Please see below commentary received from Invesco this morning, which provides analysis on the UK economy and global markets.

The challenges posed by the current raft of virus containment measures were all plain to see last week, with EZ Q4 GDP down -0.9%qoq and a second consecutive disappointing US Non-Farm Payrolls report (while headline unemployment actually fell from 6.7% to 6.3%, the lowest level since the pandemic started, the fall in the participation rate means that unemployment could realistically be much closer to 10%). However, liquidity remains plentiful, fiscal/monetary support is still robust, with more on the way, the vaccine rollout continues to accelerate and the current earnings reporting season has come through better than expected, heralding a much better year ahead on the earnings front. Barring any hiccups on the vaccination front, an easing of lockdown measures as the current wave of the pandemic dissipates should open the door to a gradual return to normality and the likelihood of a strong economic recovery in the second half. That’s certainly what economists are forecasting and financial markets are discounting.

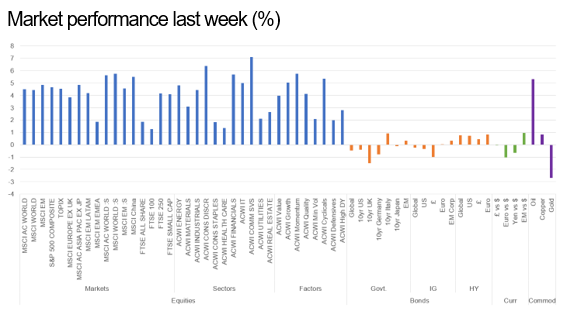

After the worst week since late October, equity markets rebounded strongly with the MSCI ACWI rising 4.5% – its best week since US election week in early November. This rapid swing in performance was reflected in volatility declining sharply, with the VIX index of implied volatility falling from an elevated 37 last week back down to 21, almost back at its post-bear markets lows. EM (4.9%) led the rally, marginally outperforming DM (4.5%), where the US was at the forefront, closely followed by Japan. Small caps outperformed, led by DM markets and are well ahead on a YTD basis, now up 98% from their late-March low, nearly 20% ahead of large caps. Other than a strong performance from Financials the sector leadership board was led by tech-related sectors, with Communication Services (7.1%) at the forefront. Growth defensives (Consumer Staples and HealthCare) were the main laggards, both returning under 2%. That left Cyclicals over 3% ahead of Defensives. Growth’s margin of outperformance versus Value was far less (1%) and it is now nearly 2% ahead YTD. The UK was the major DM regional laggard, as large caps (FTSE 100 1.3%) underperformed mid and small caps materially (both over +4% for the week), held back by their exposure to commodity sectors and defensive growth, which underperformed their global peers.

Government bond markets had a mixed week. At one extreme Italian BTPs benefitted from the prospects of a Draghi-led government, removing recent political uncertainty with the 10yr yield falling 11bp and almost back to its all-time low. Gilts, on the other hand, were hurt by the removal of near-term negative rate risk following last week’s MPC meeting. The 10yr yield rose 16bp and at 0.48% is at its highest level since March. USTs and Bunds also saw modest rises with the former at its highest level since February last year. Rising government yields weighed on the closely correlated IG credit market. Sterling markets were hit hardest where, despite spreads declining, yields rose 10bp. HY, where correlations are much closer with equity markets, fared much better. Consequently, the Global HY index hit new all-time highs as yields hit record lows (4.67%).

The US$ made further small gains, with the US$ Index increasing 0.5%, as it rose against both the Euro and Yen. It was flat against £. A rising $ didn’t prevent economically sensitive commodities from appreciating. Oil was the standout as supply continues to tighten and demand increases and at $59 is back to where it was last February. Gold has fared less well and recent declines means that it is now back at late-November levels and down nearly 5% YTD. $ strength and recovery optimism aren’t helping.

Past performance is not a guide to future returns. Sources: Datastream as at 7 February 2021. See important information for details of the indices used.1

Past performance is not a guide to future returns. Sources: Datastream as at 7 February 2021. See important information for details of the indices used.1

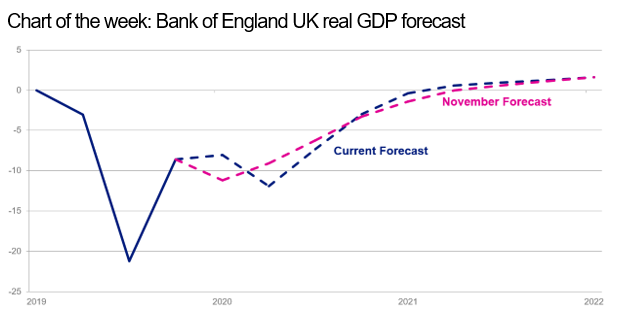

Past performance is not a guide to future returns. Source Bank of England Monetary Policy Report February 2021. Rebased 0 = 31 December 2019. Dashed lines are forecasts.

- Last Thursday, in conjunction with the MPC meeting, the Bank of England published its latest forecasts for the UK economy in its Monetary Policy Report. The chart shows the current forecast alongside the forecast from November, both rebased to 0 at Q4 2019.

- The COVID restrictions in place at present and the new trading arrangements with the EU will mean that activity will likely be impacted more in Q1 than in Q4, with GDP forecast to decline by 4%qoq, weaker than the current Bloomberg consensus expectation of -2.4%qoq and a very different profile to that expected in November. But in subsequent quarters GDP is projected to recover rapidly over 2021 towards pre-COVID levels on the assumption that a successful rollout of the vaccination programme will lead to an easing of virus-related restrictions and a normalisation of economic activity (by the end of Q3). Rising consumption and business investment alongside continued substantial fiscal and monetary support will all underpin this recovery. On the former the Bank estimate that £125bn+ of “excess” household savings have already been built up over the past year, although their (rather pessimistic?) forecast only sees 5% of that being spent. So for 2021 the forecast overall is weaker near term, but with a stronger recovery thereafter, leaving growth back at pre-pandemic levels by around the end of the year. Further out, the pace of GDP growth slows as the boost from these factors is expected to fade. Despite the strong recovery, unemployment is still expected to rise to a peak of almost 8% (current 5%) in Q3 before falling to 4.5% by the end of 2022.

- On the inflation front, CPI is expected to rise sharply towards the 2% target in the spring on the back of the reduction in VAT for certain services coming to an end and rising energy prices. With spare capacity forecast to be eliminated by the end of the year CPI is projected to be close to 2% over the remainder of the forecast period, with fading cost pressures and policy stimulus keeping a lid on any upside risk.

- Against this backdrop the MPC, as expected, kept their policy stance unchanged (Base Rate at 0.1% and QE at £895bn). For now at least no further easing would appear necessary. Consequently, while the use of negative rates remains in the policy toolbox (the Bank has told financial firms to start preparing so that they could “implement a negative rate at any point after 6 months”), the potential for its deployment in the near term has been removed. In terms of when monetary accommodation is removed there appears little risk of that happening anytime soon either and certainly not until the Bank is “achieving the 2% inflation target sustainably”. Currently the market is not pricing in a rate hike for a number of years, while the current £150bn round of QE is expected to run until the end of the year.

Key economic data in the week ahead

- A quiet week ahead on the data front with UK GDP and US inflation the main highlights.

- In the US Inflation data for January is published on Wednesday. Headline CPI is expected to remain at 0.4%mom, while Core is expected marginally higher at 0.2%mom. That would leave them both at 1.5%yoy. Last week’s Initial Jobless Claims improved to 779k, the lowest level since the end of November. Thursday’s release is forecast to remain largely similar on Thursday at 775k. On the consumer confidence front the preliminary University of Michigan Sentiment data for February is published on Friday and expected to be slightly higher at 80.5 from 79, comparable to October levels, but well below the 100+ levels seen pre-pandemic.

- The UK sees the Q4 and December monthly GDP numbers published on Friday. An easing of lockdown measures for part of the month will see the economy grow 1%mom in December, compared to -2.6%mom in November. Services is forecast to have risen 1.1%mom with Industrial Production at 0.5%mom and Construction at 0.2%mom. This would leave Q4 GDP at 0.5%qoq and -8.1%yoy. With a negative quarter forecast in Q1 this outturn would ensure that the UK economy does not suffer the ignominy of a double-dip recession, something that their neighbour, the EZ, is unlikely to avoid after Q4’s -0.9%qoq. Stronger imports, driven by stockpiling prior to the ending of the Brexit transition period with the EU, mean December’s Trade Balance is expected to have weakened to -£6bn from -£5bn previously. Sentiment in the housing market will be reflected in Tuesday’s RICS House Price Balance for January. It is expected to remain elevated at 60%, just below its recent high of 65%.

- In China January’s Inflation data on Wednesday is forecast to show a setback following increased movement restrictions due to an increase in coronavirus cases. A fall of 0.1%yoy is expected following the 0.2%yoy increase in December.

- Nothing of major significance this week from either the EZ or Japan.

We will continue to publish relevant market content and news, so please check in again with us soon.

Stay safe.

Chloe

08/02/2021