Please see below, an article from Tatton Investment Management, analysing the key factors currently affecting global investment markets. Received this morning – 02/02/2026

End of euphoria, back to normal?

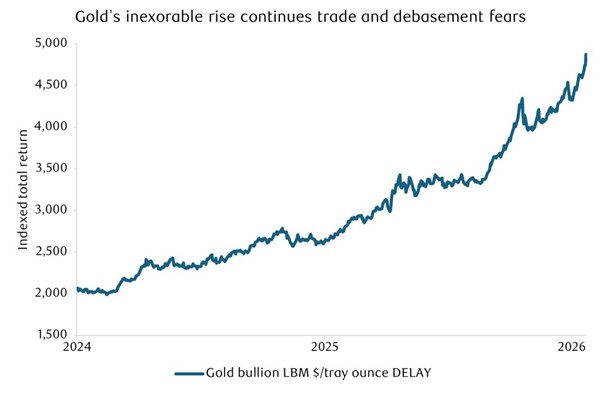

Equities hit all time highs early last week, but US stocks sold off after Microsoft’s earnings. A ‘normal’ sell-off based on earnings would be mildly comforting, after recent political risk sell-offs. However, there are liquidity risk signals over weekend trading. Gold, silver and Bitcoin have hit large profit-taking, which appears to be bleeding into emerging market equities; for example, the main South African index has fallen over 6% in today’s first hours of trading.

Gold prices have skyrocketed over the past two years, and the total stock of gold is probably now worth over $35tn – twice the size of the US treasury market and nearly a quarter the equity market capitalisation. Investors have raised their gold allocations, but we don’t think this reallocation is sustainable. Highly leveraged positions in gold suggest there has been a lot of short-term speculation recently. Gold’s actual free-float and daily trading liquidity is much smaller than bonds or equities, meaning it doesn’t take much to move gold prices. Long-term investors should be wary: it’s a valuable insurance in uncertain times, but the insurance premium is now very high.

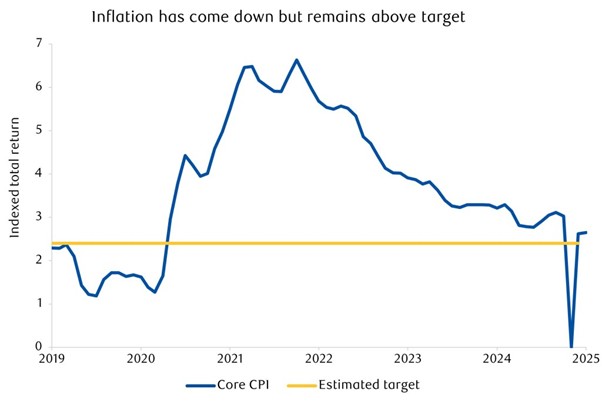

The dollar slid to its lowest level in four years after Trump called dollar weakness “great”, but Scott Bessent’s reassurance stabilised the currency. The TACO factor is helping to calm things, from (temporarily) avoiding a government shutdown to Trump appointing the experienced Kevin Warsh as next Fed chair. Markets didn’t even mind the president calling current chair Powell a “moron” for the Fed not cutting rates. The Fed referenced a rebounding labour market, but high profile layoffs still have bond markets betting on a summer rate cut. In any case, Trump’s usual disruption isn’t putting any extra pressure on the dollar.

US threats against Iran pushed up oil prices, but stock markets were focussed on Microsoft’s earnings. The tech giant’s cloud growth disappointed and its intertwining with OpenAI revived the talk of ‘circular financing’. In contrast, Meta’s better-than-expected results boosted its shares, even though Meta is spending big on AI too. This shows investors will still reward big investments, as long as they’re the right ones.

The fundamental growth and earnings outlook is strong, so it would be nice if politics continued to take a backseat.

Starmer in China – a pragmatic friendship

Kier Starmer’s trip to China has yielded incremental but meaningful results: visa-free travel for UK citizens, a “feasibility study” on a future services trade deal, and lines of communication on trade. Britain has a large trade deficit with China (it’s more than doubled since the last time a Prime Minister visited China in 2018), so the biggest prize for UK businesses would be gaining market access. There were encouraging signs on this, but the underlying problem is a chronic lack of Chinese consumer demand. Despite Beijing’s continued fiscal stimulus, Chinese consumers save too much and don’t spend enough. Measures to address the problem have mostly just added to overproduction issues (e.g. by increasing employment).

But trade deals are about the long-term – and China will have to resolve its oversaving problem one way or another. Beijing’s next five-year economic plan will reportedly emphasise private business, so this could be the ideal time to get access to Chinese markets. In theory, Britain’s supply-side problems and investment services expertise complements China’s overproduction and huge stock of savings. But in practice, restricted information on Chinese companies hinders investment, while Chinese imports to the UK often incur accusations of ‘dumping’.

Trump called the UK’s talks with China “very dangerous”, and last week threatened a 100% tariff on Canada if it makes a trade deal with China. But these are increasingly seen as empty threats, given the US Supreme Court’s pending ruling on tariffs, and Trump’s own record of backing down. China itself can be a dangerous trading partner, though: Beijing restricted Nexperia chips last year over a feud with the Netherlands, nearly halting global car manufacturing.

China is currently trying to play nice, though, and its long-term goals (creating an alternative to US-led order, internationalising the renminbi) suggest that will continue. Pursuing closer ties with China is a gamble, but probably a worthwhile one.

Will European growth stay peripheral?

Absolute Strategy Research (ASR) point out that Europe’s so-called periphery nations are doing much better than the core. Since the start of 2025, stock returns in Greece (+55%), Spain (+46%) and Italy (+37%) have been better than France (+8%) and Germany (+18%). Peripheral corporate profits are being revised up, and core profits down. It’s a role reversal for the previously high debt, low growth countries derogatorily referred to as the ‘PIIGS’ (Portugal, Italy, Ireland, Greece and Spain).

ECB interest rates used to be low for the German growth machine and punishingly high for the periphery – but that trend has now reversed. Peripheral stocks still have lower valuations than in France and Germany, too.

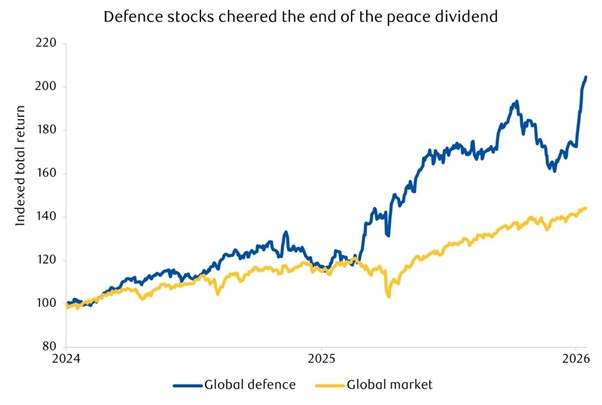

The NextGenerationEU fiscal package has boosted periphery growth more than in the core, but the NextGen boost won’t be as strong in 2026 as it has been since the pandemic. In contrast, Germany’s defence spending spree will come this year, benefitting manufacturers with spare capacity. We therefore expect core profit growth to catch up – with the possible exception of France, with its idiosyncratic political paralysis.

A strong periphery is good news for Europe, as the concentration of European growth on Germany has been a structural problem for decades. Peripheral profit growth is a strong counterpoint to those who are sceptical of the US-to-EU capital rotation. While aggregate European profits still lag US large cap, there are decent earnings dynamics to be found in Europe and, thanks to lower European equity valuations, profits don’t need to be world bearing to be attractive.

Peripheral growth is helping to overcome Europe’s structural inequalities and fiscal stimulus should help its oversaving problem. There’s talk of a “two speed” union, to get around the paralysis issue too. This is helping the mood for European equities.

Please continue to check our blog content for the latest advice and planning issues from leading investment management firms.

Marcus Blenkinsop

2nd February 2026