Please see below, an article from Brooks Macdonald, outlining the key factors currently impacting global investment markets. Received this morning – 02/12/2025

What has happened?

Markets stumbled at the start of December, with equities, bonds, and crypto all under pressure. Bitcoin slumped -5.2%, while the S&P 500 fell -0.53%, snapping a five-day winning streak. The Russell 2000 dropped -1.25%, and nearly three-quarters of S&P constituents ended lower. Tech held up better, with Nvidia rebounding +1.65%. The sell-off was driven by a surge in global bond yields, sparked by hawkish comments from Bank of Japan Governor Ueda that pushed 10-year JGB yields to their highest level since the Global Financial Crisis. US Treasuries followed suit, with 10-year yields jumping +7.2bps, which was the biggest daily rise in nearly four weeks. Stagflation fears added fuel, as the US ISM manufacturing index disappointed and higher oil prices compounded concerns.

Japan triggers global bond repricing

Ueda’s remarks have investors pricing in a near-certain December rate hike from the BoJ, sending Japanese yields to multi-decade highs. The 10-year JGB closed at 1.86%, its highest since 2008, while the 30-year hit 3.37%, a record since issuance began in the late 1990s. Even the 2-year breached 1% for the first time since the Global Financial Crisis.

Europe and UK also under pressure

European markets mirrored the global risk-off tone. The STOXX 600 slipped -0.20%, while the DAX fell -1.04%. Bond yields climbed across the region, with 10-year Bunds up +6.1bps and OATs up +7.5bps. Data offered little relief as Eurozone manufacturing PMI was revised down to 49.6, still signalling contraction. In the UK, the FTSE 100 eased -0.18%, broadly in line with European peers. The head of the OBR resigned following a premature release of budget analysis. However, that wasn’t a market moving story, and the rise in 10yr gilt yields (+4.1bps) was more muted than in other countries yesterday. Data-wise, UK mortgage approvals for October came in at 65k, slightly above expectations but still within the 18-month range of 60–70k, underscoring a housing market that remains subdued amid higher borrowing costs.

What does Brooks Macdonald think?

Today’s focus may shift to geopolitics, as Trump’s envoy meets President Putin in Moscow to discuss US proposals for ending the war in Ukraine. While recent talks have been described as “productive,” Kyiv remains firm on territorial issues, suggesting any breakthrough is still some way off. Markets will watch closely for signs of progress, but for now, rate expectations and growth concerns remain the dominant drivers.

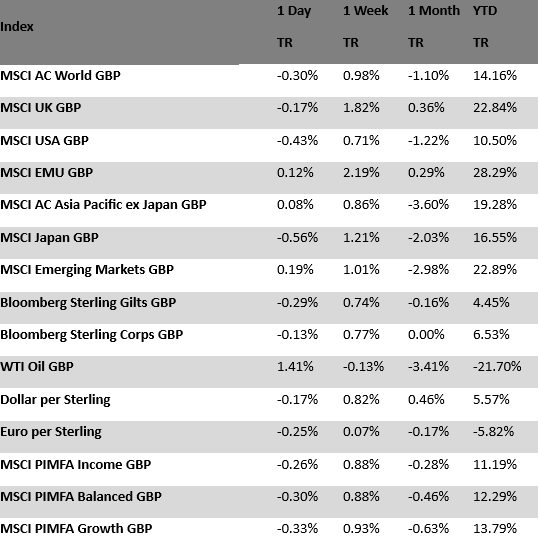

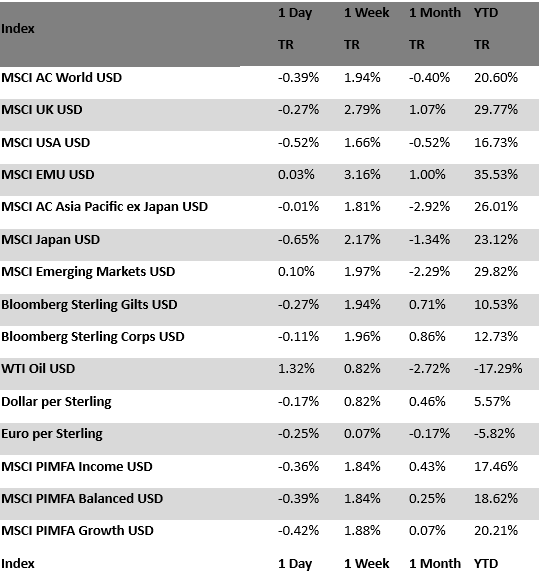

Bloomberg as at 02/12/2025. TR denotes Net Total Return.

Please continue to check our blog content for the latest advice and planning issues from leading investment management firms.

Marcus Blenkinsop

2nd December 2025