federal Reserve can do to tighten monetary policy before it either puts the brakes on the economy, breaks the stock market or both – and the answer might be not very far at all.

Some of the asset classes, funds and individual stocks which have performed best, attracted the hottest money flows and drawn the biggest headlines have started to flag, or even fall sharply. All are generally toward the riskiest end of the asset class spectrum, where the rewards can be highest, but the risks are too, should something go wrong.

Small caps are wobbling. America’s Russell 2000 index is now trading below where it was twelve months ago, and the UK’s FTSE Small Cap benchmark is losing a little momentum.

Source: Refinitiv data

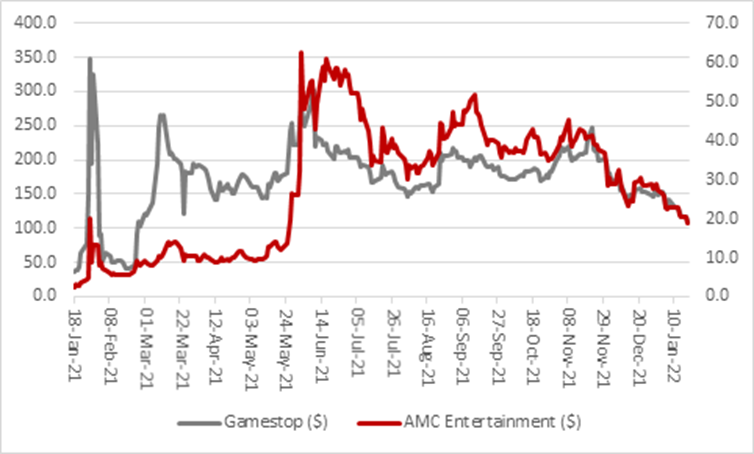

Meme stocks are taking a pasting. You have to hope that anyone who has held on to GameStop, AMC Entertainment and others to thwart the hedge funds who were short-selling these names have not ended up cutting off their own noses to spite their face. Buyers in the very early days may still be in the black, but anyone who piled in late to join the fun or try to make a fast buck could now be deeply in the red.

Source: Refinitiv data

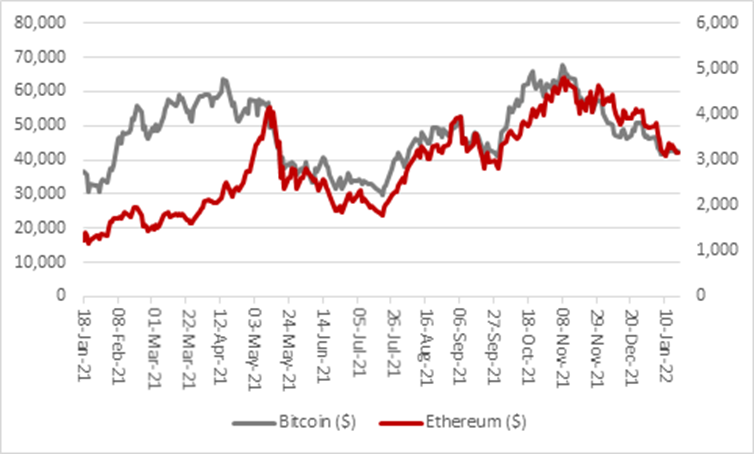

Cryptocurrencies have swooned once more.

Source: Refinitiv data

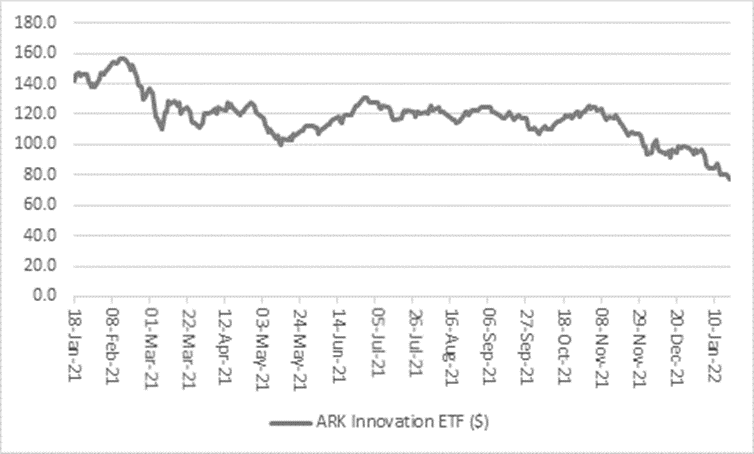

And the poster child for fans of momentum, tech and potential disruptive winners, the ARK Innovations Exchange-Traded Fund (ETF), continues to sink.

Source: Refinitiv data

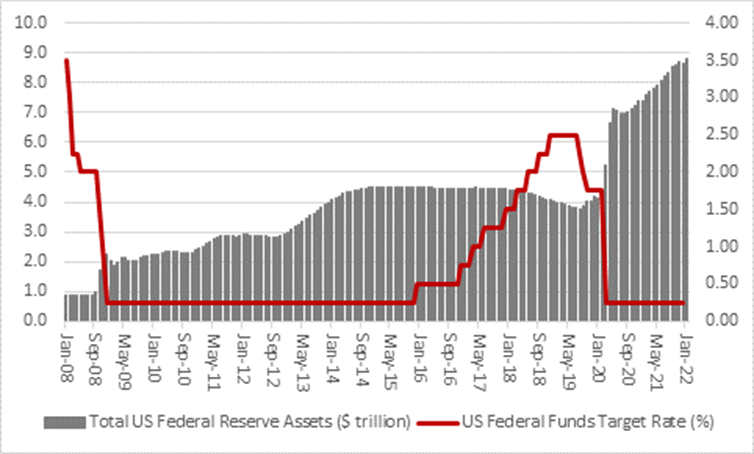

It may not be a coincidence that the Fed has started to reduce the amount of monetary stimulus it was pumping into the US economy via Quantitative Easing. It started to cut QE from a run-rate $120 billion a month by $15 billion a month in November and then by $30 billion a month from December.

That should mean the Fed’s $8.8 trillion balance sheet stops growing in March. After that, the central bank may turn to Quantitative Tightening (QT) and start to withdraw stimulus and shrink its balance sheet.

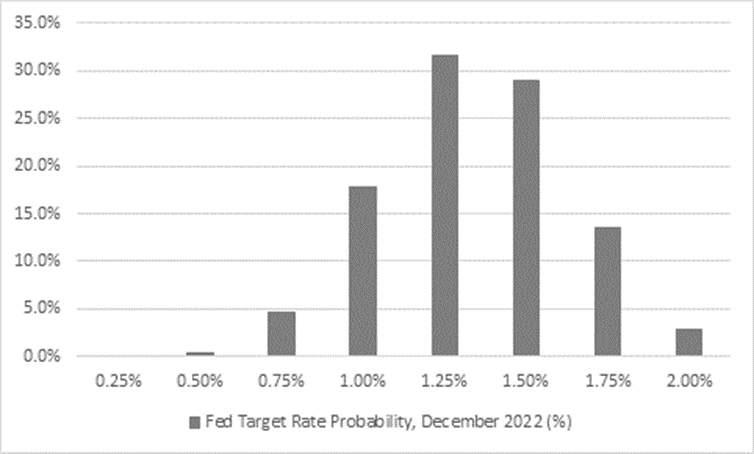

Meanwhile, the markets have started to price in at least four one-quarter percentage point interest rate increases from the US central bank by the end of this year.

Source: CME Fedwatch

Recent precedents for tighter monetary policy (or even simply, less loose, less accommodative policy) are enough to give investors pause for thought:

- In 2013, financial markets rebelled at the very talk of tighter policy and the so-called Taper Tantrum persuaded the Fed to back off.

- Between December 2015 and December 2018, under Janet Yellen and then Mr Powell, the Fed raised rates from 0.25% to 2.50%. It also shrank its balance sheet by $700 billion, or some 17%, between 2017 and 2019. But it then stopped as the US economy began to slow and signs of stress began to show in the US interbank funding markets in autumn 2019. As a result, the Fed’s balance sheet had started to grow again several months before the pandemic prompted fresh interest rate cuts and more QE in the spring of 2020.

Source: FRED – St. Louis Federal Reserve database, US Federal Reserve

There are good reasons for such caution. Global debt is so much higher now than it was in 2013 or even 2018, so the economy will be much more sensitive to even minor changes in interest rates.

More specifically for share prices and company valuations, tighter monetary policy – at a time when indebted Governments are throttling back on their fiscal stimulus programmes and looking for fresh sources of income from tax or social levies – has four possible implications:

- Higher interest rates may mean an economic slowdown, again because there is so much more debt in the system. As the old saying goes, economic upturns don’t die of old age, they are murdered in their beds by the US Federal Reserve. In addition, consumers’ ability to consume will be crimped if inflation outstrips wage growth and their incomes start to stagnate or fall in real terms.

- Higher rates reflect inflation, and faster (nominal) GDP means investors do not have to pay a premium for long-term future growth (for secular growth names like technology and biotechnology) when potentially faster, near-term cyclical growth (‘value’) can be bought for much lower multiples (even if it comes from oils, miners, banks).

- Inflation can eat away at corporate margins and profits. Right now, they stand both at pretty much record highs, as do valuations, at least in the USA, based on ratios such as market cap-to-GDP and Professor Robert Shiller’s cyclically-adjusted price-to-earnings (CAPE) ratio. If earnings start falling, valuations could do so, too, if confidence wobbles. Instead of the double-whammy that provides gearing to the upside, as investors pay higher multiples for higher earnings to give ever-higher share prices, markets see the opposite: earnings fall, investors pay lower multiples for lower earnings and share prices fall faster.

- Higher interest rates mean analysts and investors deploy an increased discount rate in their discounted cash flow models to calculate the net present value (NPV) of future cash flows from long-term growth stocks. A higher discount rate means lower NPV. A Lower NPV means a lower theoretical value of the equity and that means a lower share price.

All four are clearly worrying previously rampant financial markets but that in theory should not be the concern of the US Federal Reserve, or indeed any central bank. Their job is to keep inflation on the straight and narrow, to ensure it does not destroy wealth and prosperity and imbalance the economy.

But a decade and more of zero interest rates and QE – unintentionally or intentionally (judging by a string of speeches from former Fed chair Ben S. Bernanke dating back to at least 2003) – have persuaded or forced investors to take ever-increasing amounts of risk to get a return on their money.

Central banks are presumably concerned that having tried to create a wealth effect by stoking asset prices, the opposite effect could kick now in, hitting confidence and consumers’ ability and willingness to spend.

If inflation really does prove to be sticky, or even keep going higher, central banks may therefore be stuck between a rock and a hard place. They will want to control inflation on one side but their ability to jack up interest rates and withdraw QE may be constrained by record debts and concerns about the economy, employment (and financial markets’ stability) on the other.

Please continue to check back for a range of blog content from us and from some of the world’s leading fund management houses.

David Purcell

24th January 2022