Please see below article received from Brooks Macdonald this morning, which provides a global market update for your perusal.

What has happened?

Yesterday, global markets faced headwinds, with the S&P 500 declining by 0.53% after three consecutive gains. Key pressures included escalating US-China trade tensions, disappointing corporate earnings, and concerns over a prolonged US government shutdown. The S&P 500 fell -0.53% with chip stocks leading the underperformance. The tech sector also faced scrutiny as Tesla kicked off the Mag-7 earnings season. Despite beating revenue expectations, Tesla’s earnings per share fell 31% year-over-year to $0.50, missing estimates due to rising operating expenses. Shares dropped 3.95% in after-hours trading. In Europe, the STOXX 600 fell 0.18%, reflecting a cautious mood. Meanwhile, oil prices surged, with Brent Crude climbing above $64/bbl following new US sanctions on Russia’s largest oil companies, marking a sharper tone in US-Russia relations since President Trump’s return to office.

US-China trade tensions continue

US-China trade concerns dominated market sentiment, driven by reports that the Trump administration is considering export restrictions on goods containing US software in response to China’s limits on rare earth exports. This news hit trade-sensitive sectors hard, with the Philadelphia Semiconductor Index dropping 2.36%. Despite the rhetoric, optimism flickered as Trump hinted at a potential comprehensive deal with China’s President Xi, suggesting negotiations remain fluid ahead of a possible summit.

UK markets shine

In contrast to global unease, UK markets rallied after a surprising drop in inflation. Headline CPI held steady at 3.8% (below the expected 4.0%), while core CPI fell to 3.5% (against forecasts of 3.7%). This fuelled expectations for a Bank of England rate cut, with the probability of a December cut rising from 42% to 72%. Gilts surged, with 2-year yields dropping 8.8bps to their lowest since August 2024, and 10-year yields falling 6.0bps. UK equities also gained, with the FTSE 100 up 0.93% and the FTSE 250 soaring 1.47%, its strongest performance in over six months.

What does Brooks Macdonald think?

The ongoing US government shutdown, now in its 23rd day, continues to cloud the outlook. The record for the longest shutdown was set in 2018-19, and Polymarket odds now indicating a 75% chance of surpassing that record. The lack of a resolution between Republicans and Democrats is stifling the flow of US economic data, leaving investors navigating in the dark. We remain vigilant, preferring opportunities in markets like the UK, where positive inflation data could point to improving outlook.

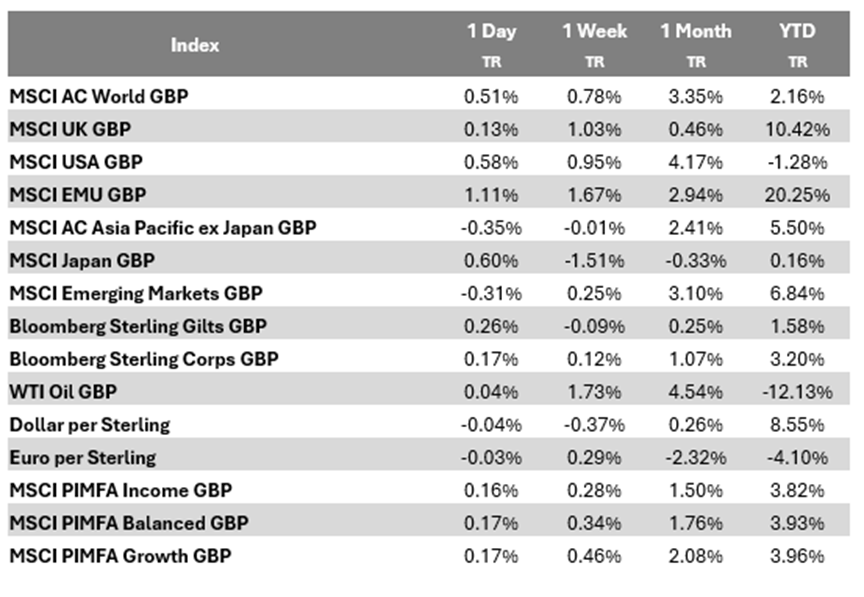

| Index | 1 Day | 1 Week | 1 Month | YTD | |

| TR | TR | TR | TR | ||

| MSCI AC World GBP | -0.39% | 0.70% | 1.70% | 11.61% | |

| MSCI UK GBP | 0.92% | 1.01% | 3.32% | 19.78% | |

| MSCI USA GBP | -0.56% | 0.55% | 1.03% | 7.52% | |

| MSCI EMU GBP | -0.49% | 0.70% | 3.15% | 26.21% | |

| MSCI AC Asia Pacific ex Japan GBP | -0.45% | 1.31% | 3.54% | 20.03% | |

| MSCI Japan GBP | 0.40% | 2.58% | 3.34% | 15.45% | |

| MSCI Emerging Markets GBP | -0.24% | 1.22% | 3.84% | 22.47% | |

| Bloomberg Sterling Gilts GBP | 0.53% | 1.08% | 2.76% | 4.36% | |

| Bloomberg Sterling Corps GBP | 0.41% | 0.71% | 1.99% | 6.11% | |

| WTI Oil GBP | 1.19% | 0.54% | -5.65% | -23.63% | |

| Dollar per Sterling | -0.11% | -0.35% | -1.17% | 6.71% | |

| Euro per Sterling | -0.19% | -0.03% | 0.47% | -4.81% | |

| MSCI PIMFA Income GBP | 0.19% | 0.63% | 1.83% | 9.89% | |

| MSCI PIMFA Balanced GBP | 0.15% | 0.64% | 1.87% | 10.81% | |

| MSCI PIMFA Growth GBP | 0.10% | 0.68% | 1.94% | 11.99% | |

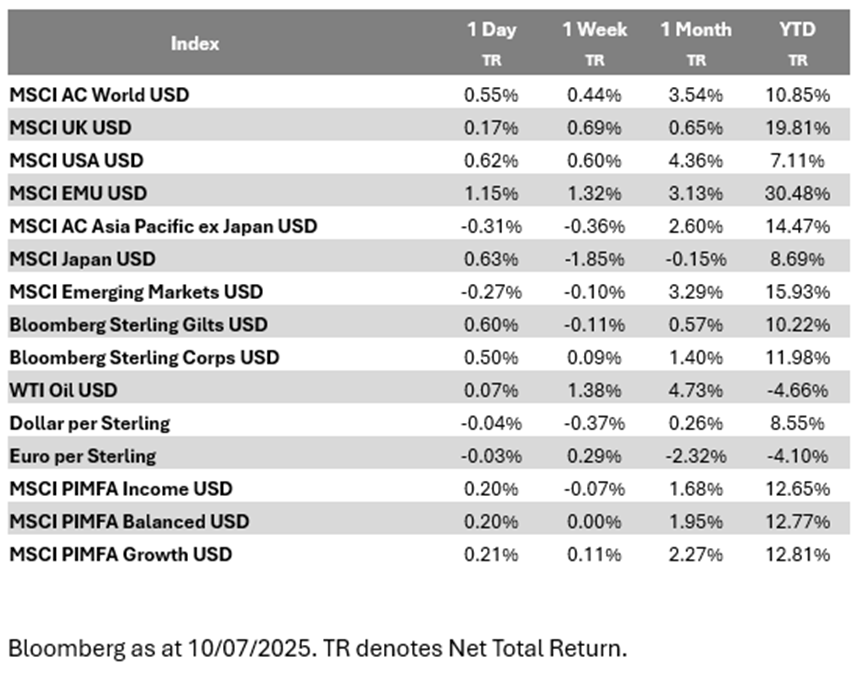

| Index | 1 Day | 1 Week | 1 Month | YTD | |

| TR | TR | TR | TR | ||

| MSCI AC World USD | -0.41% | 0.55% | 0.67% | 19.21% | |

| MSCI UK USD | 0.91% | 0.86% | 2.28% | 27.94% | |

| MSCI USA USD | -0.57% | 0.40% | 0.00% | 14.84% | |

| MSCI EMU USD | -0.50% | 0.55% | 2.11% | 34.80% | |

| MSCI AC Asia Pacific ex Japan USD | -0.47% | 1.16% | 2.49% | 28.20% | |

| MSCI Japan USD | 0.39% | 2.43% | 2.29% | 23.30% | |

| MSCI Emerging Markets USD | -0.26% | 1.07% | 2.79% | 30.81% | |

| Bloomberg Sterling Gilts USD | 0.39% | 1.01% | 1.70% | 11.29% | |

| Bloomberg Sterling Corps USD | 0.27% | 0.64% | 0.93% | 13.16% | |

| WTI Oil USD | 1.18% | 0.39% | -6.61% | -18.43% | |

| Dollar per Sterling | -0.11% | -0.35% | -1.17% | 6.71% | |

| Euro per Sterling | -0.19% | -0.03% | 0.47% | -4.81% | |

| MSCI PIMFA Income USD | 0.18% | 0.48% | 0.80% | 17.37% | |

| MSCI PIMFA Balanced USD | 0.13% | 0.49% | 0.83% | 18.35% | |

| MSCI PIMFA Growth USD | 0.09% | 0.53% | 0.91% | 19.61% | |

Bloomberg as at 23/10/2025. TR denotes Net Total Return.

Please check in with us again soon for further relevant content and market news.

Chloe

23/10/2025