Please find below, a daily update on markets, received this morning from Brooks Macdonald – 14/04/2022

What has happened?

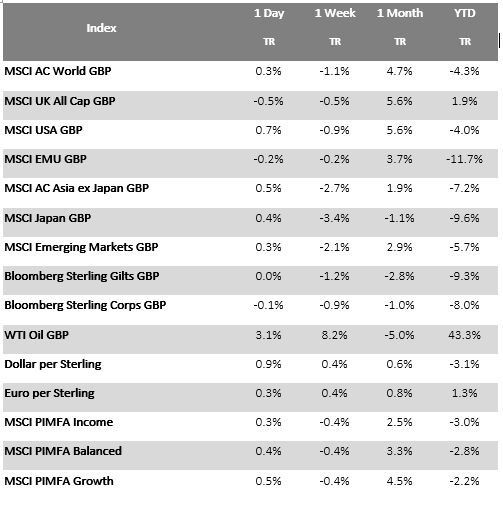

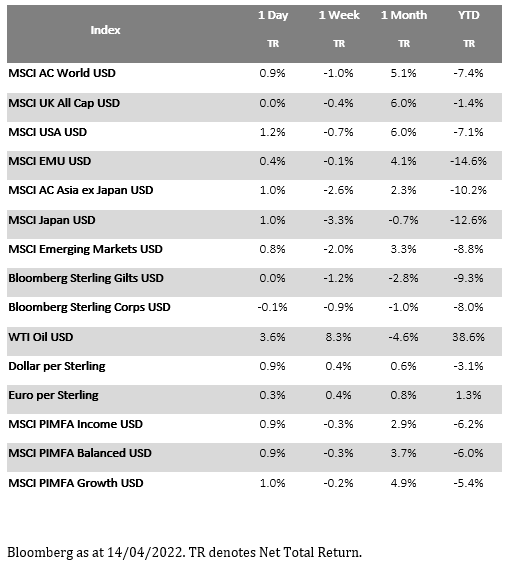

US bond prices continued the recent rally on Wednesday as markets pared back expectations for an aggressive series of interest rate rises from the US Federal Reserve. Following the latest US Consumer Price Index data for March published on Tuesday, which showed a weaker than expected core month-on-month rise in prices, hopes have risen that the near-term inflationary pressures might be at or near a peak. US 2 year bonds, which are more sensitive to monetary policy decisions, have seen yields fall more than 10 year yields this week, with the 10 year-less-2 year yield curve having risen around 40bps since the nadir at the start of the month. In equity markets, the principle of regional proximity to the Ukraine conflict weighed again on Wednesday; while equities were mixed in Europe, US equities were stronger, while across sectors, technology shares outperformed wider equity benchmarks. Overnight, Asia equity markets are broadly higher on reports that China’s policy makers may look to make further cuts in banks’ reserve requirement ratios alongside other policy tools to support the economy. Looking ahead to today the European Central Bank (ECB) holds its latest monetary policy meeting decision, though markets are not expecting much change to the ECB’s recently more hawkish messaging.

US calendar Q1 2022 company results season gets underway

The US bank JP Morgan kicked off the latest calendar Q1 2022 company results season on Wednesday. Seen as a bellwether for the broader US economy, JP Morgan reported profits which fell 42% in Q1 2022 compared to the same quarter period a year ago, and missing analyst EPS estimates amid a more cautious outlook generally. Aside the market impact from Russia’s invasion of Ukraine, investment banking revenue was lower as companies looked to have delayed deal activity in recent months. The US bank also increased reserves saying the possibility of an economic downturn had moved from ‘low’ to ‘slightly less low’. JP Morgan CEO Dimon warned of twin economic uncertainties arising from Ukraine as well as near-term inflationary headwinds. Putting pressure on policy makers, Dimon said “we remain optimistic on the economy, at least for the short term … consumer and business balance sheets as well as consumer spending remain at healthy levels … but see significant geopolitical and economic challenges ahead”. He added that “the Fed needs to try to manage this economy and try to get to a soft landing, if possible.” Asked whether the US could face a recession, Dimon said that “I am not predicting a recession. Is it possible? Absolutely.”

Brooks Macdonald’s Asset Allocation Committee weighs up the investment outlook

Brooks Macdonald’s Asset Allocation Committee held its latest monthly meeting on Wednesday, and as part of discussions, weighed up the latest investment outlook in terms of the twin market drivers of economic growth and inflation. While the broader economic growth outlook remains constructive and above longer-term trend rates of growth, the Committee are mindful that there has been a downward revision of estimates in aggregate. The Committee views a lower economic growth backdrop as likely given the impact that near-term inflationary pressures may have on the cost-of-living squeeze and corporate margins. Whilst it is too early to say whether inflation will slow meaningfully by the end of the year, the base effects mean that headline inflation is likely to slow even if inflationary pressures remain a theme into 2023.

What does Brooks Macdonald think?

Our Asset Allocation Committee is, in aggregate, presently somewhere between a so-called ‘Soft-Landing’ scenario (describing a low inflation, low economic growth outlook) and a ‘Stagflation’ scenario (high inflation, low growth). Whilst both of these scenarios might favour more growth/defensive investment styles, the Committee is maintaining its equity barbell balance at the current time. There is likely to be continued volatility in markets in the near-term as central banks in particular look to try to thread the policy needle against post-pandemic distortions and the war in Ukraine, and as such, we are keen not to be drawn prematurely in favour of either a growth/defensive or value/cyclical narrative.

Please continue to check our Blog content for advice and planning issues and the latest investment, markets and economic updates from leading investment houses

David Purcell

14th April 2022